Prediction Market Risks: What Investors Should Know Before Getting Started

Prediction Market Risks are often underestimated by new investors. At first glance, prediction markets seem simple: choose an outcome, place a position, and wait for the result. However, Prediction Market Risks are fundamentally different from those found in traditional financial markets.

Prediction markets combine Web3 infrastructure with real-world events such as elections, economic indicators, or crypto price milestones. While they introduce transparency and innovation, they also carry financial, behavioral, technical, and legal risks that investors must clearly understand before participating. This article explains those risks in a practical way and shows how tools like Bitget Wallet can help investors manage exposure more responsibly.

Key Takeaways

- Prediction markets carry unique risks that differ from traditional investing

- Binary outcomes and time limits increase capital loss potential

- Liquidity, manipulation, and regulation are major concerns

- Risk management matters more than prediction accuracy

What Is a Prediction Market ?

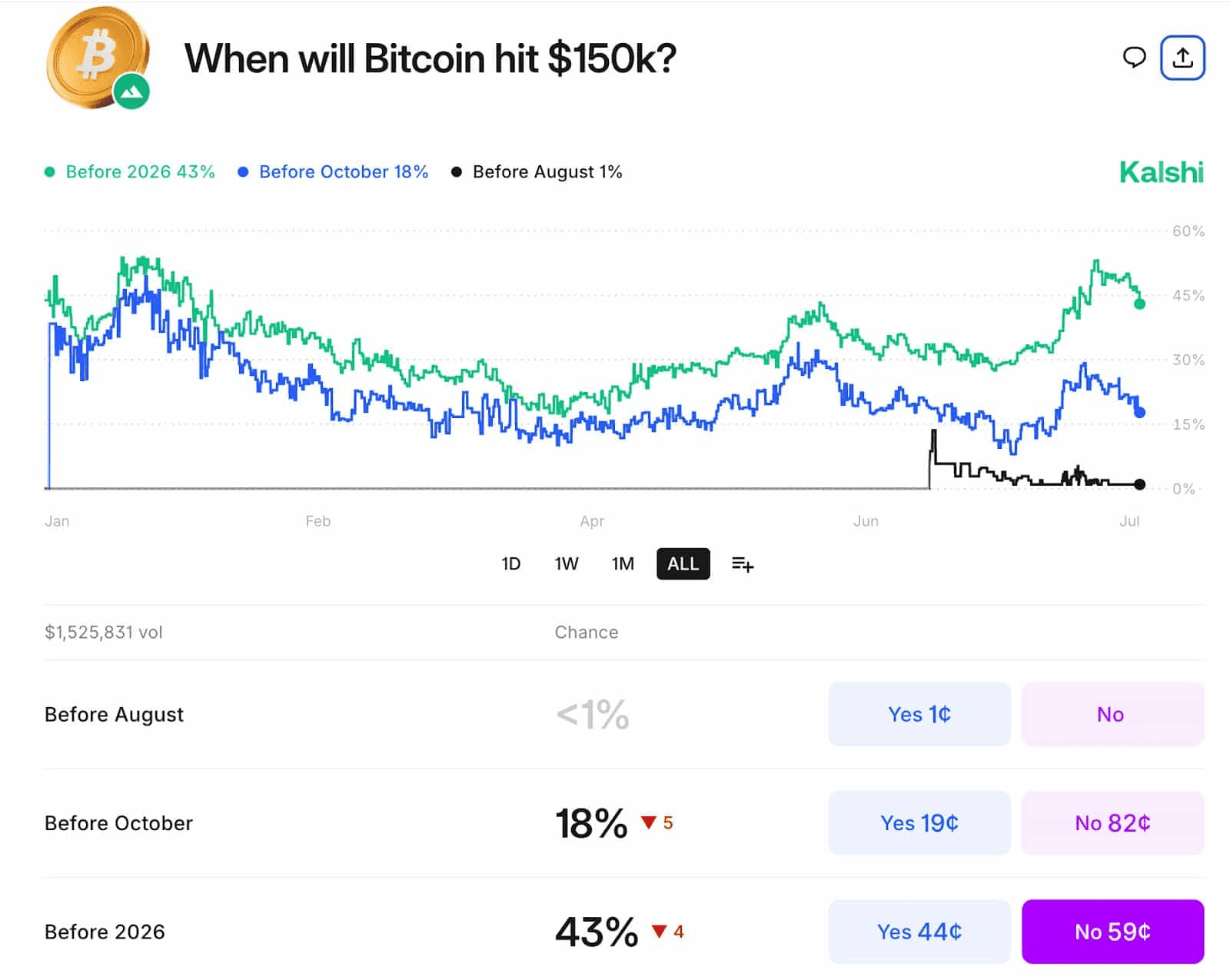

A prediction market is a platform where participants trade contracts based on the outcome of a future event. Instead of buying an asset, users buy “Yes” or “No” contracts tied to a specific outcome, such as whether Bitcoin will reach a certain price by a set date.

Each contract is priced between $0 and $1, representing the market’s implied probability. For example, a contract priced at $0.65 suggests a 65% chance of that outcome occurring. If the event happens, the contract settles at $1; if not, it settles at $0. This structure creates several event contract risks that investors must understand.

Source X

What Are Event Contracts and Why Do They Create Risk?

Event contracts are binary instruments that settle entirely at either $0 or $1 once a predefined event is resolved. Unlike traditional assets, their value does not represent ownership, cash flow, or future utility—it represents a temporary claim on a single outcome.

The risk does not come from uncertainty alone. It comes from how binary settlement, fixed time horizons, and probability pricing interact.

- Binary settlement creates cliff risk: Value does not decline gradually. A near-correct outcome still settles at zero.

- Fixed deadlines compress time: As settlement approaches, prices must rapidly converge, amplifying volatility.

