What Is United Stables (U) and How Does It Work: A Complete Guide for New Users

What is United Stables (U)? United Stables (U) goes beyond being a conventional digital asset—it represents a new approach to stablecoin design focused on liquidity unification and risk diversification, while encapsulating the core principles of on-chain finance, interoperability, and institutional-grade stability. By combining diversified stablecoin reserves with multi-chain deployment, $U aims to address fragmentation and trust concerns that have long existed in the stablecoin market.

With backing from a growing ecosystem of DeFi participants, infrastructure partners, and cross-chain liquidity providers, United Stables (U) is not merely a passing trend in the blockchain ecosystem. It introduces compelling possibilities for users and investors seeking a more resilient USD-pegged asset. This article explores everything you need to know about United Stables (U), offering insights to help you evaluate its structure, understand its role in modern crypto markets, and navigate opportunities in this rapidly evolving sector.

Safely store and use stablecoins across chains with Bitget Wallet – ideal for beginners.

Key Takeaways

- United Stables (U) is a USD-pegged stablecoin backed 1:1 by a diversified basket of major stablecoins and cash equivalents, designed to reduce issuer and liquidity risk.

- $U focuses on liquidity unification and cross-chain settlement, helping address fragmentation across DeFi, trading, and on-chain payments on networks like Ethereum and BNB Chain.

- Positioned as a next-generation stable asset, $U appeals to both retail and institutional users seeking a more resilient alternative to single-issuer stablecoins.

- $U can be securely stored, swapped, and used on-chain via Bitget Wallet, giving users a non-custodial, multi-chain way to access stablecoin liquidity and DeFi opportunities.

What Is United Stables (U) and Why It Matters?

United Stables (U) is a USD-pegged stablecoin built on Ethereum and BNB Chain that represents a modern evolution of stablecoins focused on liquidity unification rather than single-issuer dominance. Instead of relying on one reserve source, the project aggregates multiple major fiat-backed stablecoins into a single settlement asset.

The project is built around the following core values:

- Liquidity unification to reduce fragmentation across markets

- Risk diversification through multi-asset stable backing

- Interoperability across chains, DeFi protocols, and trading venues

United Stables (U) does not draw from ancient cultural symbolism; instead, it applies financial resilience and transparency principles to on-chain finance, aiming to support a sustainable, trustworthy, and collaborative stablecoin ecosystem for both retail and institutional users.

Source: X

The stablecoin protocol United Stables ($U) has been launched for less than a week, and the FDV has approached $300 million. It has also been integrated with top projects in the BNB Chain ecosystem such as Binance Wallet, ListaDAO, Aster, Fourmeme, and Venus.

United Stables (U) Listing Details and Launch Date

1. Key Listing Information

Here are the important details about the United Stables (U) listing:

- Exchange: To be announced

- Trading Pair: U / USDT

- Deposit Available: December 18, 2025

- Trading Start: December 18, 2025

- Withdrawal Available: December 19, 2025

Don’t miss your chance to start trading United Stables (U) on exchanges and be part of this groundbreaking journey.

- Please refer to the official announcement for the most accurate schedule.

