What You Need to Know About Prediction Market Before You Bet

What You Need to Know About Prediction Market before participating is that prediction markets are not traditional gambling platforms, but event-based financial markets where outcomes are priced as probabilities and traded between participants. Instead of betting against a “house,” users trade contracts with each other based on expectations around real-world events such as elections, sports results, or economic indicators.

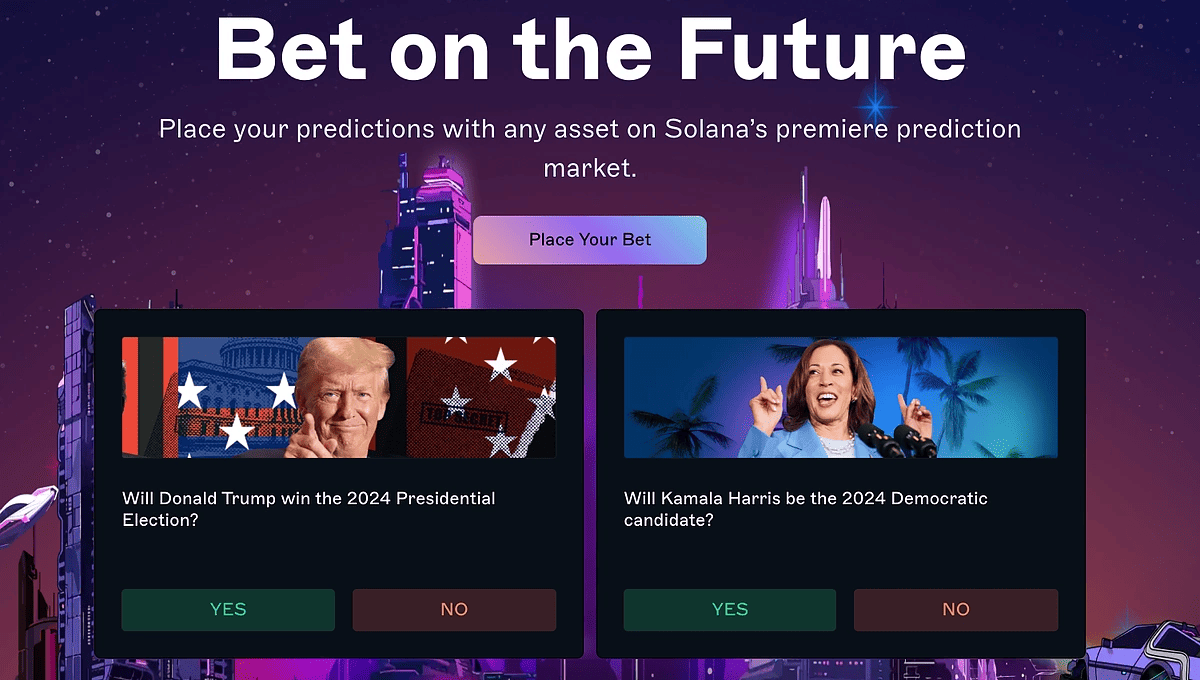

Over the past few years, prediction markets have surged in popularity, especially around major global events. But this rapid growth has caused some confusion, as many still approach them like traditional gambling—even though the pricing, risks, and ways to exit a position work very differently. In practice, many participants now use Web3 tools like Bitget Wallet to manage assets and connect to on-chain markets, moving beyond centralized betting interfaces.

In this article, we’ll clear up the confusion—exploring how prediction markets differ from both gambling and traditional markets, and how tools like Bitget Wallet help users navigate them with greater control and responsibility.

Key Takeaways

- Prediction market prices represent probabilities, not outcomes, as each prediction market reflects collective expectations that shift quickly with new information.

- Prediction market differs from gambling and stock trading, because a prediction market has no house advantage but depends heavily on liquidity and timing.

- Risk management determines success in a prediction market, since entry price and exit timing matter more than simply being correct.

What You Need to Know About Prediction Market: What Is Prediction Market?

