How to Buy USAT in 2026: A Beginner’s Step-by-Step Guide to USAT

How to buy USAT in 2026 is a common question among beginners exploring stable-value crypto assets. USAT is a U.S.-regulated, dollar-backed stablecoin designed to maintain a 1:1 peg with the U.S. dollar, rather than a speculative crypto asset. Because of its stablecoin design, buying USAT follows a more straightforward acquisition process compared to volatile cryptocurrencies.

Unlike speculative tokens or early-stage crypto projects, buying USAT does not involve mining programs, presales, or protocol participation. Instead, USAT is typically accessed through supported centralized exchanges or compliant platforms. For asset management, Bitget Wallet provides secure stablecoin storage, hot memecoin trading, and a seamless cross-chain experience.

Advanced trading skills are not required to get started with USAT; however, it is essential to understand where USAT is officially listed, how stablecoins operate, and how to avoid common beginner pitfalls. Following a clear, step-by-step process helps reduce risk and uncertainty. This guide explains how to buy USAT safely and efficiently in 2026, including key considerations for users who are new to cryptocurrency.

Key Takeaways

- USAT is a USD-backed stablecoin, designed for price stability rather than speculation.

- Beginners can acquire USAT in 2026 through supported centralized exchanges or compliant platforms, depending on availability.

- Verifying official listings, supported networks, and platform legitimacy is essential to buying USAT safely and confidently.

What Is USAT?

USAT is a regulated stablecoin designed to maintain a 1:1 value with the U.S. dollar. Unlike volatile cryptocurrencies, USAT is built for stability and is commonly used for trading, payments, settlements, and short-term value storage within crypto markets.

USAT’s value does not depend on market narratives or price momentum. Instead, its primary role is to function as a digital representation of USD, allowing users to move dollar-denominated value efficiently across crypto platforms.

What makes USAT different from basic or narrative-driven tokens?

USAT is designed as a utility-first stablecoin, prioritizing price stability and reliable settlement over speculation. Unlike narrative-driven tokens that depend on attention cycles and price momentum, USAT’s role is defined by its function as a regulated digital dollar within the crypto ecosystem.

-

Stability-focused design:

USAT is engineered to track the U.S. dollar, rather than fluctuate based on hype or speculative demand.

-

Value drivers:

USAT’s usefulness comes from liquidity, trust, regulatory positioning, and adoption as a settlement asset—not from price appreciation.

-

Access model:

USAT is distributed through centralized exchanges and supported platforms, not through presales, mining programs, or early-access participation.

Source: X

Is USAT a scam or just high-risk?

USAT is not a scam, but it is still a crypto asset and should be used with informed caution.

As a stablecoin, USAT generally carries lower volatility risk than speculative tokens. However, users should still be aware of:

- Platform risk (exchange or wallet security)

- Regulatory or policy changes affecting stablecoins

- Temporary liquidity or redemption constraints during extreme market conditions

What users should do to reduce risk:

Before buying USAT, users should confirm they are interacting only with official exchange listings and supported wallets. Fake tokens, impersonator platforms, and misleading promotions remain common risks. Always verify ticker symbols, supported networks, and withdrawal options through official sources before proceeding.

As of 2026, USAT has been officially launched by Tether as a U.S.-regulated, dollar-backed stablecoin, with issuance and custody handled through Anchorage Digital Bank, and its launch and regulatory positioning independently reported by established crypto media and educational platforms.

Where to Buy USAT?

When users search for where to buy USAT, they are usually looking for the safest and most direct way to access a regulated digital dollar in 2026.

In 2026, USAT is primarily obtained through centralized exchanges or compliant platforms that support USAT trading pairs and withdrawals. Users should not expect mining access, presales, or special participation programs.

While USAT is designed to remain close to $1, fees, supported networks, and withdrawal rules may vary by platform. Always review the latest official terms before committing funds, and avoid assumptions about universal availability or liquidity.

