How Sports Prediction Markets Work: A Beginner’s Guide to Event Trading

How sports prediction markets work has become an increasingly common question as more users look beyond traditional sportsbooks toward trading-style participation in sports outcomes. Rather than locking into fixed odds, participants interact with markets that move dynamically as expectations change. As interest in sports prediction markets grows alongside broader access to on-chain trading infrastructure, understanding the underlying mechanics is essential. In practice, many participants use self-custodial tools such as Bitget Wallet to manage assets while engaging with these markets, making clarity around contracts, pricing, and execution far more important than simply picking winners.

Bitget Wallet offers a simple, self-custodial way to manage assets while accessing on-chain prediction markets.

Key Takeaways

- How sports prediction markets work is based on trading event contracts that reflect real-time probabilities, not fixed odds.

- Sports prediction markets allow traders to enter and exit positions before an event ends, similar to financial markets.

- Sports event contracts settle at $1 or $0, creating clear risk and reward for each position.

- Unlike sportsbooks, this model supports inventory-style trading, where timing and pricing matter more than final scores.

- Tools like Bitget Wallet help users manage assets securely when accessing on-chain prediction market platforms.

How Sports Prediction Markets Work at the Contract Level?

Sports prediction markets operate at the contract level by turning a specific sports outcome into a standardized event contract. Each contract represents a single, clearly defined result—such as whether a team wins or loses—and carries a fixed settlement value. Because the outcome criteria are predetermined, these contracts can be bought and sold before the event is completed, allowing prices to change as expectations shift. This contract-based structure is what enables trading behavior, making participation dependent on probability assessment and timing rather than simply predicting the final score.

Source: nytimes

What is sports event market

A sports event market is the environment where individual outcomes are represented as tradable contracts rather than bets. Each market centers on a single, clearly defined event, allowing participants to express expectations by buying or selling contracts tied to that outcome.

How sports event contracts are created from real-world outcomes?

Sports event contracts are structured around binary results, such as win or loss, yes or no. Each contract represents one measurable outcome and resolves in a fixed way: it settles at $1 if the outcome occurs and $0 if it does not.

This standardization is critical to how sports prediction markets work. Because outcomes are clearly defined and settlement is fixed, contracts can be freely traded before resolution, enabling market-driven price discovery rather than bookmaker-determined odds.

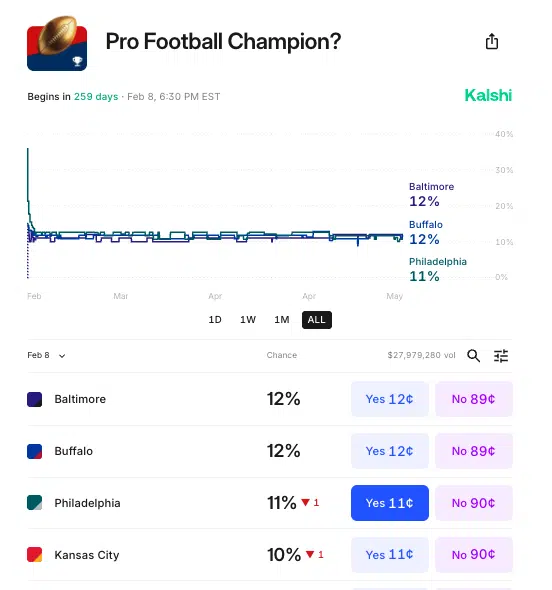

How Sports Event Contracts Are Priced by the Market?

Sports event contracts are priced by the market through continuous buying and selling rather than being set by a bookmaker. Each contract trades between $0 and $1, with the price reflecting the collective probability assigned to a specific outcome at that moment. When more participants believe an outcome is likely and buy contracts, the price rises; when confidence decreases and selling increases, the price falls. As new information emerges—such as team news, injuries, or in-game momentum—market participants adjust their positions, causing prices to update in real time. This dynamic process allows probabilities to evolve naturally based on supply, demand, and shared expectations.

Source: bettingusa

How probability is expressed through contract pricing?

Probability is expressed through the exact price level at which trades clear, not through odds or payout formulas. Each price point represents a willingness threshold: buyers accept risk below that price, while sellers accept exposure above it. When contracts transact at a new price, the implied probability shifts immediately, even if no external event has occurred. Small price movements often signal marginal opinion changes, while rapid jumps usually reflect new information entering the market. In this way, probability is not declared—it is continuously recalculated through executed trades.

How traders influence prices through buying and selling?

Prices change as participants buy and sell contracts. Increased demand pushes prices higher, while selling pressure drives them lower. This continuous interaction reflects new information, changing sentiment, and shifting expectations.