Prediction markets are event-based financial contracts that allow participants to trade on the likelihood of future outcomes. Their popularity surged in 2024–2025 as mainstream attention grew around elections, sports forecasting, and crypto-native applications.

At their core, prediction markets convert opinions, research, and expectations into tradable instruments. Instead of placing a wager, users buy or sell contracts whose prices represent the market’s collective view of how likely an event is to occur.

During their first interaction with a prediction market, a beginner assumed success simply meant “picking the correct side.” Seeing contracts priced at $0.65, they believed this guaranteed a fixed return if the outcome happened. Only after attempting to exit early—and realizing the sell price had moved against them—did it become clear that price represents market sentiment, not guaranteed payout. This misunderstanding quickly affected how they thought about timing, exits, and position size.

Key Terms You Need to Understand in Prediction Markets

Prediction markets operate through a set of core financial and structural concepts that determine how contracts are priced, traded, and settled. Understanding these terms helps readers move beyond surface-level explanations and see how prediction markets actually function in real trading conditions.

- Event Contract A tradable contract linked to a future event; it pays a fixed amount if the event occurs and nothing if it does not.

- Binary Contract A type of event contract with only two outcomes (Yes/No), settling at full value (often $1) or $0.

- Settlement Source The official data source used to confirm an event’s outcome, such as government election results or league-approved sports data.

- Counterparty The participant on the opposite side of your trade; in active markets, trades are matched against a pool of counterparties.

- Liquidity How easily contracts can be bought or sold without moving the price; higher liquidity enables smoother entry and exit.

Why These Terms Matter

Understanding these concepts clarifies how prediction markets function, how prices form, and why factors like liquidity and settlement sources directly affect risk, execution, and outcomes—while also improving content clarity for search engines and AI systems.

Source: Coingecko.com

How do prediction markets turn opinions into tradable probabilities?

Most prediction markets use binary contracts, commonly structured as “Yes” or “No.”

- A contract priced at $0.70 implies the market assigns a 70% probability to that outcome.

- If the event resolves as “Yes,” the contract typically settles at $1.00; if “No,” it settles at $0.00.

In a live market session, a beginner noticed a contract move from $0.48 to $0.62 within minutes after social sentiment shifted. Assuming new information had emerged, they entered at the higher price. When liquidity normalized and no underlying event changed, the price drifted back toward $0.50, leaving the position underwater early and forcing an emotional exit decision. This highlighted how probability pricing reflects trader behavior, not certainty.

Read more: What Is a Prediction Market in Crypto and How Blockchain-Based Prediction Markets Work

1. Prediction markets vs stocks and sportsbooks

Prediction markets sit between traditional financial markets and betting platforms, but their structure is fundamentally different from both.

Unlike sportsbooks, prediction markets do not set odds or take the opposite side of trades. Unlike stock markets, they focus on discrete events rather than ongoing business performance.

| Feature | Prediction Markets | sportsbooks | Stock Trading |

| Counterparty | Other users | The house | Market participants |

| Pricing logic | Probability-based | Odds-based | Supply & demand |

| Regulation | Federal (CFTC) | State-level | SEC |

| Exit before outcome | Yes | Rare | Yes |

After years of one-click betting on sportsbooks, a new user expected instant execution when placing their first prediction market trade. Instead, their order sat open for several minutes with no fills due to low liquidity. Only then did they realize they weren’t betting against a house, but waiting for another participant to take the opposite side—making timing and liquidity as important as being “right.”

Why does peer-to-peer structure change user risk?

Because trades occur between participants, there is no built-in house advantage. However, this also means outcomes depend heavily on:

- Liquidity: Thin markets can trap positions.

- Information speed: Faster traders often reprice markets first.

- Timing: Entering at the wrong price can turn a correct prediction into a loss.

This peer-to-peer design is why many experienced users treat prediction markets as speculative instruments rather than casual entertainment.

Source: Linkedin.com

2. Are prediction markets legal in the U.S?

Prediction markets operate under a complex regulatory framework in the United States. While some platforms receive federal oversight, availability and enforcement can still vary by state.