Comparison of USAT Buying Methods

Understanding where to buy USAT depends on your custody preference, execution method, and risk tolerance. The comparison below highlights the most common options for users evaluating where to buy USAT safely and efficiently.

| Buying Method | Custody Model | Execution | Control | Recommended For | Main Risks |

| On-chain Swap (DEX via Wallet) | Non-custodial | User-controlled, on-chain | High | Self-custody, DeFi users | • Contract impersonation • Price slippage • Gas fee volatility |

| On-chain UEX (via Exchange) |

Custodial | Platform-managed, on-chain | Medium | Users who want on-chain exposure without wallet management | • Custodial exposure • Withdrawal limits • Platform dependency |

| Centralized exchange (CEX) | Custodial | Platform-managed | Low | Beginners, high-liquidity traders, fiat on-ramps | • Custodial risk • Withdrawal delays • Regional or national regulatory restrictions |

Why Many Users Buy USAT With Bitget Wallet?

For users evaluating the best wallet to buy USAT, a non-custodial solution is often preferred, as it allows users to maintain full control of assets while interacting with supported USAT trading and liquidity venues. Bitget Wallet also supports cross-chain access and helps reduce common beginner mistakes like interacting with impersonation tokens.

What Bitget Wallet Helps With?

✅ Self-custody and asset control Users retain full ownership of private keys and funds, reducing exposure to custodial and platform-related risks.

✅ On-chain swaps with transparent execution Explore over 1M tokens with real-time in-app rankings—discover trending assets early and stay ahead of the market.

✅ Multi-chain access with cost-efficient execution Bitget Wallet supports 130+ blockchains, including 7 major networks such as Solana, Base, Arbitrum, Polygon, Tron, and more. This allows users to buy, hold, and manage USAT across different ecosystems without being locked into a single chain environment.

On supported networks, users can also benefit from gas-free transactions or long-term gas discounts, helping reduce execution costs when swapping, transferring, or managing assets across chains—an advantage for users who trade frequently or operate across multiple ecosystems.

✅ Flexible post-purchase asset management After buying USAT, users can hold, transfer, or manage assets freely across supported chains without withdrawal limits or third-party restrictions, making it easier to adapt to changing liquidity or market conditions.

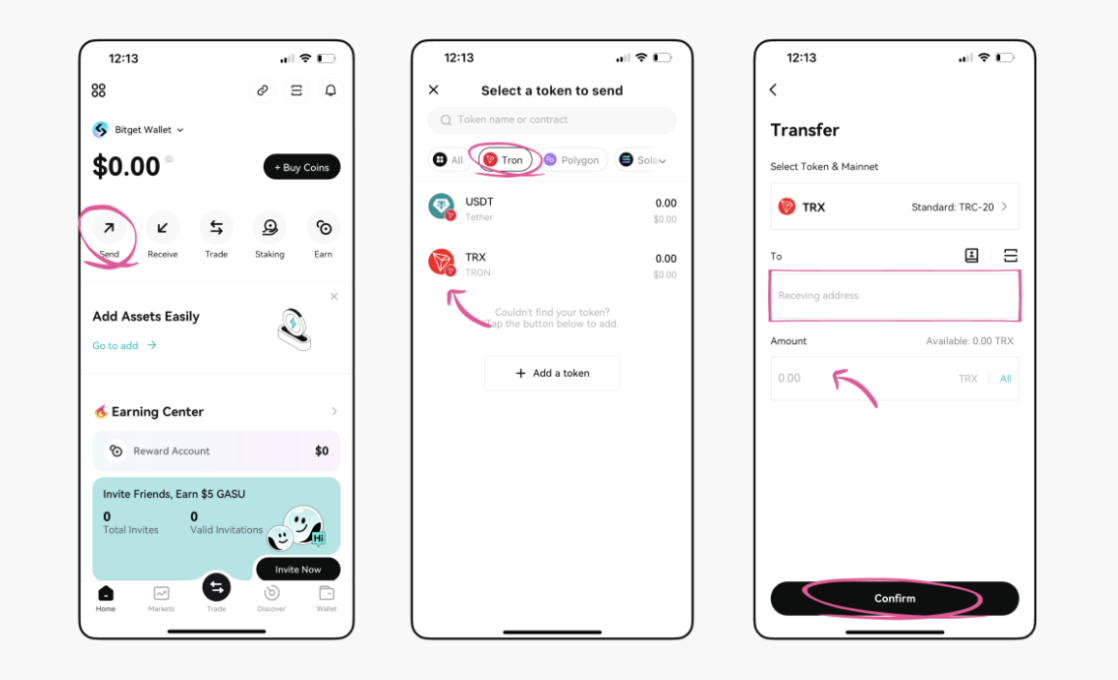

How to Buy USAT on Bitget Wallet?

