What Is USDD (USDD): Understanding TRON’s On-Chain Dollar Stablecoin

What Is USDD (USDD)? USDD (USDD) is not just an ordinary token; it symbolizes the pursuit of a decentralized, on-chain USD-pegged stablecoin within the TRON ecosystem. In the realm of blockchain finance and DeFi, it combines monetary stability with smart-contract technology, aiming to provide a censorship-resistant digital dollar for on-chain use.

With strong support from the TRON DAO Reserve, USDD (USDD) not only represents a major development trend in the stablecoin sector but also serves as a foundational liquidity and settlement asset across decentralized markets. This article will guide you through every aspect of USDD (USDD)—from its mechanism and backing to its role in DeFi—helping you understand its position within the cryptocurrency ecosystem and how it is used on-chain.

For users looking to interact with USDD efficiently, Bitget Wallet provides secure stablecoin storage, hot memecoin trading, and a seamless cross-chain experience, enabling users to manage USDD alongside other on-chain assets in a single non-custodial wallet.

Key Takeaways

- USDD (USDD) is a USD-pegged stablecoin designed for on-chain payments, liquidity, and DeFi usage within the TRON ecosystem.

- It is supported by the TRON DAO Reserve, using an overcollateralized, reserve-backed model rather than a purely algorithmic peg.

- USDD’s primary role is stability and settlement, not speculation, making it a core infrastructure asset for trading, lending, and cross-protocol activity in decentralized markets.

What Is USDD (USDD)?

USDD (USDD) is a USD-pegged stablecoin based on the TRON blockchain that represents a modern, on-chain version of the U.S. dollar. The project embodies the following values:

- Price stability through reserve support and overcollateralization

- Decentralization via on-chain issuance and governance mechanisms

- Liquidity efficiency for payments, trading, and DeFi applications

USDD (USDD) not only reflects the long-standing role of the dollar as a global settlement unit but also applies it to blockchain finance and DeFi, aiming to build a sustainable, transparent, and collaborative on-chain financial ecosystem supported by the TRON DAO Reserve.