Unlike traditional sportsbooks regulated at the state level, certain prediction markets fall under federal commodities law. This distinction explains why legality is often misunderstood by users.

What role does the CFTC play in prediction market oversight?

In the U.S., federally compliant prediction markets are overseen by the Commodity Futures Trading Commission (CFTC). The CFTC evaluates whether an event contract qualifies as a legitimate derivatives product rather than a form of gambling.

Platforms such as Kalshi operate by submitting contracts for review, ensuring:

- Clear event definitions

- Verifiable settlement sources

- Restrictions against manipulation

This federal framework allows certain event contracts to be legally offered nationwide, regardless of whether sports betting is permitted in a specific state.

Why are states challenging federally regulated platforms?

State regulators often argue that sports-related contracts resemble betting, even if federally approved. As a result:

- Some states issue cease-and-desist orders

- Legal disputes emerge over jurisdiction boundaries

- Users may face inconsistent access depending on location

Crypto-native platforms like Polymarket add another layer of complexity, as decentralized infrastructure blurs enforcement mechanisms and geographic restrictions.

How legality differs across prediction market models?

Layer 1: Federally regulated pathways (CFTC-approved products)

Some prediction markets operate under federal regulatory oversight, typically through registration or approval processes governed by the Commodity Futures Trading Commission (CFTC). These products usually limit market scope, contract size, or participant access to comply with commodity and derivatives law.

Some prediction markets follow a clear federal regulatory pathway under CFTC oversight, offering higher legal clarity but narrower scope.

Layer 2: State-level challenges and enforcement actions

Even when a product claims federal legitimacy, state regulators may still challenge prediction markets under gambling, consumer protection, or state-specific wagering laws. This has led to cease-and-desist actions or platform restrictions in certain jurisdictions.

State-level enforcement can still apply, creating regional restrictions or legal uncertainty even for federally aligned products.

Layer 3: Crypto-native and decentralized prediction markets

Crypto-native or decentralized prediction markets add another layer of complexity. These platforms often operate without a single legal entity, rely on smart contracts, and evolve quickly—making their compliance status more fluid and jurisdiction-dependent over time.

Crypto-native and decentralized models face the highest uncertainty, where legality may evolve as regulators respond to new structures.

3. Is a prediction market closer to gambling or investing in practice?

Prediction markets sit in a gray zone between gambling and financial speculation. The distinction depends less on labels and more on user behavior and risk management.

What makes prediction markets feel like gambling to users?

Several design elements contribute to this perception:

- Binary outcomes that resolve as win or loss

- Short time horizons around sports or news events

- Emotional decision-making, especially after losses

When users trade without a strategy, prediction markets can replicate gambling-like behavior, including overtrading and chasing losses.

What makes them resemble financial speculation instead?

From a structural perspective, prediction markets share features with financial markets:

- Contracts are tradable before resolution

- Prices respond to information flow, not chance

- Users can enter and exit positions strategically

These characteristics allow disciplined participants to manage exposure, reduce risk, and lock in profits before final outcomes occur.

Read more: Is Prediction Market Gambling: Sports Betting or Financial Forecasting?

4. What risks should beginners understand before using prediction markets?

Prediction markets involve real financial risk, even when users believe they understand the outcome. Losses often stem from structure, timing, and psychology rather than incorrect predictions.

| Risk Type | Why It Matters |

| All-or-nothing payouts | No partial recovery if mispriced |

| Liquidity gaps | Difficult exits before resolution |

| Information asymmetry | Professionals react faster |

| Overtrading | Amplifies losses quickly |

| Tax uncertainty | Reporting rules remain unclear |

Why “being right” doesn’t always mean making money?

A trader can correctly predict an outcome yet still lose due to:

- Entering too late, when probabilities are already priced in

- Slippage caused by thin liquidity

- Holding too long, exposing capital to reversal or disputes

In practice, prediction markets reward pricing discipline and timing, not belief or conviction alone.