As a result, prices often move well before games conclude. This is a key reason sports prediction markets behave more like live trading venues than static betting systems.

How Trading Sports Prediction Markets Differs From Placing Bets?

Trading in sports prediction markets differs from placing bets because participants are managing positions, not locking in outcomes. Instead of committing capital to a single result and waiting for settlement, traders interact with a live market where prices change continuously. The focus shifts from predicting who wins to deciding when to enter, adjust, or exit exposure based on changing probabilities. This execution-first structure makes timing, liquidity, and price movement central to performance, rather than just the final score.

This execution-first structure highlights the core difference in prediction markets vs sports betting, where traders manage positions dynamically instead of locking into fixed wagers.

Source: realtrading

Read More: Is Prediction Market Gambling: Sports Betting or Financial Forecasting?

How position entry and exit work before settlement?

When entering a position, a trader buys or sells contracts at the current market price, establishing exposure immediately. That exposure can be reduced, closed, or reversed at any time before the event ends by executing an opposite trade. If market sentiment shifts or new information emerges, traders can respond instantly rather than being forced to hold until resolution. This ability to exit early transforms participation into an active process, where managing risk during the event matters as much as the initial decision.

How settlement replaces traditional payouts?

At settlement, contracts resolve mechanically rather than through payout calculations. A contract linked to a correct outcome settles at $1, while an incorrect outcome settles at $0, regardless of the price paid. Profit or loss is simply the difference between the entry price and the settlement value. There are no odds adjustments, no multipliers, and no conditional terms. This fixed settlement structure simplifies outcomes and makes all risk transparent at the moment a position is opened.

How CFTC-Regulated Prediction Markets Operate in the US?

In the United States, sports prediction markets operate under a federal regulatory framework rather than state gambling laws. Oversight by the Commodity Futures Trading Commission places these markets within the derivatives category, which directly shapes how contracts are structured, listed, and settled. As a result, market design prioritizes standardization, transparency, and risk disclosure, influencing both what users can trade and how those trades are executed.

Under CFTC-regulated prediction markets, sports event contracts are treated as derivatives rather than gambling products, shaping how markets are structured and offered nationwide.

Source: Gamblingnews

How federal oversight defines market structure?

Federal oversight classifies sports event contracts as financial instruments instead of wagers. This classification allows platforms to offer markets nationwide without tailoring products to individual state betting regulations. It also requires contracts to be clearly defined, outcomes to be objectively verifiable, and settlement rules to be fixed in advance. These requirements limit discretionary pricing or payout adjustments and ensure that all participants interact with the same standardized contract terms.

How compliance affects available sports markets?

Regulatory compliance directly determines which events and contract formats are available. Some sports outcomes may not meet approval standards, and certain market structures can be delayed, modified, or excluded entirely. This can affect market depth and liquidity, especially for niche events. For users, this means that availability is not purely demand-driven; it reflects regulatory constraints that shape contract selection, trading volume, and overall market behavior.

How to Trade Sports Prediction Markets Step by Step

Trading sports prediction markets follows a simple, repeatable loop: read the price → pick a side → define risk → enter → manage → exit or settle.

The key difference from betting is control — you are not locked in and can exit early when prices move.

Step-by-step: How to trade sports prediction markets

Step 1: Choose one clear market

Pick a single yes/no outcome you can explain in one sentence (e.g., Team A wins).

Keep it simple until you understand how prices move.

Step 2: Read the contract price as probability

Think of the price as a chance estimate. $0.70 ≈ the market believes there is a 70% chance. This price is the foundation of every decision.

Step 3: Decide your edge (Buy, Skip, or Avoid)

- Buy only if you believe the true chance is higher than the price.

- Avoid or sell if you believe it’s lower.

- Skip if you cannot clearly explain your reasoning.

Step 4: Define your maximum loss first

Before entering, decide the exact amount you’re willing to lose. Your risk is fixed and known upfront — use that to stay disciplined.

Step 5: Enter with patience

Do not chase sudden price moves. Enter only at a price you are comfortable holding.

Step 6: Plan your exit early

Always know your exit path:

- Take profit if price moves in your favor.

- Cut loss if the market proves you wrong.

- Hold to settlement only if your original logic still holds.

Step 7: Keep positions uncorrelated

Avoid stacking trades tied to the same team, game, or news.

How traders evaluate probabilities before entering a position?

Before entering a trade, traders assess whether the market price accurately reflects the likelihood of an outcome. This involves comparing the implied probability in the contract price with their own analysis based on available information, such as team conditions, matchup dynamics, or game context. A trade is only justified when there is a meaningful gap between the trader’s estimate and the market’s consensus. Without this difference, there is no structural edge, regardless of confidence in the outcome.