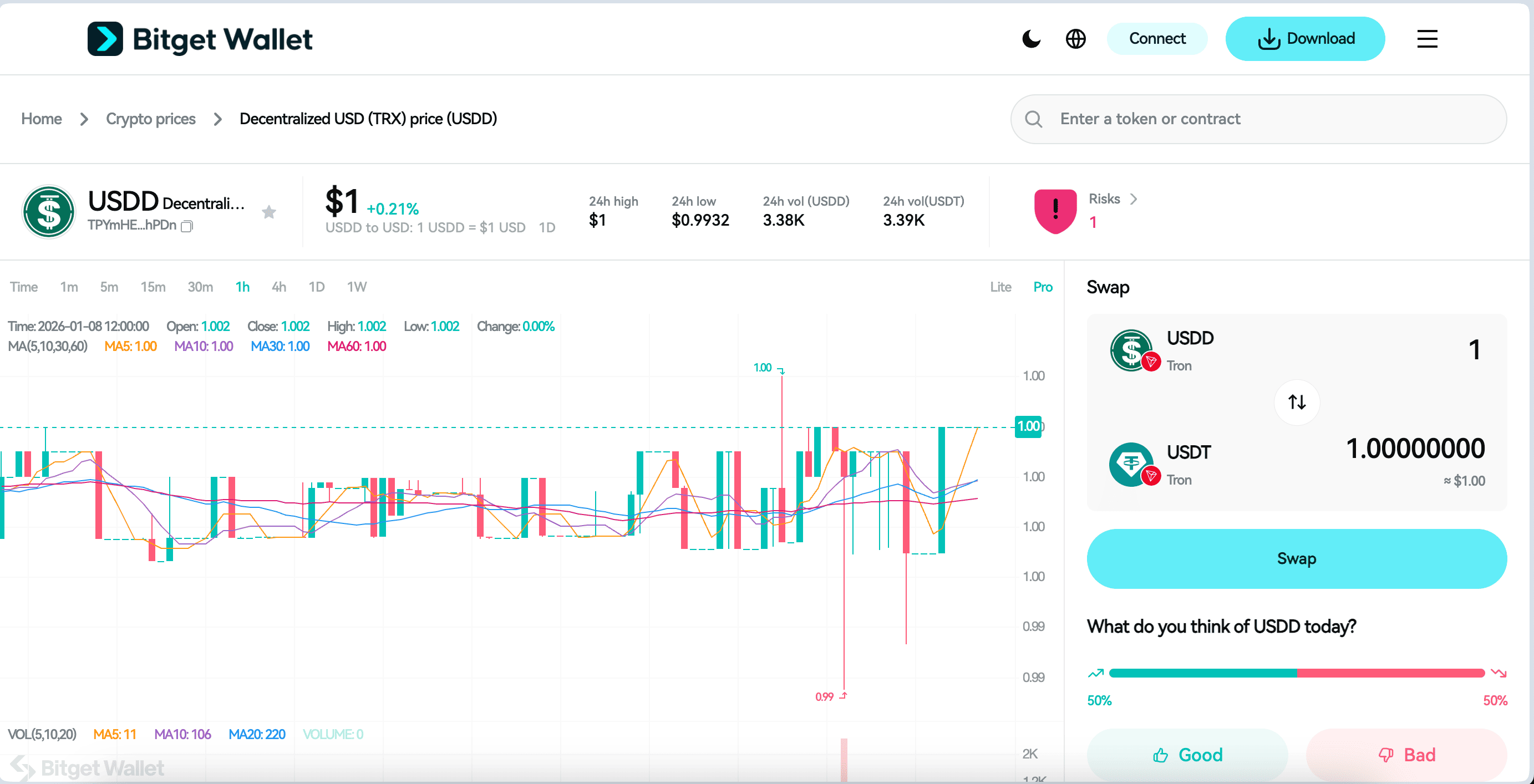

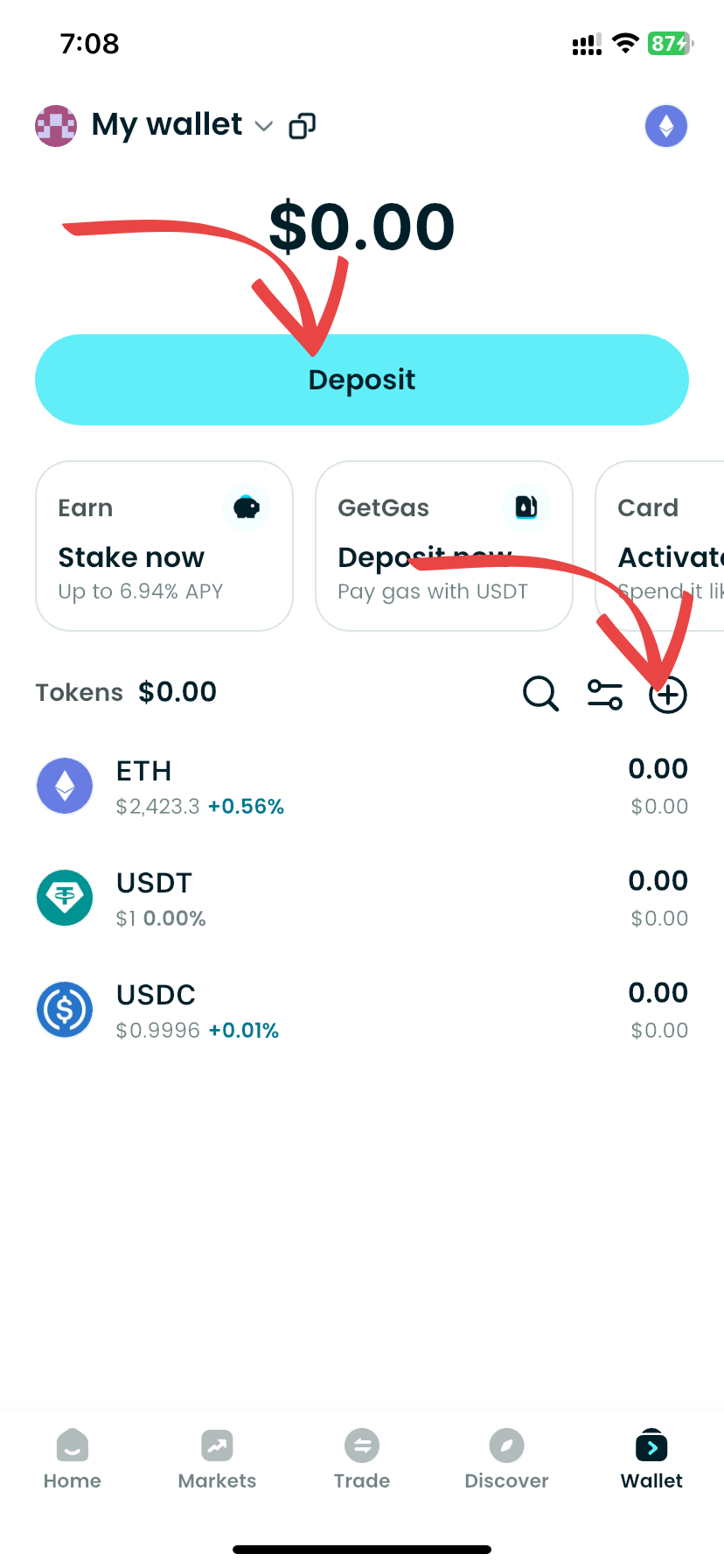

Source: Bitget Wallet

USDD continues to expand its on-chain presence across the TRON ecosystem, serving as a core settlement and liquidity asset in DeFi protocols, trading pairs, and payment flows, while maintaining its USD peg through reserve-backed mechanisms and active market support rather than pure algorithmic minting.

USDD (USDD) Listing Details and Launch Date

1. Key Listing Information

Here are the confirmed details about the USDD (USDD) listing:

- Exchange: Bitget

- Trading Pair: USDD/USDT

- Deposit Available: May 2022

- Trading Start: May 2022

- Withdrawal Available: May 2022

USDD (USDD) has been tradable on Bitget since its launch period in May 2022 and is primarily used for stable trading pairs, liquidity management, and on-chain settlement.

- Please refer to Bitget’s official announcements and trading pages for the most up-to-date status and any future changes.

USDD (USDD) Price Prediction 2026

Predicting the price of any cryptocurrency relies on market trends, project fundamentals, and real-world usage. As a USD-pegged stablecoin, USDD (USDD) is designed for price stability, not speculative growth. With reserve backing and active peg management, USDD is expected to continue closely tracking its USD target.

With ongoing adoption across on-chain settlements, DeFi liquidity pools, and trading pairs within the TRON ecosystem, the price of USDD (USDD) in 2026 is expected to stabilize within the range of $0.99 – $1.01, reflecting normal market fluctuations around its intended $1 peg.

If the project maintains its reserve-backed model and further expands its applications in DeFi, payments, and cross-chain liquidity, USDD (USDD) is expected to remain anchored near $1.00 throughout 2026, reinforcing its role as a stable on-chain dollar asset rather than a price-appreciating token.

Source: Bitget Wallet

Key Features of USDD (USDD)

The standout features of USDD (USDD) include:

-

USD Peg Stability

USDD is designed to maintain a 1:1 peg with the U.S. dollar, using a reserve-backed and overcollateralized model. This structure helps reduce volatility and makes USDD suitable for payments, settlements, and stable trading pairs in on-chain markets.