United Stables (U) Price Prediction and Outlook 2025

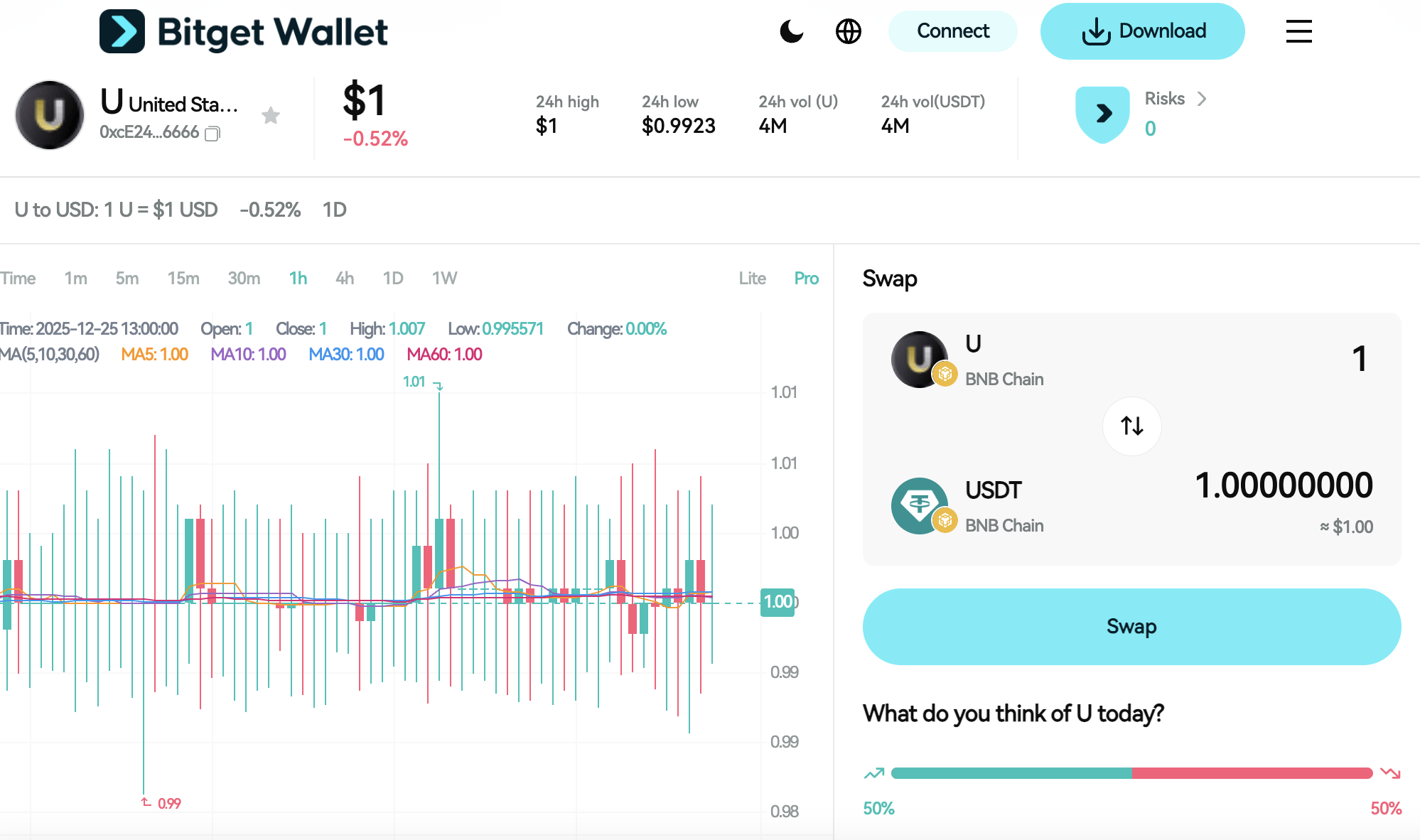

The value of United Stables (U) is shaped by stablecoin market conditions, reserve management, and on-chain adoption rather than speculative trading. As a USD-pegged stablecoin, $U is expected to trade within a narrow range of $0.99–$1.01, reflecting its 1:1 peg to the U.S. dollar. Should reserve transparency remain intact and adoption in DeFi settlement, cross-chain transfers, and on-chain payments continue to expand, $U is expected to maintain its $1.00 peg throughout 2025.