Trading USAT (USAT) is easy on Bitget Wallet. Follow these simple steps to get started:

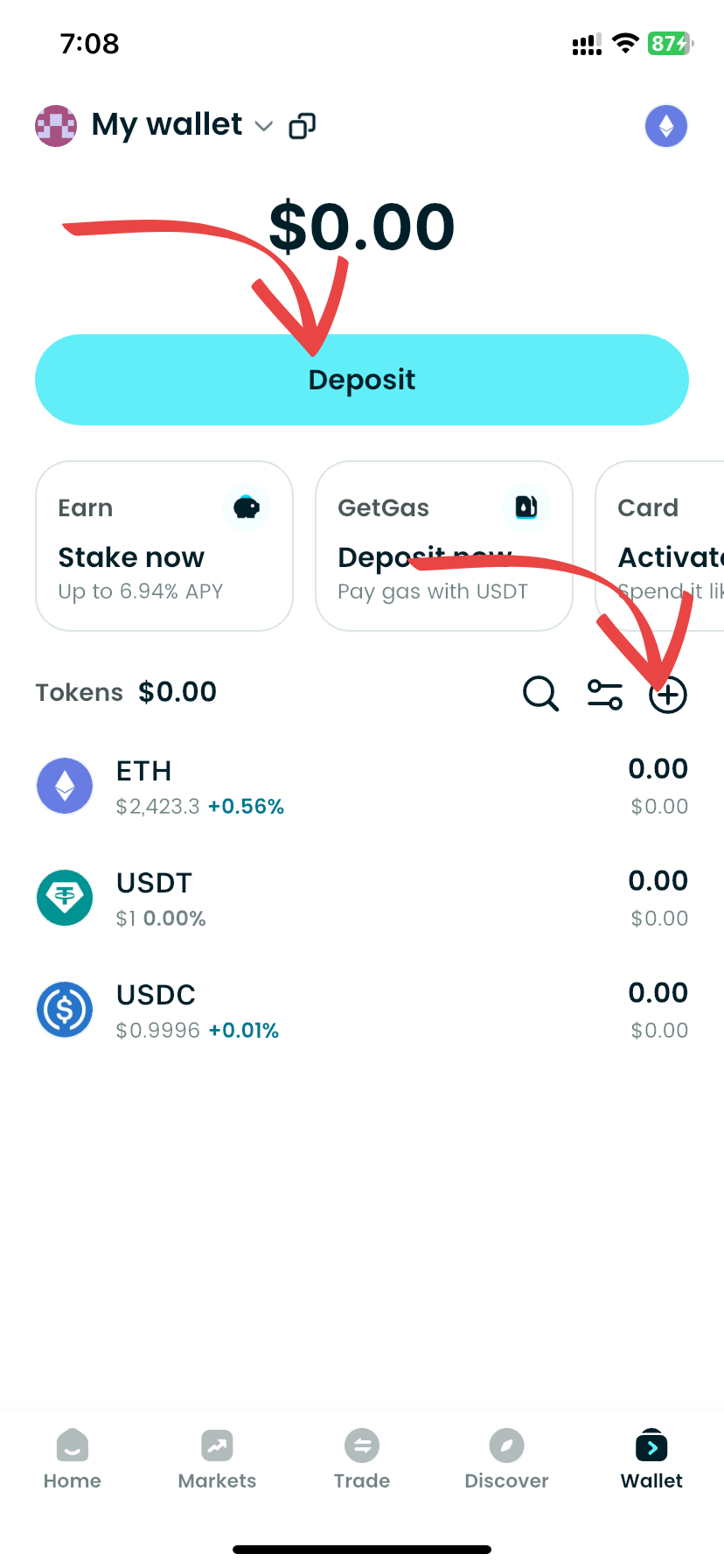

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading USAT (USAT).