-

Reserve-Backed Mechanism

USDD is supported by reserves managed by the TRON DAO Reserve, which include assets such as TRX, BTC, and USDT. This reserve-based approach strengthens confidence in the peg and allows for market intervention during periods of stress.

-

DeFi and On-Chain Utility

USDD is widely used across the TRON DeFi ecosystem, enabling liquidity provision, lending, borrowing, and cross-protocol settlement. Its on-chain nature allows users to move capital efficiently without exposure to price volatility, making it a core infrastructure asset rather than a speculative token.

How Does USDD (USDD) Work?

The operation of USDD (USDD) is based on its USD-peg mechanism and reserve-backed stabilization model, designed to keep the token’s value aligned with the U.S. dollar rather than enabling speculative price movements.

-

Peg Maintenance Mechanism

USDD targets a 1:1 value with the U.S. dollar, relying on market incentives and liquidity mechanisms to keep its price within a narrow range. When demand shifts, arbitrage activity and liquidity flows help guide USDD back toward its intended peg.

-

Reserve-Backed Stabilization

USDD is supported by reserves managed by the TRON DAO Reserve, which include assets such as TRX, BTC, and stablecoins. These reserves are used to support confidence and provide intervention capacity during periods of market stress, reducing the risk of prolonged de-pegging.

-

On-Chain Utility and Circulation

USDD circulates across the TRON blockchain and connected DeFi applications, where it is used for trading pairs, liquidity pools, lending, borrowing, and on-chain settlements. Its design prioritizes capital efficiency and stability, allowing users to interact with DeFi without exposure to high volatility.

By integrating on-chain governance principles, reserve transparency, and ecosystem partnerships, USDD (USDD) aims to function as a sustainable and reliable stablecoin, strengthening its role as a core settlement and liquidity asset within the broader crypto ecosystem.