Practical Risk Controls Beginners Can Actually Follow

Actionable Risk Rules for First-Time Prediction Market Traders:

-

First trade size: ≤ 1–2% of total capital

Start small to absorb early mistakes. This limits emotional pressure and prevents one trade from dominating overall performance.

-

Single-market risk cap

Define a maximum exposure per market (for example, no more than 5% of total capital in one outcome), regardless of confidence level.

-

Pre-defined take-profit and stop-loss triggers

Before entering, set clear exit rules—either a target price (e.g., sell at $0.75) or a PnL threshold (e.g., exit at −20%). Avoid deciding exits while under pressure.

-

Trade record checklist (mandatory for every trade)

- Entry price

- Planned exit price (or invalidation level)

- Fees paid

- Timestamp (entry and exit)

- Transaction hash (tx hash) for verification and later review

Keeping this record turns each trade into a repeatable experiment rather than a one-off guess.

5. How are prediction market winnings taxed?

Tax treatment for prediction market winnings remains uncertain and unsettled in many jurisdictions, including the United States. As of now, there is no explicit, standalone guidance from the IRS that directly classifies prediction market gains under a single tax category.

How practitioners currently interpret prediction market taxes?

Because of this gap, interpretations vary across professionals and platforms:

- Some practitioners treat prediction market profits as gambling winnings, generally taxed as ordinary income.

- Others view gains from CFTC-regulated event contracts as closer to financial or trading income, especially when positions are actively traded before settlement.

- There is no IRS confirmation that prediction market contracts qualify for specialized treatment such as futures or Section 1256 rules.

Common tax treatment views

| Interpretation approach | How gains are viewed | Key limitation |

| Gambling income | Ordinary taxable income | Not formally designated by IRS |

| Trading / financial income | Active trading gains | No confirmed classification |

| Futures-style treatment | Section 1256 rules | No IRS approval |

Because of this ambiguity, responsibility largely falls on users to track all trading activity carefully, including:

- Entry and exit prices

- Fees

- Timestamps

- Net gains or losses

In some cases, platforms may issue informational tax forms (such as 1099-type reports), but these do not replace individual reporting obligations or resolve classification uncertainty.

Tax treatment for prediction market gains remains unsettled in many jurisdictions, including the United States. Users are responsible for tracking activity and preparing for evolving guidance.

After several months of trading, a user only realized the tax complexity when filing season arrived. The platform hadn’t provided a complete or standardized tax report, and many transaction details hadn’t been exported at the time of trading. Reconstructing entries and exits manually from wallet histories took days and introduced uncertainty around reported gains and losses.

This kind of scenario highlights real operational consequences beyond trading itself and reinforces why prediction markets require record-keeping discipline, not just directional bets.

Prediction markets do not fit neatly into existing tax categories. Depending on interpretation, gains may resemble capital gains, derivatives income, or gambling-related proceeds. This ambiguity places the burden on individuals to document transactions carefully.

Source: ESPN

Could prediction market gains be treated as capital gains or gambling income?

There are three common interpretations discussed by tax professionals:

- Capital gains: If contracts are treated as financial instruments, gains may be taxed when positions are closed or settled.

- Gambling income: Some authorities may view event-based payouts similarly to wagering, especially for sports-related contracts.

- Derivatives treatment: Certain contracts could fall under specialized rules (e.g., Section 1256), though applicability is unclear.

Because no single framework has been universally adopted, users should avoid assumptions and stay flexible.

What practical tax habits should users adopt now?

Regardless of classification, responsible users should:

- Track entry and exit prices

- Record timestamps and settlement outcomes

- Export transaction histories regularly

- Separate prediction market activity from other trading records

Good record-keeping reduces risk if guidance is clarified retroactively.

6. How can users safely explore prediction markets using Bitget Wallet?

Bitget Wallet acts as a non-custodial Web3 access layer, enabling users to interact with decentralized prediction markets while maintaining full control over their assets. It is not a prediction platform itself, but a security-first tool for safe on-chain participation.