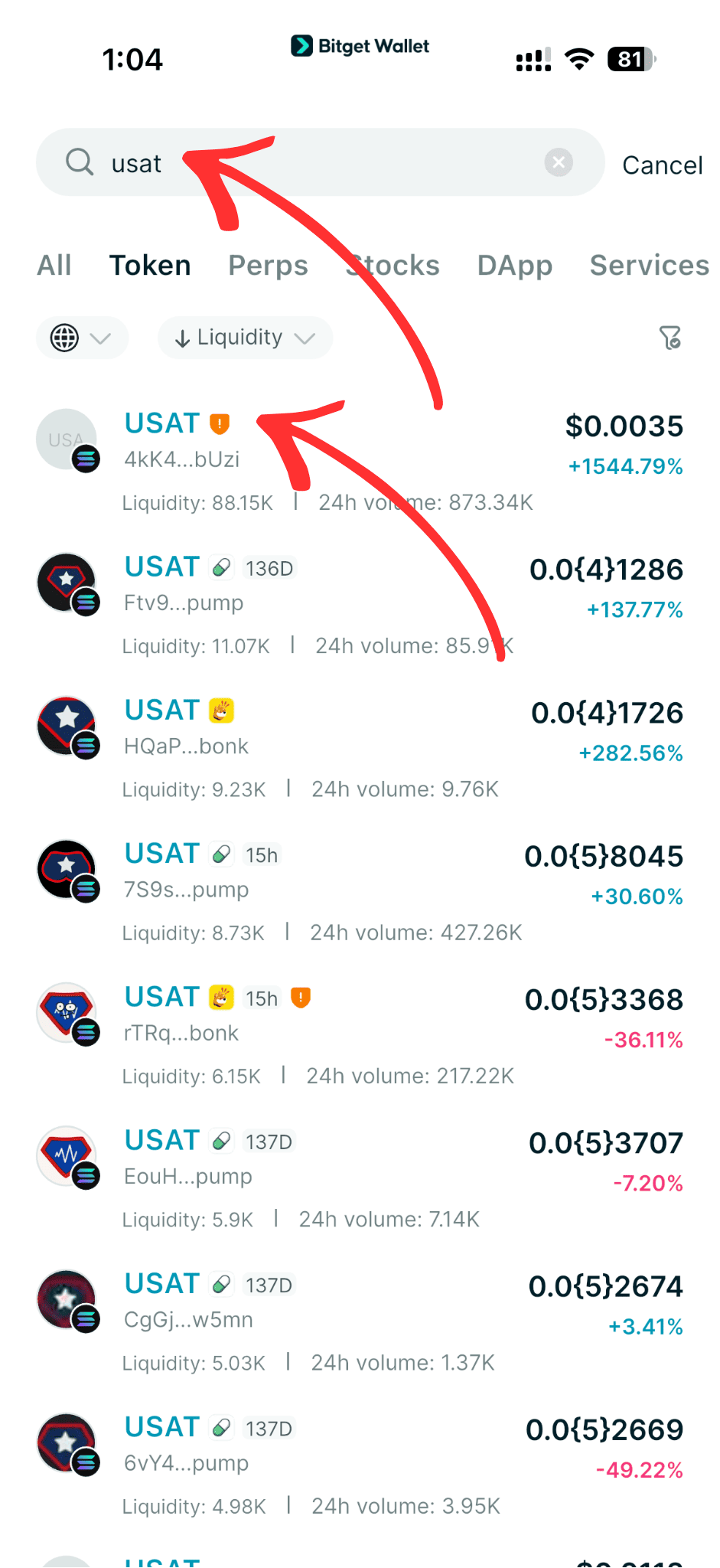

Step 3: Find USAT (USAT)

On the Bitget Wallet platform, go to the market area. Search for USAT (USAT) using the search function. Click on the token to access its trading page.

If the token is newly trending or liquidity is moving fast, always verify the latest official contract address on the exact swap page you’re using before trading.