How position sizing and risk exposure work?

Once a decision to trade is made, risk is defined by position size. Because each contract has a fixed settlement value, the maximum loss is known upfront at the time of purchase. Traders control exposure by limiting how many contracts they hold rather than relying on odds or leverage. Smaller position sizes reduce volatility and allow for flexibility if market conditions change, while oversized positions increase sensitivity to short-term price movements.

How traders manage multiple event positions?

When holding multiple positions at the same time, overall risk depends on how those events relate to each other. Positions tied to the same team, league, or external factors can move together, amplifying gains or losses unexpectedly. Effective management requires spreading exposure across unrelated events and monitoring total capital at risk rather than viewing each position in isolation. This portfolio-level view is critical for maintaining consistency over time.

How to Participate Safely Using Tools Like Bitget Wallet?

In sports prediction markets, participation does not end after a single trade. Positions may be opened, partially closed, adjusted, or exited entirely as prices move. This makes the tool used to interact with the market a core part of the trading process, not just a place to store funds.

Self-custodial tools fit into prediction market participation by serving as the control layer between the user and on-chain markets. Instead of depositing assets into a platform, users keep funds in their own wallet and authorize every trade directly. When using a wallet such as Bitget Wallet, each position change requires explicit approval, ensuring assets are only moved in response to intentional actions.

This setup matters because prediction market trading involves frequent execution decisions rather than a one-time commitment. By keeping custody, execution, and confirmation in the same place, self-custodial tools reduce unintended exposure, improve transparency, and allow users to manage risk actively while markets evolve.

Read more: What Is a Prediction Market in Crypto and How Blockchain-Based Prediction Markets Work, Best Crypto To Invest in 2026: Top Coin Picks

How Investors Should Evaluate Risk in Sports Prediction Market Trading?

From an investor perspective, risk in sports prediction markets comes less from being wrong about an outcome and more from how exposure is managed while prices move. Because contracts trade continuously before settlement, risk exists at every moment—not just at the final result. Evaluating this correctly requires thinking in terms of positions, liquidity, and timing rather than wins and losses alone.

Source: Investopedia

How inventory risk differs from traditional betting risk

In prediction markets, positions behave like inventory rather than fixed wagers. The value of a contract changes as market expectations shift, meaning unrealized gains can disappear quickly if sentiment reverses. Investors are exposed to mark-to-market risk the moment a position is opened, even if the final outcome has not changed. Liquidity also matters: exiting a position at a desired price may not always be possible, especially in thinner markets. This makes risk ongoing and dynamic, unlike traditional bets where exposure is static until settlement.

How common mistakes occur in event-based trading

Many losses stem from behavioral errors rather than faulty analysis. Traders often overcommit to outcomes that feel “obvious,” ignoring how much probability is already priced in. Others hold winning positions too long, watching profits evaporate instead of taking partial exits when prices move favorably. A frequent mistake is treating probabilities as guarantees—forgetting that even high-confidence outcomes can fail. Successful investors manage uncertainty continuously, adjusting exposure instead of anchoring to a single prediction.

Conclusion

How sports prediction markets work comes down to trading probabilities through standardized event contracts, not placing fixed bets on outcomes. By understanding how contracts are structured, how prices reflect market expectations, and how positions can be managed before settlement, participants can engage with these markets using process and timing rather than intuition alone.

For those who choose to participate, consistency depends on discipline, risk control, and execution clarity. Using self-custodial tools like Bitget Wallet helps users maintain asset control and transparency while interacting with on-chain prediction markets, supporting responsible participation as market conditions evolve.

Stay in control while trading on-chain with Bitget Wallet.

FAQs

How Sports Prediction Markets Work in Simple Terms

They convert sports outcomes into tradable contracts priced by probability. You can trade before an event ends, and contracts settle cleanly at $1 or $0 based on the result.

Are Sports Prediction Markets Legal in the US?

Yes. Many operate under Commodity Futures Trading Commission oversight, enabling nationwide access through federal derivatives rules rather than state betting laws.

How Do Sports Prediction Markets Differ From Sportsbooks?

Prediction markets emphasize trading and control—prices show probabilities, positions can be exited early, and settlement is fixed. Sportsbooks rely on fixed odds and only resolve at the final outcome.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Is Prediction Market Legal: US Federal vs State Laws Explained2026-01-05 | 5 mins

- Prediction Market Risks: What Investors Should Know Before Getting Started2025-12-30 | 5 mins