Key Factors Impacting United Stables (U) Price

Several aspects influence the potential price movement of United Stables (U):

- Market Conditions: Demand for USD liquidity during market volatility and capital rotation into stablecoins

- Adoption & Utility: Usage of $U as a settlement asset in DeFi protocols, cross-chain liquidity, and on-chain payments

- Project Expansion: Integration with additional blockchains, wallets, DEXs, and liquidity venues

Future Price Outlook

As United Stables (U) expands further in on-chain finance and stablecoin infrastructure, broader adoption is expected to support consistent demand and liquidity. Analysts do not project price appreciation beyond the peg; instead, $U’s outlook for 2025 centers on maintaining stability near $1.00, with only minor short-term deviations possible due to liquidity conditions. Users should evaluate reserve disclosures, regulatory developments, and stablecoin market risks before holding or using $U.

Source: CoinMarketCap, CoinGecko, Bitget Wallet

Source: Bitget Wallet

Core Features of United Stables (U) and Why They Matter?

The standout features of United Stables (U) include:

-

Diversified 1:1 Stablecoin Backing

Unlike single-issuer stablecoins, $U is backed 1:1 by a basket of major fiat-backed stablecoins and cash equivalents. This structure is designed to reduce concentration and issuer risk, helping improve resilience during periods of market stress or liquidity shifts.

-

Liquidity Unification Across Chains

$U functions as a unified settlement asset, aggregating stablecoin liquidity that would otherwise be fragmented across multiple tokens and blockchains. This makes it easier for users and protocols to move USD liquidity efficiently across Ethereum, BNB Chain, and DeFi ecosystems.

-

On-Chain Transparency and Interoperability

United Stables emphasizes on-chain issuance, transferability, and reserve visibility, enabling users to verify activity directly on supported blockchains. Combined with multi-chain deployment, this supports interoperability across wallets, DEXs, and DeFi protocols without relying on custodial intermediaries.

The United Stables (U) Ecosystem: How It Functions?

How United Stables (U) Works?

- Built on Ethereum and BNB Chain, enabling secure, censorship-resistant, and widely compatible on-chain transactions.

- Uses Proof-of-Stake–based consensus (Ethereum PoS; BNB Chain PoSA) to validate transactions efficiently with predictable finality.

- Supports DeFi liquidity, cross-chain settlement, on-chain payments, and stablecoin swaps, acting as a neutral USD settlement asset across ecosystems.

Key Benefits

- Reduced Concentration Risk – By aggregating multiple fiat-backed stablecoins into a single 1:1-backed token, $U helps mitigate reliance on any single issuer.

- Improved Liquidity Efficiency – $U unifies fragmented stablecoin liquidity, making it easier for users and protocols to access deep USD liquidity across chains.

- Interoperable & Non-Custodial Access – As an on-chain stablecoin, $U integrates seamlessly with wallets, DEXs, and DeFi protocols without requiring custodial intermediaries.

United Stables (U) Team: Leadership and Strategic Vision

| Section | Details |

| The Team | Led by United Stables, the project is developed by a team with experience in stablecoin infrastructure, on-chain liquidity management, and DeFi systems. Rather than promoting individual founders, the team emphasizes transparency, reserve integrity, and system reliability. |

| The Vision | Focused on reducing stablecoin fragmentation and concentration risk, United Stables aims to build a neutral, resilient USD settlement layer that supports DeFi, cross-chain liquidity, and on-chain payments within the broader crypto financial infrastructure. |

| Partnerships | United Stables collaborates with blockchain networks (Ethereum, BNB Chain), DeFi protocols, liquidity venues, and wallet providers to expand adoption and strengthen its role as a unified stablecoin settlement asset across multiple ecosystems. |

Key Use Cases of United Stables (U): How It’s Transforming On-Chain Finance

United Stables (U) serves a variety of purposes, including:

-

Unified Stablecoin Settlement

$U acts as a neutral USD settlement asset that aggregates liquidity from multiple fiat-backed stablecoins, reducing fragmentation across DeFi protocols and trading venues.

-

Cross-Chain Liquidity & Transfers

Deployed on Ethereum and BNB Chain, $U enables efficient movement of USD liquidity across chains, supporting swaps, bridges, and multi-chain DeFi strategies.