- Prices reflect probability, not value: Rising prices signal market belief, not intrinsic worth, creating reflexive bubbles.

- Late information dominates outcomes: News arriving close to settlement can instantly override prior analysis.

- No recovery after settlement: Once the event resolves, the position ends—there is no holding, compounding, or rebound.

What Are the Risks of Prediction Markets?

Prediction market risks differ fundamentally from traditional investing risks because contracts are binary, time-restricted, and often thinly traded. Participants are not investing in long-term value—they are exposed to outcome resolution within a fixed window.

The key risks below are explained not only by what they are, but also by when, where, and under what conditions they are most likely to occur.

1. Liquidity Risk

Liquidity risk occurs when there are not enough buyers or sellers to support efficient price discovery.

This risk is most likely to occur:

- In niche or low-attention events with limited participant interest

- During the final 24–72 hours before settlement, when traders rush to exit

- Immediately after sudden news, when order books thin out temporarily

Under these conditions, low liquidity can lead to:

- Severe price slippage when entering or exiting positions

- Inability to close trades at expected prices

- Probabilities that reflect order imbalance rather than real consensus

In practice, this means even a correct prediction can become unprofitable due to execution risk, not analytical error.

Source Ivestopedia

2. Price Volatility Risk

Price volatility in prediction markets intensifies as the event deadline approaches, because uncertainty collapses into a binary outcome.

This risk is highest:

- Near settlement, when prices must converge toward $0 or $1

- During major data releases, rumors, or breaking news

- In events driven by real-time information, such as elections or court rulings

Because there is no post-settlement recovery, late-entry volatility exposes users to abrupt losses that cannot be managed over time.

For example, retail traders often underestimate how fast prices can move in the final hours, leading to emotionally driven entries at peak probability levels.

3. Market Manipulation and Bot Risk

Market manipulation risk arises when prices are influenced by actors with disproportionate capital or automated execution speed.

