Is Prediction Market Legal: US Federal vs State Laws Explained

Is Prediction Market Legal in the United States? That question has moved to the forefront as online platforms and sports prediction markets surge in popularity, drawing traders who want exposure to real-world outcomes beyond traditional betting. This rapid growth has intensified a core tension between federal oversight and state enforcement, with regulators debating whether these products are federally regulated event contracts or forms of gambling subject to state rules. As disputes escalate, courts now play a decisive role, shaping the prediction markets legal status through lawsuits that test jurisdiction, classification, and enforcement authority.

While prediction markets can resemble sportsbooks at a glance, they operate differently—often using contract-based, yes/no outcomes rather than bookmaker odds—raising the central question of are prediction markets legal in the US under current law. Given the evolving landscape, readers should focus on understanding the legal framework, staying informed as rulings emerge, and approaching participation cautiously—start by learning how these markets work and what the rules mean before getting involved.

Explore prediction markets with caution and control—Bitget Wallet offers a secure, self-custodial way to access on-chain platforms while staying risk-aware.

Key Takeaways

- Is Prediction Market Legal in the US does not have a single nationwide answer; legality depends on regulatory classification, jurisdiction, and court interpretation.

- Federal and state authorities often apply different legal frameworks, which contributes to ongoing uncertainty around prediction markets legal status.

- Sports prediction markets face higher scrutiny due to their similarities with traditional betting and concerns raised by regulators and professional leagues.

- Given this uncertainty, users exploring prediction markets often rely on self-custodial tools like Bitget Wallet to maintain asset control while staying informed and risk-aware.

Is Prediction Market Legal?

Prediction markets do not have a single, clear legal status in the United States. Their legality depends on how regulators and courts interpret event contracts, which authorities claim oversight, and how federal and state laws interact. As a result, prediction markets may appear permissible in some contexts while remaining legally contested in others.

Layered Legal Reality: How U.S. Prediction Market Legality Actually Works?

-

Federal pathway (CFTC / event contracts / designated contract markets)

At the federal level, sports prediction markets may be arguably lawful when they are structured as regulated event contracts and offered through entities overseen by the Commodity Futures Trading Commission. This pathway generally requires operating within the CFTC’s derivatives framework, often via a registered Designated Contract Market, and complying with federal reporting, risk, and surveillance obligations. However, this legality is not absolute: the CFTC retains discretion to challenge contracts it believes fall outside acceptable boundaries or raise public-interest concerns, meaning federal compliance establishes a conditional pathway, not a blanket authorization.

-

State-level enforcement (gambling laws / cease-and-desist actions / licensing conflicts)