USDD (USDD)’s Team, Vision, and Partnerships

The Team

USDD (USDD) is led and governed by the TRON DAO, a decentralized organization with extensive experience in blockchain infrastructure, stablecoin design, and on-chain liquidity management. The team’s objective is not merely to issue a new token, but to position USDD as a reliable monetary primitive—a digital dollar alternative that supports stability, resilience, and trust within decentralized finance.

The Vision

The core vision of USDD (USDD) lies in building a decentralized, censorship-resistant, and reserve-supported stablecoin that can function as a long-term settlement asset. USDD aims to create a sustainable ecosystem that represents financial stability and on-chain transparency within the broader DeFi and blockchain finance industry, reducing reliance on centralized custodians while maintaining price consistency.

Partnerships

USDD (USDD) operates closely with projects and protocols across the TRON ecosystem, including DeFi platforms, liquidity providers, and infrastructure partners that support payments, trading pairs, lending, and cross-protocol settlement. These ecosystem-level collaborations strengthen USDD’s liquidity, adoption, and real-world usability across decentralized financial applications.

Use Cases of USDD (USDD)

USDD (USDD) serves a variety of purposes, including:

-

Stable Trading and Settlement

USDD is widely used as a stable trading pair and settlement asset, allowing traders to move in and out of positions without exposure to market volatility.

-

DeFi Liquidity and Yield Strategies

USDD is utilized in liquidity pools, lending, and borrowing protocols across the TRON DeFi ecosystem, supporting capital efficiency and on-chain financial activity.

-

On-Chain Payments and Value Transfer

USDD enables fast, low-cost on-chain payments and transfers, making it suitable for remittances, treasury management, and cross-protocol settlements.

These applications highlight the practical value of $USDD in blockchain finance and decentralized finance (DeFi).

Roadmap of USDD (USDD)

The roadmap for USDD (USDD) reflects an ongoing development and stabilization strategy rather than a hype-driven launch cycle, focusing on reserve strength, ecosystem integration, and long-term reliability as a stablecoin.

| Quarter | Roadmap |

| Q3 2025 | Strengthen reserve transparency and reporting; optimize peg-stability mechanisms; expand USDD usage across core TRON DeFi protocols |

| Q4 2025 | Broader integration with on-chain payments, lending, and liquidity platforms; improve risk management frameworks under the TRON DAO Reserve |

| Q1 2026 | Enhance cross-protocol and cross-chain accessibility; expand USDD’s role as a settlement and treasury asset in DeFi |

| Q2 2026 | Focus on long-term sustainability: reserve resilience, ecosystem partnerships, and deeper adoption as a stable on-chain dollar |

These roadmap milestones highlight the practical value of $USDD in blockchain finance and decentralized finance (DeFi), emphasizing stability, liquidity, and infrastructure growth rather than speculative expansion.

How to Buy USDD (USDD) on Bitget Wallet?

Trading USDD (USDD) is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading USDD (USDD).