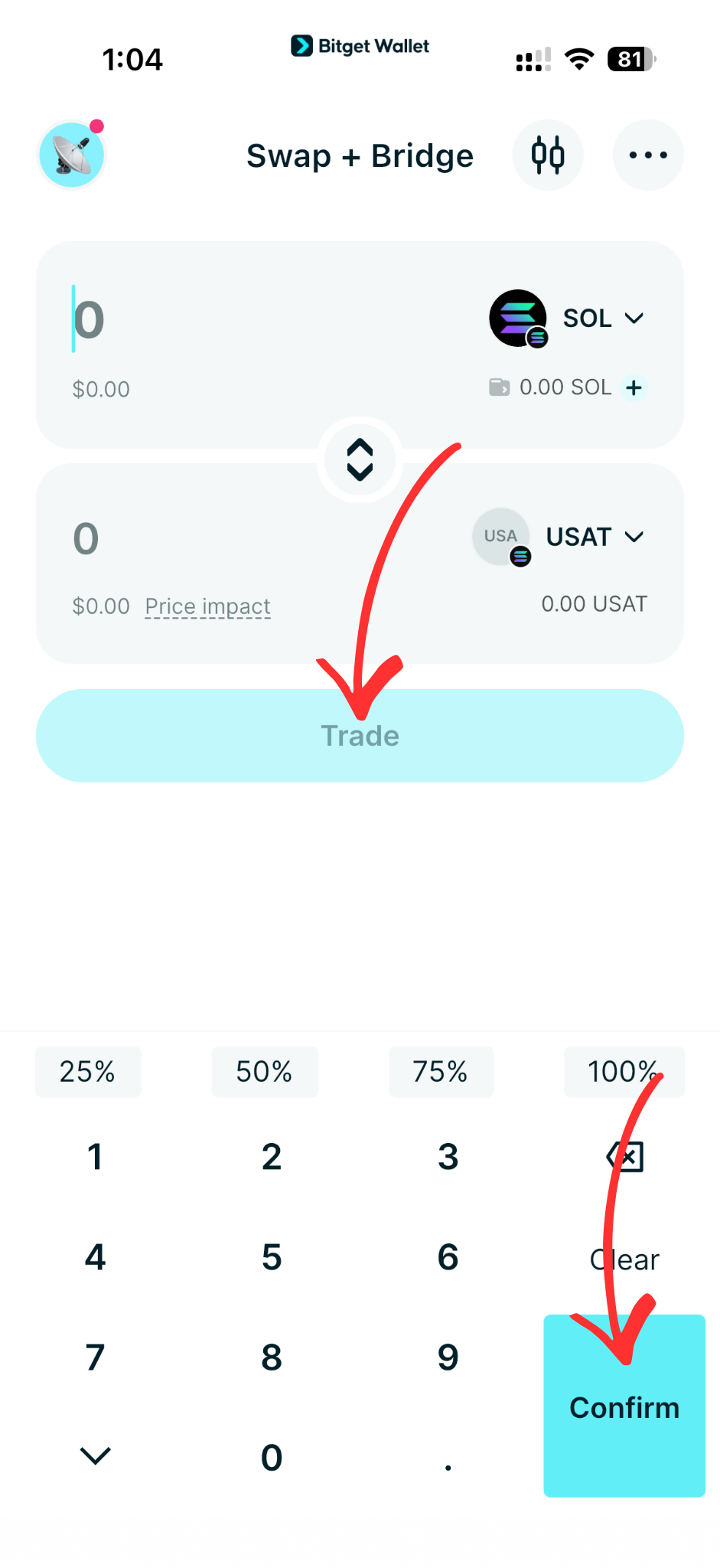

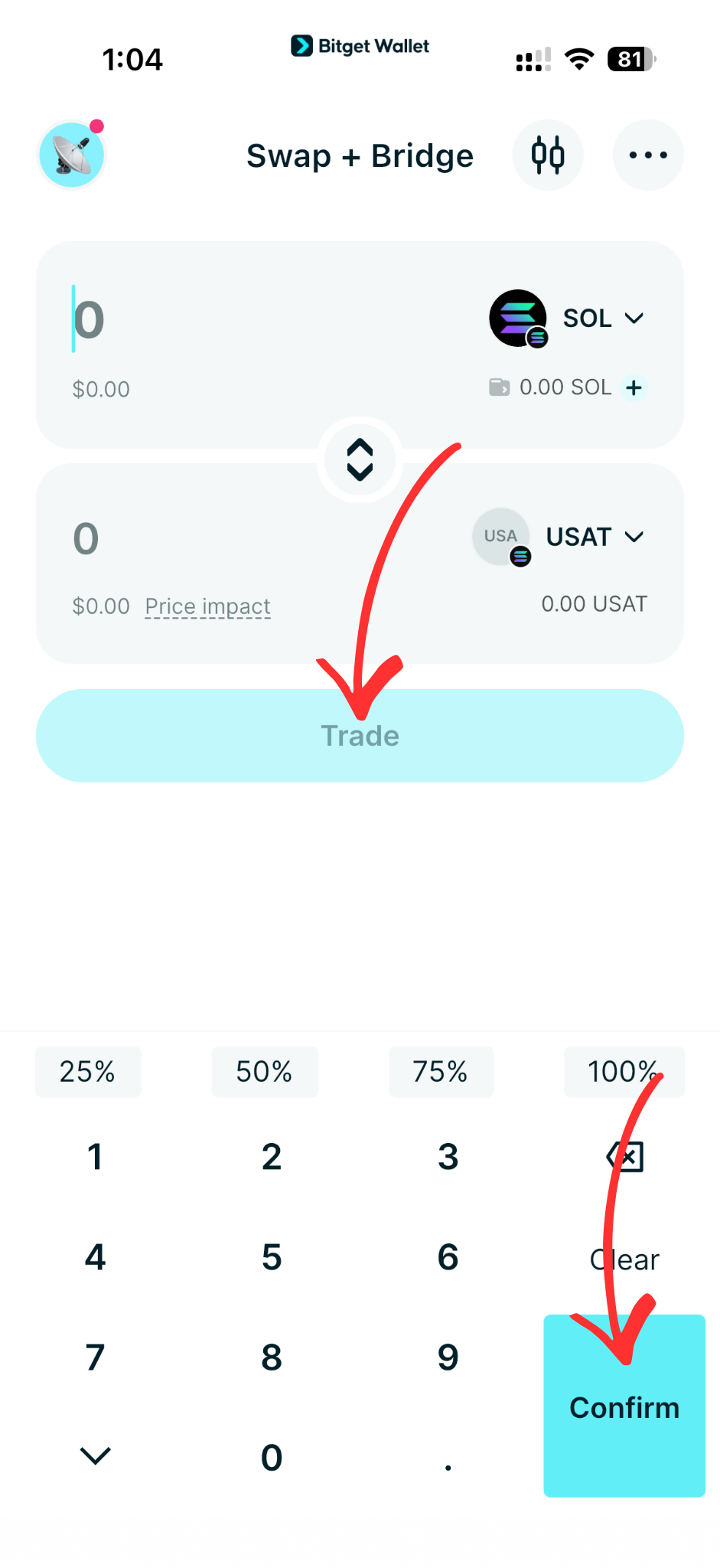

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, USAT/USDT.

By doing this, you will be able to exchange USAT (USAT) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of USAT (USAT) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased USAT (USAT).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your USAT (USAT) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

▶Learn more about USAT (USAT):

What Should You Know About USAT Price Volatility?

USAT price volatility is fundamentally different from that of speculative crypto assets because USAT is designed to maintain a 1:1 peg with the U.S. dollar. Rather than reacting to market hype, narratives, or momentum, USAT’s price behavior is shaped by liquidity conditions, platform mechanics, and broader market stability. As a result, USAT is best understood as a value-preservation and settlement asset, not a vehicle for volatility-driven trading.

Volatility behavior:

Under normal market conditions, USAT remains tightly anchored around $1. Minor deviations may occur due to liquidity conditions, exchange-specific order flow, or short-term market stress, but these movements are typically limited and temporary. USAT is not influenced by hype cycles, roadmap announcements, or speculative sentiment.

Peg and stability factors:

USAT’s stability depends on reserve management, regulatory compliance, and platform liquidity rather than token distribution mechanics. Temporary deviations from the peg—if they occur—are usually linked to broader market disruptions, platform-level issues, or short-term liquidity imbalances. As a result, USAT should be viewed as a value-preservation and settlement asset, not a vehicle for volatility-based trading.

USAT Price Prediction: How High Can USAT Go?

USAT does not have a traditional price prediction range.