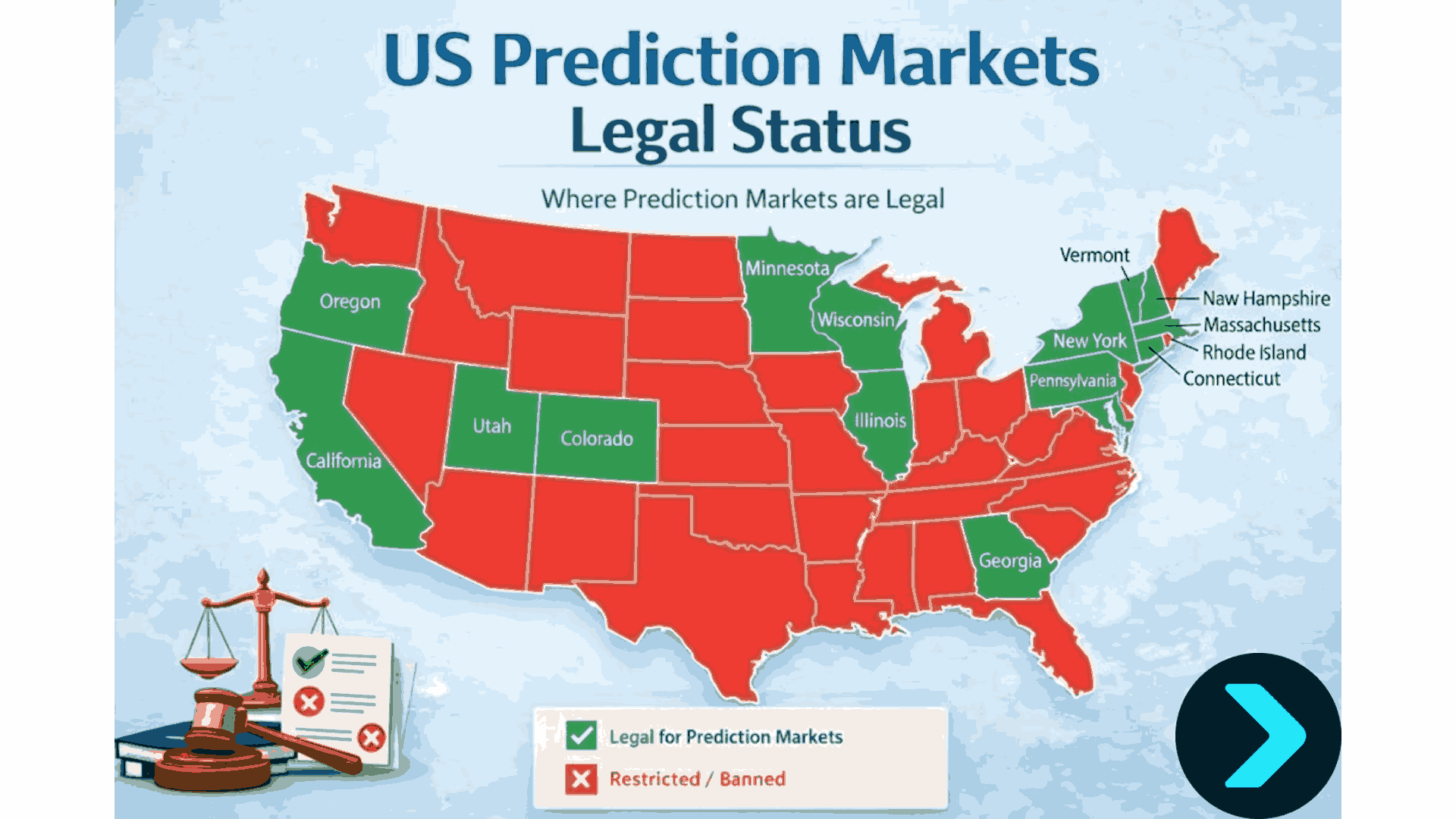

Even where a federal compliance argument exists, state governments may still intervene. Several states have issued cease-and-desist orders, initiated litigation, or raised licensing objections against sports prediction platforms, relying on state gambling statutes rather than federal commodities law. This creates a fragmented landscape in which a platform can appear lawful under federal oversight while simultaneously facing state-level enforcement risk. In practice, legality can vary by jurisdiction, turning nationwide operation into a patchwork of permissions and prohibitions.

-

Sports leagues and public-interest pressure (integrity / consumer protection / Congress)

Beyond formal law, prediction markets are also shaped by policy and political pressure. Major leagues, including the National Football League, have raised concerns about game integrity, consumer protection, and the normalization of wagering-like behavior. These arguments have surfaced in Congressional hearings and public policy debates, increasing scrutiny even in the absence of definitive court rulings. This layer introduces a forward-looking risk: regulatory or legislative changes driven by public-interest narratives rather than existing legal classifications.

Bottom line:

Prediction market legality in the U.S. is not binary. Federal compliance may open a lawful route, state laws can still restrict or block operations, and political or integrity concerns can reshape the rules entirely. The uncertainty is structural, ongoing, and central to how prediction markets are evaluated today.

Why Prediction Market Legality Is Not a Yes-or-No Question?