-

DeFi Trading, Payments, and Treasury Use

$U is used for DEX trading pairs, liquidity provisioning, on-chain payments, and treasury management where price stability and reserve diversification are required.

These applications highlight the practical value of $U in on-chain finance and stablecoin infrastructure, where stability, liquidity efficiency, and interoperability matter more than price speculation.

United Stables (U) Roadmap 2025: Key Milestones and Expansion Plans

The roadmap for United Stables (U) reflects a pragmatic, infrastructure-first rollout focused on stability, liquidity, and adoption. Where exact milestones have not been formally published, items below are framed as documented focus areas rather than promises.

| Quarter | Roadmap |

| Q3 2025 | Project development and reserve framework preparation; smart-contract design; early ecosystem discussions ahead of public launch. |

| Q4 2025 | Official launch of $U (December 18, 2025) on Ethereum and BNB Chain; initial on-chain liquidity availability; early DeFi and wallet integrations. |

| Q1 2026 | Expansion of DeFi integrations and liquidity venues; broader wallet support; continued emphasis on reserve transparency and peg stability. |

| Q2 2026 | Ongoing ecosystem growth, potential additional chain support, and exploration of centralized exchange listings subject to regulatory and partner readiness. |

These milestones highlight the practical role of $U in on-chain finance and stablecoin infrastructure, where long-term success is measured by peg reliability, liquidity depth, and ecosystem adoption, not speculative price growth.