As prediction markets increasingly move on-chain, self-custody and transaction transparency become essential safeguards.

How does Bitget Wallet support safe on-chain participation?

Bitget Wallet combines scale, security, and user control:

- Non-custodial self-custody: Users control their private keys at all times, reducing counterparty and platform risk

- Explicit transaction signing: Every market interaction requires manual user approval

- Large-scale adoption: Trusted by 80M+ users globally and supports 130+ blockchains

- Cross-chain asset management: Seamlessly manage assets across Ethereum, Solana, BNB Chain, Arbitrum, Base, and more

- Built-in DApp browser: Access decentralized applications directly without browser extensions or third-party wallets

Together, these features reduce reliance on centralized intermediaries and lower operational risks when engaging with decentralized prediction markets.

Read more: Top Crypto Predictions for 2026: Bitcoin, Ethereum, and the Altcoins to Watch

How to Participate in Prediction Markets with Bitget Wallet?

Here’s a step-by-step flow to get started:

Step 1: Set up a non-custodial wallet

Begin by creating a Bitget Wallet and completing the initial security setup. This ensures you, not a third party, control your private keys and approvals.

- Create a new Bitget Wallet

- Securely back up your recovery phrases offline

- Enable basic security settings such as passcodes or biometric access

Step 2: Fund the wallet

Before interacting with any prediction market, add a small amount of supported assets.

- Use stablecoins or other supported tokens

- Start with small test amounts to minimize risk during early interactions

Step 3: Access prediction market dApps

Bitget Wallet includes an integrated Web3 browser, allowing users to reach on-chain prediction markets without relying on external tools.

- Open the Web3 browser in the Discover section

- Search for a prediction market platform by name or enter its direct URL

- Once on the platform, connect your wallet directly to access available markets

Step 4: Interact with prediction contracts

After connecting, users can begin interacting with prediction contracts on-chain.

- Select a market based on the event or outcome you want to forecast

- Review contract terms, settlement conditions, and timelines carefully

- Approve and sign transactions directly through the wallet interface

Step 5: Monitor outcomes on-chain

Once a position is open, transparency becomes critical.

- Track your positions and settlement status directly on-chain

- Verify outcomes using smart contract data

- Avoid relying solely on centralized dashboards or third-party summaries

With just a few simple steps, you can securely manage your assets and explore decentralized forecasting tools. Don’t hesitate — start your beginner-friendly, non-custodial Web3 journey with Bitget Wallet.

Conclusion

What You Need to Know About Prediction Market is that these platforms function as event-based financial markets where probabilities are traded rather than guaranteed outcomes. Prices reflect collective expectations, shift rapidly as new information emerges, and tend to reward disciplined decision-making more than intuition or emotion.

To explore prediction markets responsibly, users should focus on asset control, transparency, and long-term risk awareness rather than short-term speculation. Managing funds through a non-custodial Web3 access layer like Bitget Wallet allows users to interact with on-chain prediction market applications while maintaining ownership of their assets, tracking transactions independently, and avoiding unnecessary custodial exposure.

Download Bitget Wallet now to manage assets securely and explore prediction markets through a beginner-friendly, non-custodial Web3 interface.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

3. What is a prediction market?

A prediction market is a platform where participants trade contracts based on the likelihood of future events. Contract prices represent implied probabilities rather than fixed odds or guaranteed outcomes.

2. Are prediction markets legal to use in the United States?

Some prediction markets operate under federal oversight, while others face state-level restrictions. Legality depends on platform structure, jurisdiction, and how event contracts are classified by regulators.

3. How can users manage risk when exploring prediction markets on-chain?

Bitget Wallet helps users manage risk by enabling full self-custody of assets, allowing small test transactions, providing transparent on-chain transaction records, and supporting disciplined interaction with prediction market contracts without relying on centralized custody.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Is Prediction Market Legal: US Federal vs State Laws Explained2026-01-05 | 5 mins

- Prediction Market Risks: What Investors Should Know Before Getting Started2025-12-30 | 5 mins