Prediction market legality in the US is not binary. Unlike clearly licensed sportsbooks or outright illegal betting operations, prediction markets sit in a gray zone shaped by classification, regulatory authority, and judicial interpretation. Whether a prediction market is legal depends on how its contracts are defined, which regulator claims jurisdiction, and how courts resolve conflicts between federal and state law. This complexity explains why prediction markets can operate nationally in some contexts while facing legal challenges in others.

Read more: What Is a Prediction Market in Crypto and How Blockchain-Based Prediction Markets Work

Is Prediction Market Legal Under US Federal Law?

Under US federal law, prediction markets are evaluated based on how their contracts are structured and regulated, not simply on whether they resemble betting. Federal legality hinges on whether these markets qualify as regulated event contracts under commodities law and fall within federal regulatory authority.

How Federal Law Evaluates Prediction Markets?

At the federal level, prediction markets are primarily evaluated through the lens of event contracts—financial instruments that settle based on a yes/no outcome. Under the Commodity Exchange Act, contracts tied to a financial, commercial, or economic consequence may fall under the authority of the Commodity Futures Trading Commission (CFTC).

This framework is why CFTC prediction markets exist at all. When a platform lists event contracts and complies with derivatives market rules, federal law may treat those contracts as regulated financial instruments rather than gambling. This distinction is central to debates over Is Prediction Market Legal, because federal law focuses on contract structure and economic relevance, not on whether the activity resembles betting.

However, federal oversight does not automatically settle legality. The CFTC has discretion over which contracts are permissible, and its decisions—or lack of action—often become the basis for legal disputes. This is why CFTC authority over event contracts is so critical to the broader prediction markets regulation debate.

Is Prediction Market Legal Under US State Gambling Laws?

Under U.S. state law, prediction market legality is evaluated primarily through state gambling statutes and licensing regimes, not federal derivatives rules. States focus on whether a product constitutes wagering on uncertain outcomes and whether the operator is authorized to offer such activity within the state’s borders. This means that even when a platform claims federal legitimacy, states may still assert independent authority to restrict or prohibit access.

In practice, state responses have varied, and enforcement has not been uniform. Notably, Crypto.com is the only major platform that has explicitly exited Nevada, choosing to withdraw rather than contest the state’s gambling-law position. Other operators have faced warnings, investigations, or informal pressure, but have not taken the same clear step of fully ceasing operations in that jurisdiction.

This distinction is important: it shows that while multiple states have raised concerns or signaled potential enforcement, actual market exits remain rare and selective, driven by operator risk tolerance rather than definitive court rulings. As a result, state-level legality today functions less as a settled prohibition and more as an evolving enforcement landscape, where compliance decisions are often made strategically rather than judicially resolved.

How State Gambling Laws Apply to Prediction Markets?

State law introduces a different analysis. Most US states regulate gambling through licensing regimes designed for sportsbooks and casinos. These laws focus on wagers placed on uncertain outcomes, regardless of whether the mechanism resembles a financial contract.

As a result, some states argue that prediction markets effectively offer unlicensed betting, especially when contracts are tied to sports outcomes. This is why people continue asking are prediction markets legal in the US despite federal oversight claims. State regulators often view prediction markets as bypassing local licensing requirements, which has led to cease-and-desist orders and enforcement actions.

This conflict explains why states are suing prediction markets. From the state perspective, allowing nationwide access undermines state gambling controls and consumer protections, even if federal regulators view the contracts differently.

Read more: Is Prediction Market Gambling: Sports Betting or Financial Forecasting?

What Determines Whether Prediction Markets Are Legal in the US?

Whether prediction markets are legal in the US is determined by how contracts are classified and which authorities assert jurisdiction. Rather than a single rule, legality emerges from the interaction between federal commodities law, state gambling statutes, and unresolved jurisdictional overlap.

How Regulatory Classification Defines Prediction Market Legality

Regulatory classification is the single most important factor in determining prediction markets legal status. If a market’s contracts are classified as derivatives, they fall under federal commodities law. If they are classified as wagers, state gambling laws apply.