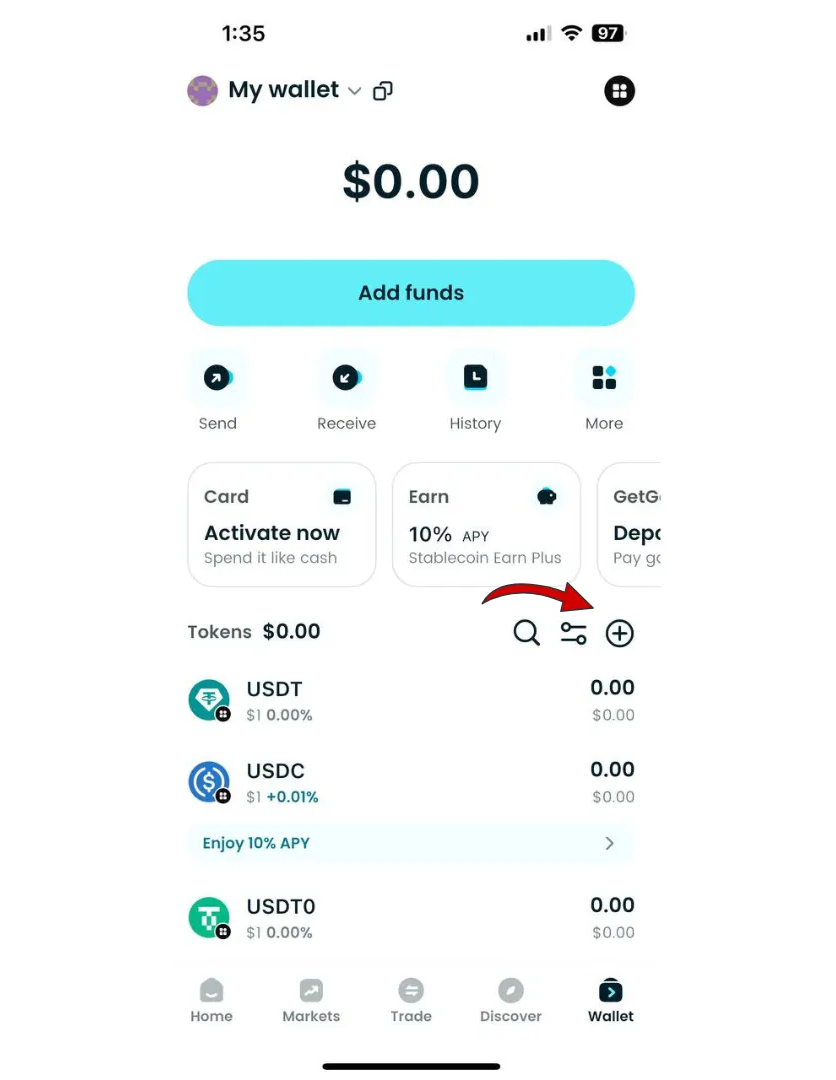

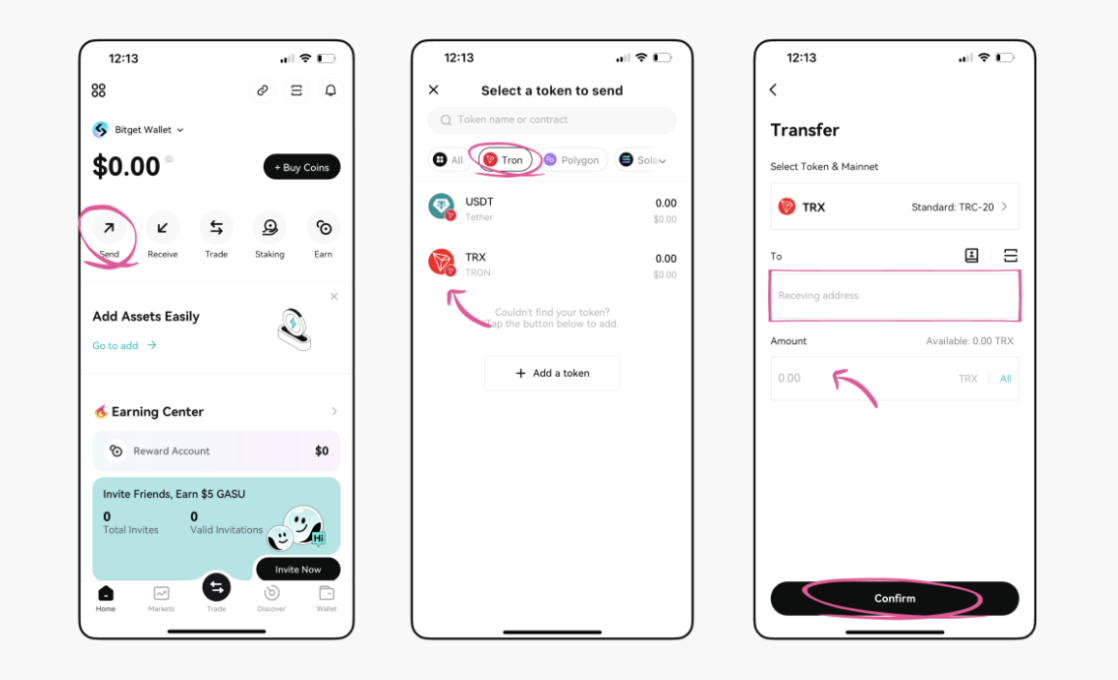

How to Buy United Stables (U) on Bitget Wallet?

Trading United Stables (U) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't have an account, download the Bitget Wallet app. Sign up by providing the necessary information and setting up your wallet securely.

Step 2: Deposit Funds

Once your account is set up, you need to deposit funds. You can do this by:

- Transferring Cryptocurrency: Send crypto from another wallet.

- Buying Crypto: Use a credit or debit card to purchase crypto directly on Bitget Wallet, ensuring you have enough funds for trading United Stables (U).