This risk is most common:

- In low-liquidity markets, where small capital can move prices

- During off-peak trading hours, when fewer participants are active

- Shortly before settlement, when retail traders react quickly to price signals

Typical manipulation behaviors include:

- Temporarily inflating probabilities to trigger momentum buying

- Using bots to exploit latency and thin order books

- Forcing price moves that do not reflect new information

For example, beginners often mistake short-term price spikes for informed consensus, entering positions after manipulation has already occurred.

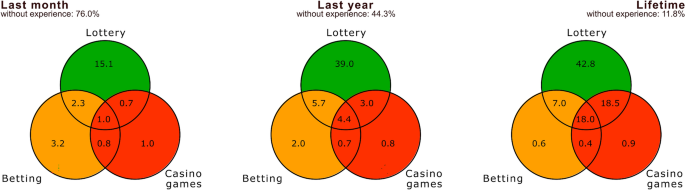

4. Gambling-Like Structural Risk

Prediction markets carry a structural risk similar to gambling because outcomes are binary and time-limited.

This risk becomes pronounced:

- When users trade frequently across many short-term events

- When position sizing increases after losses, seeking recovery

- When markets are treated as entertainment rather than capital allocation

Unlike traditional investing, there is:

- No compounding effect

- No long-term value accumulation

- No ability to “hold through” adverse outcomes

Over time, this structure increases emotional decision-making and capital erosion, especially for retail participants.

Source X

5. Regulatory and Legal Risk

Regulatory risk stems from inconsistent legal classification across jurisdictions.

This risk is most likely to surface:

- When platforms expand into new regions without clear licensing

- During regulatory crackdowns or policy updates

- When users cross borders or use VPNs unknowingly

Consequences may include:

- Sudden platform shutdowns

- Frozen or inaccessible positions

- Unclear tax reporting obligations

For example, many users only become aware of regulatory risk after an enforcement action occurs, when it is already too late to exit positions.

Source X

Are Prediction Markets Risky Compared to Traditional Investing?

Prediction markets sit at the intersection of investing and gambling, which is why they are often misunderstood. Whether they function more like one or the other depends less on the platform itself and more on structure, usage, and user behavior.

The Case for Prediction Markets as Investing

Supporters argue that prediction markets resemble financial markets because prices are formed through collective information.

From this perspective:

- Prices represent market-implied probability, similar to how markets price risk

- Participants trade based on analysis, data, and expectations

- Decentralized design reduces reliance on a single authority

In theory, prediction markets can aggregate dispersed information efficiently, especially for events where traditional forecasting models fall short.

The Case for Prediction Markets as Gambling

Critics focus on the binary payoff structure, which closely mirrors betting systems.

Key similarities include:

- Only two possible outcomes in most contracts

- Fixed upside and total loss downside

- No ownership, yield, or long-term value accumulation

Because contracts settle at $0 or $1, outcomes depend entirely on resolution rather than gradual value creation. This makes short-term speculation unavoidable.

How Do Prediction Market Odds Resemble Gambling Mechanics?

Prediction market prices move based on supply and demand, not intrinsic value. Like betting odds, rising prices reflect where money is flowing—not necessarily better information.

This creates risk when:

- Retail users equate higher prices with higher certainty

- Liquidity distortions exaggerate probability signals

- Short-term momentum replaces independent analysis

This misinterpretation is a key reason why prediction markets are risky for investors, especially those without experience managing binary, time-bound exposure.

What Is a Prediction Market in Crypto and How Blockchain-Based Prediction Markets Work

How Do Market Manipulation and Bots Increase Prediction Market Risks?

Automation plays a major role in modern prediction markets. Bots react faster than humans, exploit arbitrage gaps, and adjust positions instantly based on oracle updates.

This increases Prediction Market Risks by:

- Reducing fairness for manual traders

- Creating false confidence signals

- Increasing short-term volatility

For individual investors, this means competing against systems designed to capitalize on micro-inefficiencies.

How Can Investors Reduce Prediction Market Risks in Practice?