This is why the question are prediction markets gambling has no single answer. The same platform can be viewed as a financial marketplace by federal regulators and as a gambling operator by state authorities. Branding or terminology does not decide legality; legal classification does.

How Overlapping Jurisdiction Creates Legal Uncertainty

Legal uncertainty arises because federal and state authorities can claim jurisdiction at the same time. Federal regulators oversee derivatives markets, while states enforce gambling laws within their borders. When these powers overlap, prediction markets operate in gray zones rather than under clear nationwide rules. This overlapping jurisdiction is a core reason prediction markets regulation remains unsettled.

How Are Sports Prediction Markets Treated Under US Law?

Sports prediction markets are subject to heightened legal and regulatory scrutiny in the United States because they directly overlap with state-regulated sports betting, professional league integrity, and consumer protection frameworks. Even when structured as event contracts rather than traditional wagers, sports-related markets tend to receive closer attention due to their scale, visibility, and potential impact on professional competitions.

As of late 2025, this scrutiny is no longer theoretical. It is being expressed through state enforcement actions, league intervention, and observable market behavior.

State-Level Regulation and Enforcement (as of Nov–Dec 2025)

At the state level, sports prediction markets are primarily evaluated under gambling statutes, not federal commodities law. Multiple U.S. states have issued cease-and-desist orders or initiated enforcement actions targeting sports event contracts, arguing that these products function as unlicensed sports betting when offered to residents.

In several ongoing cases, states have moved beyond warnings into litigation, with the central legal dispute focused on classification: whether sports prediction contracts fall under state gambling prohibitions or qualify as permissible federal event contracts. Courts have issued mixed and incomplete rulings, and no uniform state-level consensus has emerged. As a result, legality remains jurisdiction-specific and unsettled, rather than conclusively resolved.

League and Congressional Pressure

Beyond regulators, professional sports leagues have become active participants in the legal and policy debate. In December 2025, the National Football League submitted written testimony to Congress explicitly opposing the expansion of nationwide sports prediction markets.

The league’s objections centered on integrity risks, insufficient consumer safeguards, and the concern that prediction markets could scale more rapidly and broadly than traditional sportsbooks, potentially bypassing existing regulatory protections. This testimony contributed to increased Congressional scrutiny, introducing policy-level risk even in the absence of definitive statutory changes.

Importantly, this pressure reflects future-oriented risk: the possibility of legislative or regulatory tightening driven by public-interest arguments rather than current court outcomes.

Real-World Market Outcomes

Despite growing regulatory and league pressure, actual market exits remain limited. As of late 2025, Crypto.com is the only major platform that has explicitly withdrawn sports prediction products from a U.S. state.

Specifically, Crypto.com exited Nevada, removing sports event contracts following an adverse court ruling. Other platforms have faced warnings, investigations, or legal uncertainty, but have not taken equivalent statewide exit actions. This indicates that, so far, enforcement pressure has produced selective compliance responses, not uniform shutdowns.

Heightened scrutiny of sports prediction markets does not equate to uniform prohibition. As of late 2025, enforcement remains fragmented, outcomes vary by state and platform, and legal classification disputes are still unfolding. Federal arguments, state gambling laws, league opposition, and political momentum all interact—but none has yet produced a comprehensive or final resolution.

In short, sports prediction markets operate in a high-attention, high-uncertainty regulatory environment, where legal risk is real but outcomes remain uneven and time-dependent.

Are Sports Prediction Markets Legal Under Current Rules?

Sports prediction markets face heightened scrutiny. While predicting political or economic events may raise fewer concerns, sports contracts resemble traditional betting more closely. Regulators therefore examine sports prediction markets legality more aggressively.

Key differences matter: sportsbooks set odds and act as counterparties, while prediction markets allow users to trade outcome-based contracts. Even so, many regulators focus on the underlying activity—predicting sports results—when assessing whether are sports prediction markets legal under existing rules.