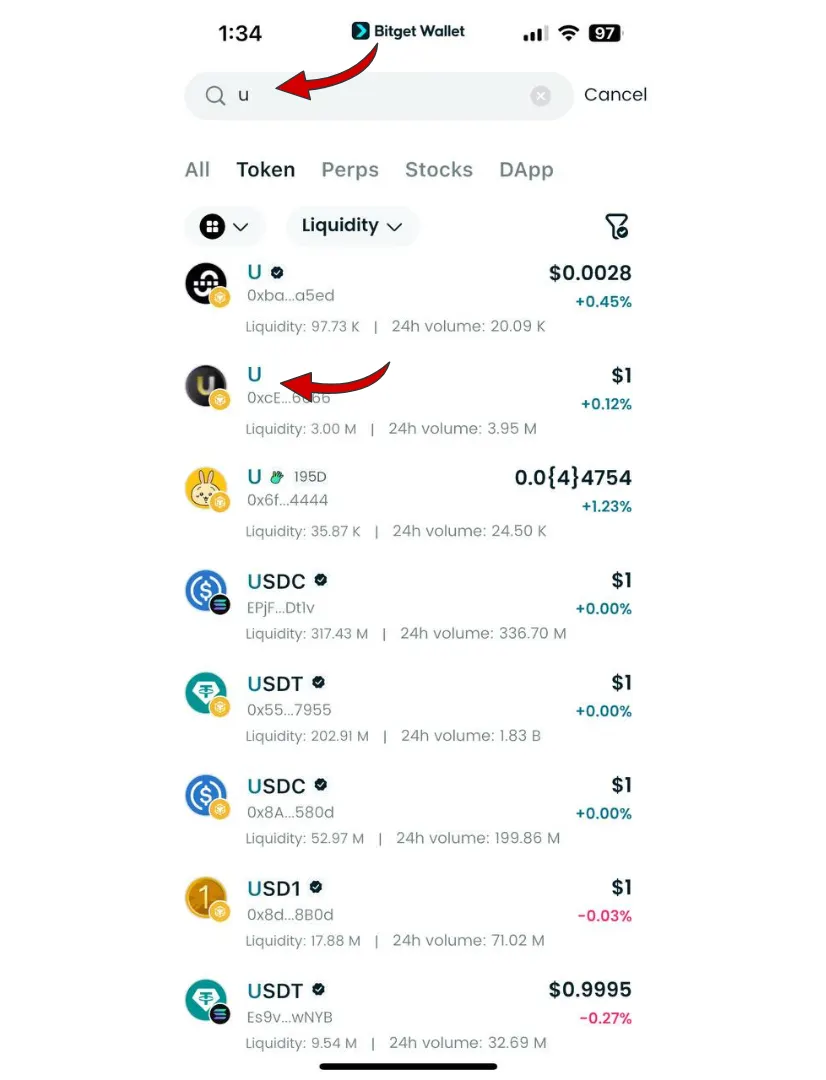

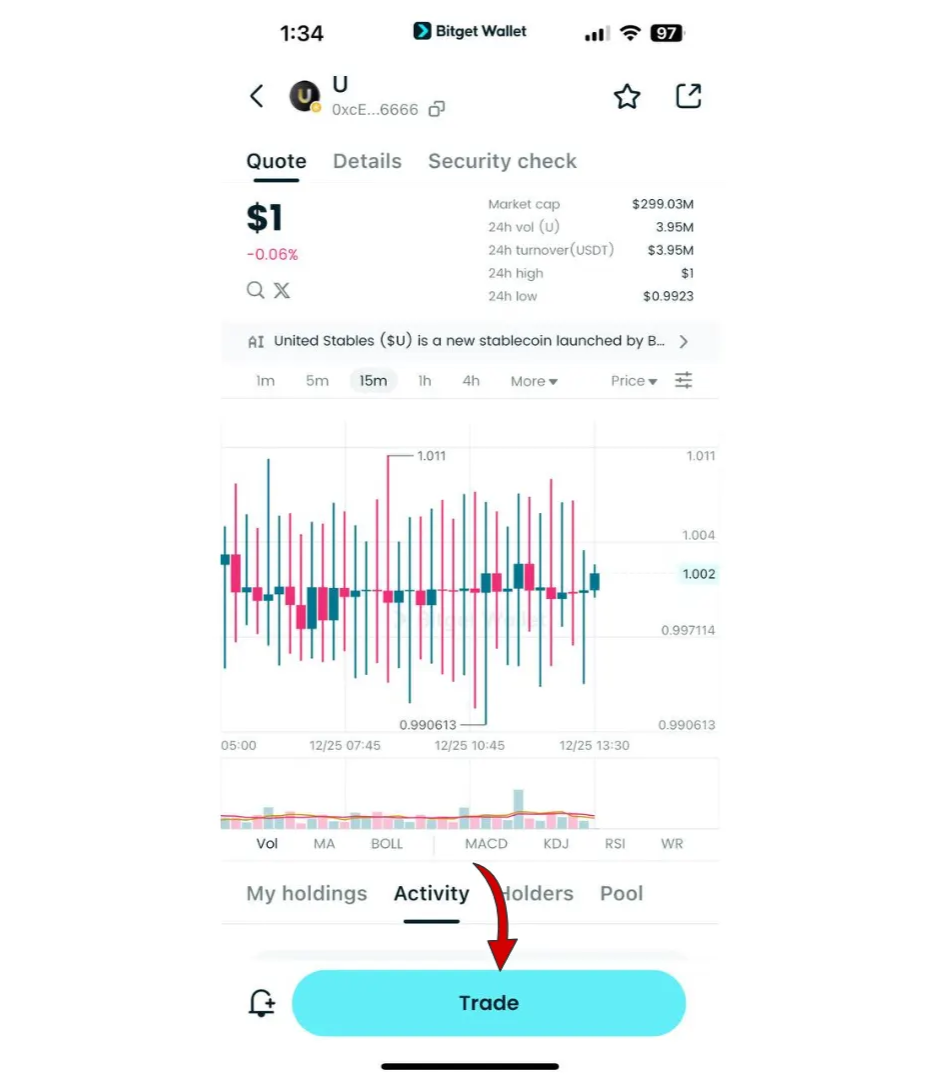

Step 3: Find United Stables (U)

In the Bitget Wallet interface, navigate to the market section. Use the search bar to find United Stables (U). Click on the token to view its trading page.

Since this token has not been listed yet, please refer to the final contract address provided by the project team after the token is officially listed.