As a USD-backed, regulated stablecoin, USAT is designed to maintain a 1:1 peg with the U.S. dollar, meaning its intended price target is $1, not upward or downward appreciation. Unlike speculative crypto assets, USAT does not derive value from adoption growth, technical roadmaps, or investor sentiment.

Key Factors Impacting USAT Price Stability

Rather than price appreciation, USAT’s performance is measured by stability and reliability. Key factors that influence short-term price behavior include:

-

Market Liquidity:

Temporary supply–demand imbalances on specific exchanges can cause minor, short-lived deviations around $1.

-

Platform & Redemption Mechanics:

Exchange withdrawal rules, settlement speed, and redemption access can affect how tightly USAT tracks its peg during high-volume periods.

-

Broader Market Stress:

During extreme market events, stablecoins may briefly deviate from their peg due to liquidity pressure, not changes in intrinsic value.

Price Outlook

USAT’s long-term price outlook is intentionally flat. Its objective is to remain as close to $1 as possible across market conditions. Any sustained deviation from this level would be considered a temporary market dislocation, not a performance gain.

For this reason, USAT should be evaluated based on price stability, liquidity depth, and operational reliability, rather than upside potential or speculative return expectations.

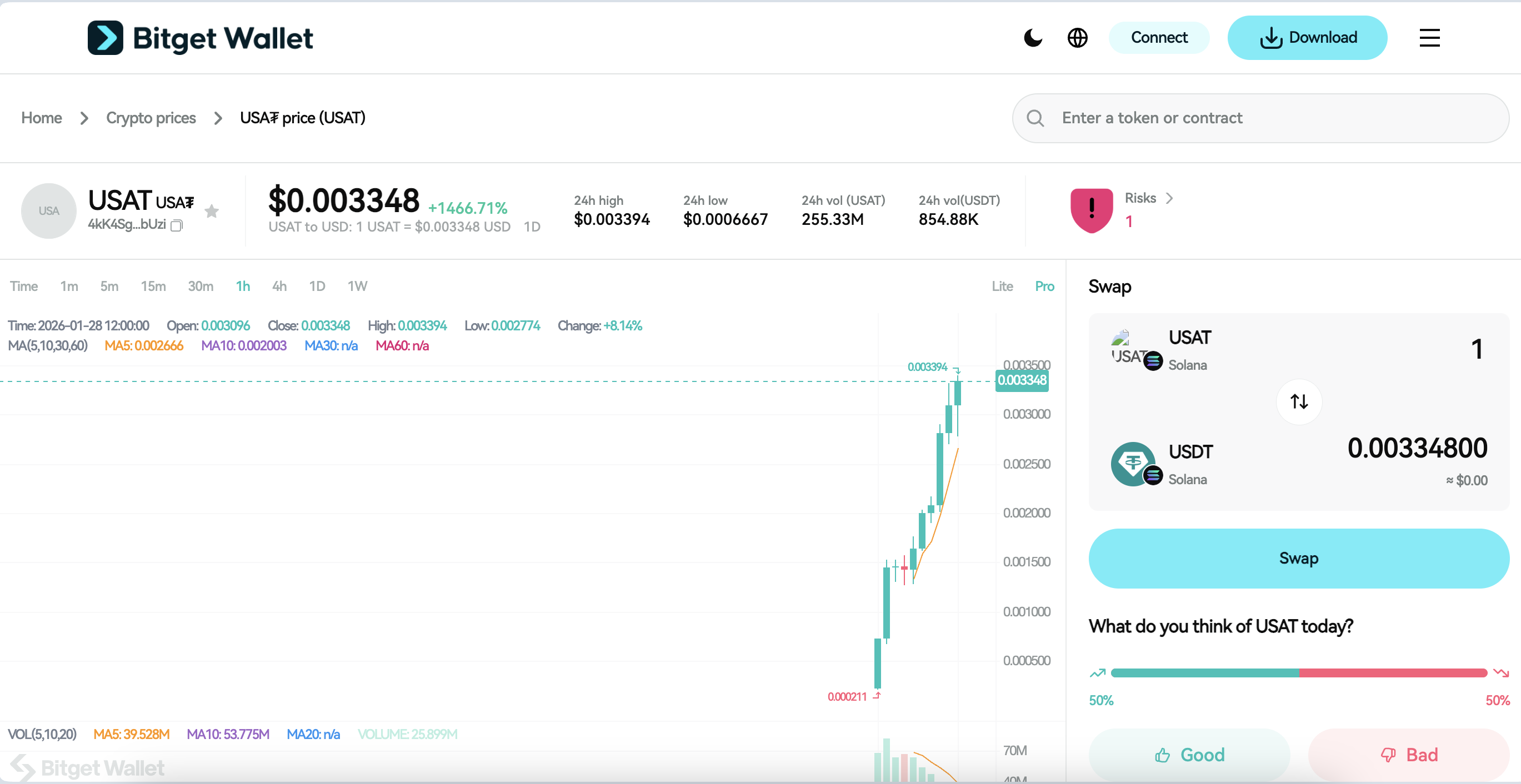

Source: Bitget Wallet

Is USAT Crypto Safe to Use?

Whether USAT is “safe” to use depends primarily on platform selection, custody practices, and user behavior, rather than price volatility. While USAT is a regulated stablecoin and generally carries lower market risk than volatile crypto assets, it is not entirely risk-free.

Key risks to be aware of:

-

Platform or custody risk:

Exchange solvency, wallet security, or operational failures can affect access to funds.

-

Regulatory or policy changes:

Changes in stablecoin regulations may affect availability, usage, or redemption conditions.

-

Liquidity or redemption risk:

In extreme market conditions, short-term liquidity constraints may temporarily impact conversions.

-

Impersonation or fake tokens:

Copycat tickers or fake contracts may appear on unsupported networks or platforms.

USAT is designed for stability and compliance, but users should still apply basic security and verification practices.

How to Approach USAT Usage With a Smarter Strategy

With stablecoins like USAT, the primary objective is capital preservation and operational efficiency, not price timing or speculation; a disciplined approach focuses on minimizing avoidable risks and using USAT strictly for its intended purposes, such as payments, settlement, and short-term value storage.