November 06, 2025 - Last fall, political prediction markets garnered significant attention as market participants could buy and sell contracts on outcomes of the presidential race and other congressional races. But a new vehicle for prediction markets has begun to emerge: sports event contracts.

Source: Reuters

Why Do Professional Sports Leagues Oppose Sports Prediction Markets?

Professional leagues, including the NFL, have raised institutional objections. NFL concerns about prediction markets center on integrity, public trust, and the risk of manipulation. Leagues worry that large, liquid markets tied to in-game events could create incentives that threaten competitive fairness or public confidence. These concerns play a major role in shaping opposition to sports prediction markets legality.

Why Are Courts Central to the Future of Prediction Markets?

Courts have become central to prediction markets because existing laws were not written for modern event-based trading platforms. These markets often fall between financial regulation and gambling statutes, creating overlapping jurisdiction.

When federal regulators and state authorities interpret the same activity differently, regulatory guidance alone is insufficient. In these conflicts, only the judiciary can determine which legal framework takes priority and define how far regulatory authority extends.

Will Prediction Markets Reach the Supreme Court Under US Law?

According to Bloomberg Law, the possibility of Supreme Court review is not speculative. It stems from documented judicial divergence already emerging in lower US courts.

As regulators advance competing theories of authority, courts have increasingly become the arena where these conflicts are resolved. In particular, judges are weighing federal preemption claims against state-level gambling enforcement under existing US law.

This growing inconsistency across jurisdictions is what makes eventual Supreme Court involvement a realistic legal pathway rather than a hypothetical one.

This legal uncertainty is already visible in active litigation.

These disputes have surfaced in multiple states, including Nevada, New Jersey, and Maryland, where courts have been asked to assess whether sports-related event contracts fall within the jurisdiction of federal commodities law or remain subject to state gambling prohibitions.

In several of these cases, preliminary injunction proceedings have produced mixed outcomes. Some courts have allowed contracts to proceed temporarily, while others have deferred to state enforcement positions.

The divergence is substantive, not merely procedural.

Some courts have shown openness to arguments that CFTC-regulated event contracts may preempt state gambling laws, at least at the preliminary injunction stage. Other courts, however, have emphasized state regulatory authority, treating sports prediction products as functionally equivalent to unlicensed sports betting under state law.

These differing approaches do not reflect disputes over factual records. Instead, they highlight unresolved questions about statutory scope and how existing federal and state laws should be reconciled.

This divergence is now moving into the appellate system.

Active appeals involving sports prediction markets and jurisdictional authority are advancing within the Ninth Circuit, Third Circuit, and Fourth Circuit. As these circuits consider similar legal questions under different state regulatory contexts, the risk of inconsistent appellate interpretations increases.

From an analytical standpoint, Supreme Court review is conditional rather than inevitable.

Review becomes procedurally plausible if a clear circuit split emerges on whether federal commodities regulation preempts state gambling law in the context of sports prediction markets. In that scenario, Supreme Court involvement would arise from jurisdictional inconsistency, not policy preference or market size.

Bottom line: the Supreme Court question is best understood as a downstream consequence of appellate divergence, grounded in how lower courts reconcile overlapping federal and state authority—an issue that remains actively contested as of late 2025.

The legal status of sports event contracts will ultimately be decided by the Supreme Court, but likely not until 2027 or 2028, according to speakers on arguably the most hotly anticipated panel of G2E 2025.

In a standing-room-only panel Wednesday in Las Vegas, consultant and journalist Dustin Gouker of The Closing Line, Covington & Burling LLP Partner Kevin King, and Arizona Department of Gaming Director Jackie Johnson discussed the rise and future of prediction markets.

Source: Ingame

What Would a Supreme Court Ruling Change for Prediction Markets?

A Supreme Court decision could clarify which regulator has final authority, establish nationwide consistency, or reinforce state enforcement powers. Any outcome would significantly reshape prediction markets legal status and determine whether these platforms can operate uniformly across the US.

How Can Users Participate Responsibly Amid Legal Uncertainty?