Risk reduction starts with mindset and discipline. Prediction markets should never represent a core investment strategy.

Practical steps include:

- Limiting position size per event

- Using stablecoins to control volatility

- Avoiding last-minute emotional trades

- Reviewing on-chain liquidity before entering positions

- Separating speculative funds from long-term holdings

These habits significantly reduce the risks of betting on prediction markets.

How Can You Trade Prediction Markets More Safely Using Bitget Wallet?

Prediction markets carry structural risks that cannot be eliminated, but they can be contained through proper asset control and exposure management. This is where tooling choice matters.

Bitget Wallet is a non-custodial wallet that allows users to retain full ownership of their assets while interacting with on-chain prediction platforms. Instead of promising higher returns, its primary safety value lies in risk isolation and visibility.

1. Custody Risk

Custody risk arises when prediction market participants rely on centralized platforms or intermediaries to hold funds. Platform outages, account freezes, or operational failures can prevent users from accessing capital when timing matters most.

How Bitget Wallet helps mitigate this risk:

- Users retain full control of private keys through non-custodial storage

- Assets remain in the user’s wallet, not locked inside a centralized exchange

- Platform-level failures do not directly affect wallet-held funds

This reduces dependency on third parties and limits exposure to access-related risks during volatile market conditions.

2. Overexposure Risk

Binary contracts can encourage oversized positions due to their fixed payoff structure. This helps prevent prediction market trades from unintentionally consuming long-term investment capital.

- Users can allocate a dedicated wallet for prediction market activity

- Exposure is visible at the wallet level, making position size easier to monitor

3. Fund Separation Risk

Fund separation risk occurs when speculative prediction market trades are conducted from the same wallet that holds long-term assets. During volatile periods, this mixing increases emotional decision-making and makes it harder to enforce discipline after losses or rapid price movements.

Risk trigger conditions:

- High-frequency trading sessions that blur exposure boundaries

- Loss-recovery behavior following failed predictions

Mitigation using Bitget Wallet:

- Segregate stablecoins specifically used for event contracts

- Isolate long-term holdings from short-term, outcome-based trades

By structurally separating speculative capital from core assets, users can limit cascading losses and reduce emotion-driven position escalation—two of the most common causes of capital erosion in prediction markets.

- Read more:

- What Is a Prediction Market in Crypto and How Blockchain-Based Prediction Markets Work

- Top Crypto Predictions for 2026: Bitcoin, Ethereum, and the Altcoins to Watch

- Best Crypto Presale in 2026: Top 100x Potential Tokens Every Investor Should Watch

Conclusion

Prediction markets carry structural risks driven by binary outcomes, fixed settlement timelines, and uneven information flow. Unlike traditional investing, losses cannot be absorbed over time, making execution, timing, and discipline critical factors.

Rather than attempting to eliminate these risks, safer participation depends on containing exposure, maintaining clear boundaries, and retaining direct control over assets. Using a non-custodial tool like Bitget Wallet allows users to separate speculative capital from long-term holdings, monitor exposure transparently, and reduce reliance on third-party custody.

Ultimately, prediction markets reward structure and restraint more than confidence. For most participants, disciplined risk management—supported by proper wallet architecture—is more important than predicting outcomes correctly.

FAQs

Are prediction markets risky for beginners?

Yes. Prediction markets are risky for beginners due to binary outcomes, high volatility, and low liquidity, which can quickly lead to losses.

Are prediction markets gambling or investing?

Prediction markets share characteristics with both. They use market pricing like investing but have binary outcomes similar to gambling.

What are the biggest prediction market risks to watch out for?

The biggest risks include liquidity issues, price manipulation, regulatory uncertainty, and emotional decision-making near event deadlines.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Is Prediction Market Legal: US Federal vs State Laws Explained2026-01-05 | 5 mins

- What You Need to Know About Prediction Market Before You Bet2025-12-30 | 5 mins