Practical principles to follow:

-

Use USAT as a utility asset:

Treat USAT as digital cash for trading, payments, or temporary value storage—not as an investment.

-

Choose reputable platforms:

Use well-established exchanges and wallets with strong security records.

-

Limit custodial exposure:

Avoid keeping large balances on exchanges longer than necessary.

-

Verify ticker symbols and networks:

Ensure you are interacting with the correct USAT token on supported networks only.

Using USAT with a risk-aware mindset helps preserve capital and improves overall portfolio discipline.

Conclusion

Knowing where to buy USAT starts with understanding that it is a regulated, dollar-backed stablecoin, not a speculative crypto asset or growth investment. Its primary role is to provide stability, liquidity, and efficient value transfer within the crypto ecosystem.

Responsible usage depends on platform verification, sound custody practices, and realistic expectations. While USAT reduces exposure to price volatility, users must still manage operational and platform-related risks carefully.

Manage stablecoins, DeFi, and cross-chain assets securely with Bitget Wallet.

CTA

FAQs

1. How to buy USAT safely as a beginner?

Beginners should purchase USAT only through supported centralized exchanges or verified platforms, confirm ticker symbols carefully, and start with small amounts. Avoid unofficial links or unsupported networks.

2. Where to buy USAT?

USAT is typically available through centralized exchanges or compliant platforms that support USAT trading pairs and withdrawals. Availability may vary by region and platform.

3. Do I need KYC to buy USAT?

Whether KYC is required depends on the purchase method. Centralized exchanges (CEXs) typically require KYC, as users trade through custodial accounts managed by the platform.

In contrast, buying USAT through on-chain swaps using a non-custodial wallet like Bitget Wallet does not require KYC. Users interact directly with decentralized liquidity from their own wallet, without submitting identity information. However, this also means users are fully responsible for security, contract verification, and transaction execution.

4. Is USAT high risk?

USAT carries lower market risk than volatile crypto assets due to its dollar peg, but it is not risk-free. Platform risk, regulatory changes, and custody practices still matter.

5. What should I check before using USAT?

Before using USAT, verify the official ticker, supported networks, platform credibility, withdrawal rules, and any applicable fees. Always ensure you are interacting with the correct USAT token.