With prediction markets operating in a shifting legal landscape, responsible participation starts with risk awareness rather than assumptions of legality. Because regulatory interpretations differ across jurisdictions and continue to evolve, users must take an informed, cautious approach before engaging with any prediction market platform.

What Should Users Understand Before Participating in Prediction Markets?

Given ongoing uncertainty, users should approach prediction markets cautiously. Jurisdiction matters, platforms differ in compliance standards, and legal interpretations continue to evolve. Responsible participation means understanding local rules, conducting platform due diligence, and treating prediction markets as high-risk activities rather than guaranteed opportunities.

How Does Bitget Wallet Help Users Access Prediction Markets More Safely?

As prediction markets continue to evolve amid regulatory uncertainty, tools that emphasize user control and security become increasingly important. Rather than determining legality, the role of a wallet is to help users interact with on-chain platforms responsibly while maintaining full ownership of their assets.

Read more: Top Crypto Predictions for 2026: Bitcoin, Ethereum, and the Altcoins to Watch

How Does Bitget Wallet Support Secure Participation in Prediction Markets?

Bitget Wallet is a non-custodial wallet application that allows users to manage private keys and sign on-chain transactions. It does not operate prediction markets, structure contracts, or assess the legality of any activity. In discussions of prediction markets, Bitget Wallet is best understood as infrastructure software for asset custody and transaction approval, rather than as a participation or access mechanism.

From a practical standpoint, the wallet’s primary function is self-custody. Users retain direct control over private keys, must explicitly approve transactions, and can view balances and transaction history on-chain. These features may support clearer asset oversight and reduce reliance on centralized custodians, but they do not mitigate legal, market, or protocol-level risks associated with third-party applications.

Bitget Wallet also supports multi-chain asset management, which can allow users to separate funds across networks or addresses. This capability may be used for basic operational risk management—such as isolating experimental activity from long-term holdings—rather than to expand or promote engagement with any specific market type.

Review Bitget Wallet’s official documentation to evaluate its self-custody model and transaction-signing controls firsthand.

Conclusion

Is Prediction Market Legal in the US? The answer ultimately depends on how prediction market contracts are classified, which regulators assert authority, and how courts resolve ongoing conflicts between federal and state law. Because no single nationwide rule exists yet, prediction markets legal status remains fluid and subject to change as new rulings and regulatory actions emerge.

In this uncertain environment, users should stay informed, approach participation cautiously, and prioritize tools that emphasize control and security. For those exploring on-chain prediction markets, Bitget Wallet offers a self-custodial option that helps users manage risk and engage responsibly while the legal landscape continues to evolve.

Start with control and caution—Bitget Wallet helps you explore prediction markets responsibly.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. Is Prediction Market Legal in the United States?

Prediction markets operate in a legal gray zone shaped by federal regulation, state gambling laws, and ongoing court decisions. Their legality depends on classification, jurisdiction, and judicial interpretation rather than a single nationwide rule.

2. Are Prediction Markets Gambling or Financial Instruments?

Prediction markets can be treated as either gambling or financial instruments, depending on how contracts are structured and how regulators classify them. This distinction is central to how different authorities assess legality.

3. Are Sports Prediction Markets Legal Everywhere in the US?

No. Sports prediction markets legality varies by jurisdiction and faces stricter scrutiny than other event-based markets due to integrity, licensing, and consumer protection concerns.

4. Why Are States Suing Prediction Market Platforms?

States argue that prediction markets bypass local gambling licenses and undermine state-level enforcement frameworks, particularly when contracts resemble traditional sports betting.

5. Can I Use Bitget Wallet to Access Prediction Markets Safely?

Bitget Wallet provides secure, self-custodial access to on-chain prediction market platforms, helping users maintain control over assets. However, it does not guarantee legality, and users remain responsible for understanding applicable rules.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Prediction Market Risks: What Investors Should Know Before Getting Started2025-12-30 | 5 mins

- What You Need to Know About Prediction Market Before You Bet2025-12-30 | 5 mins