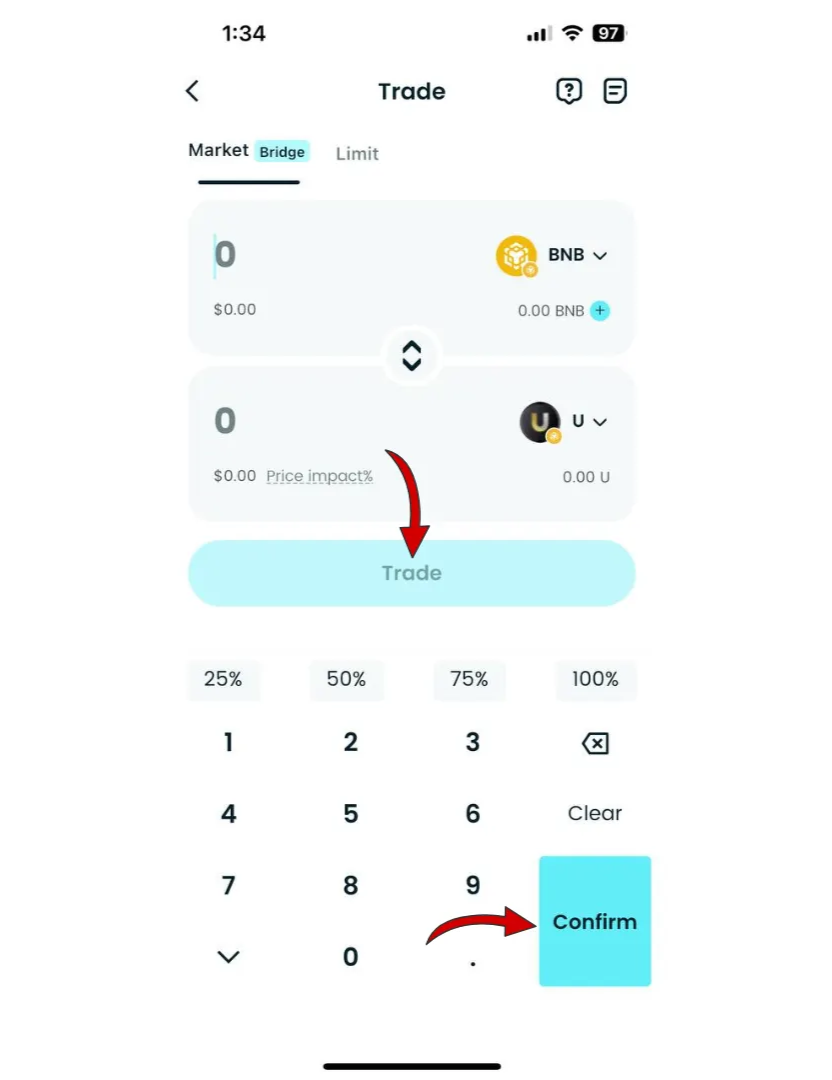

Step 4: Choose Your Trading Pair

Select the trading pair you wish to use, such as U/USDT. This will allow you to trade United Stables (U) against USDT or another cryptocurrency.

Step 5: Place Your Order

Decide whether you want to place a market order (buy/sell at the current market price) or a limit order (set your own price). Enter the amount of United Stables (U) you wish to buy or sell, then confirm your order.

Step 6: Monitor Your Trade

After placing your order, you can monitor its status in the “Open Orders” section. Once the order is executed, you can check your balance to see your newly acquired United Stables (U).

Step 7: Withdraw Your Funds (Optional)

If you wish to transfer your United Stables (U) or any other cryptocurrency to another wallet, navigate to the withdrawal section, enter your wallet address, and confirm the transaction.

▶ Learn more about United Stables (U):

Conclusion

United Stables (U) stands out as a next-generation stablecoin designed to solve real structural issues in the crypto market, including liquidity fragmentation and single-issuer risk. Rather than pursuing price speculation, $U focuses on peg stability, diversified backing, and cross-chain usability, making it a practical tool for DeFi participants, traders, and users who need reliable USD liquidity in on-chain finance.

Using Bitget Wallet to access United Stables (U) further enhances this experience. Bitget Wallet offers non-custodial security, multi-chain support, seamless swaps, and deep DeFi integration, allowing users to store, swap, and deploy $U efficiently without relying on centralized intermediaries. For users seeking a secure, flexible, and user-friendly way to engage with stablecoin liquidity, Bitget Wallet provides a clear advantage when buying and using United Stables (U) in today’s evolving Web3 ecosystem.

Manage all your stablecoins in one seamless, Bitget Wallet: beginner-ready wallet.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is United Stables (U)?

United Stables (U) is a USD-pegged stablecoin backed 1:1 by a diversified basket of major fiat-backed stablecoins and cash equivalents. It is designed to reduce concentration risk and unify stablecoin liquidity across chains like Ethereum and BNB Chain.

2. Is United Stables (U) a good investment?

United Stables (U) is not designed for price appreciation. As a stablecoin, its purpose is to maintain a stable value near $1.00, making it suitable for trading, payments, DeFi settlement, and treasury management rather than speculative gains.

3. How can I buy and use United Stables (U) safely?

You can buy, store, and swap United Stables (U) using Bitget Wallet, which provides non-custodial security, multi-chain support, and seamless access to on-chain liquidity. Always verify the official contract address before interacting with the token.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Buy USAT in 2026: A Beginner’s Step-by-Step Guide to USAT2026-01-28 | 5mins