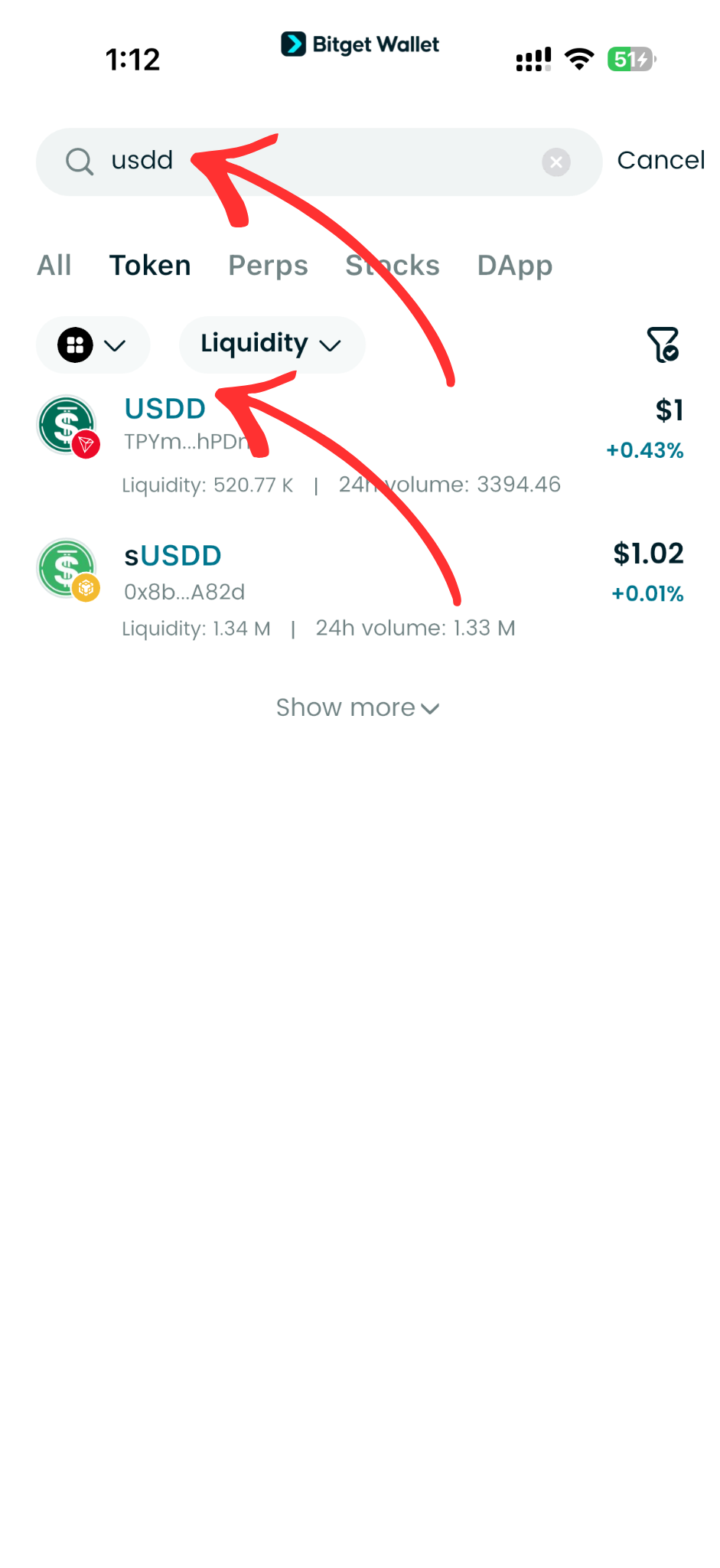

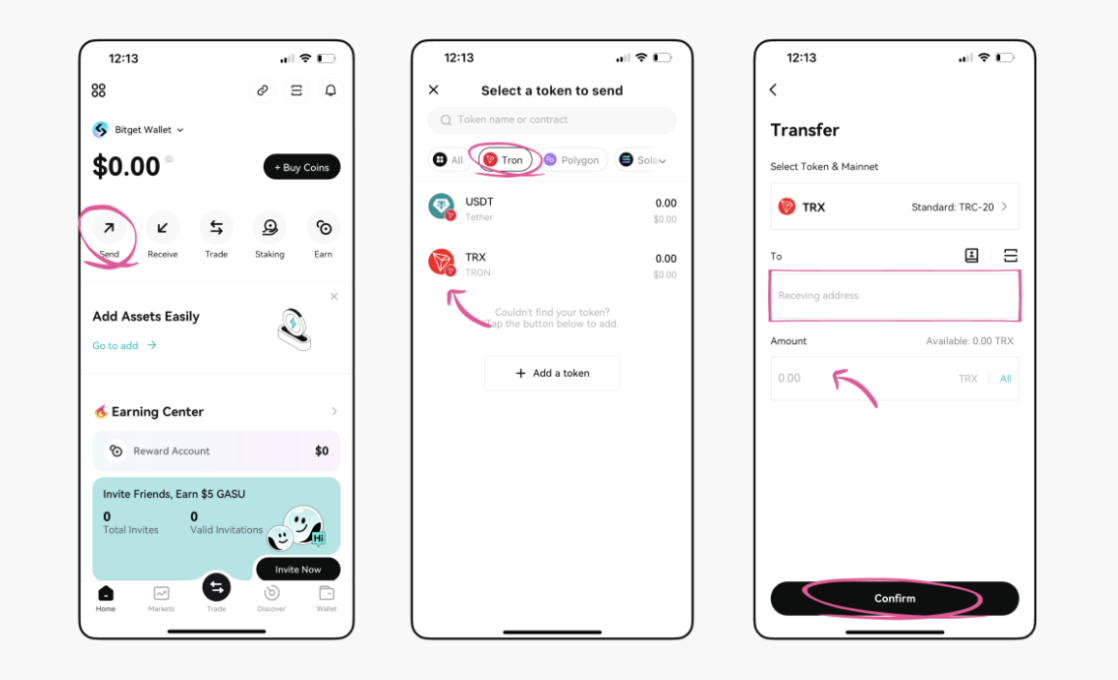

Step 3: Find USDD (USDD)

On the Bitget Wallet platform, go to the market area. Search for USDD (USDD) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

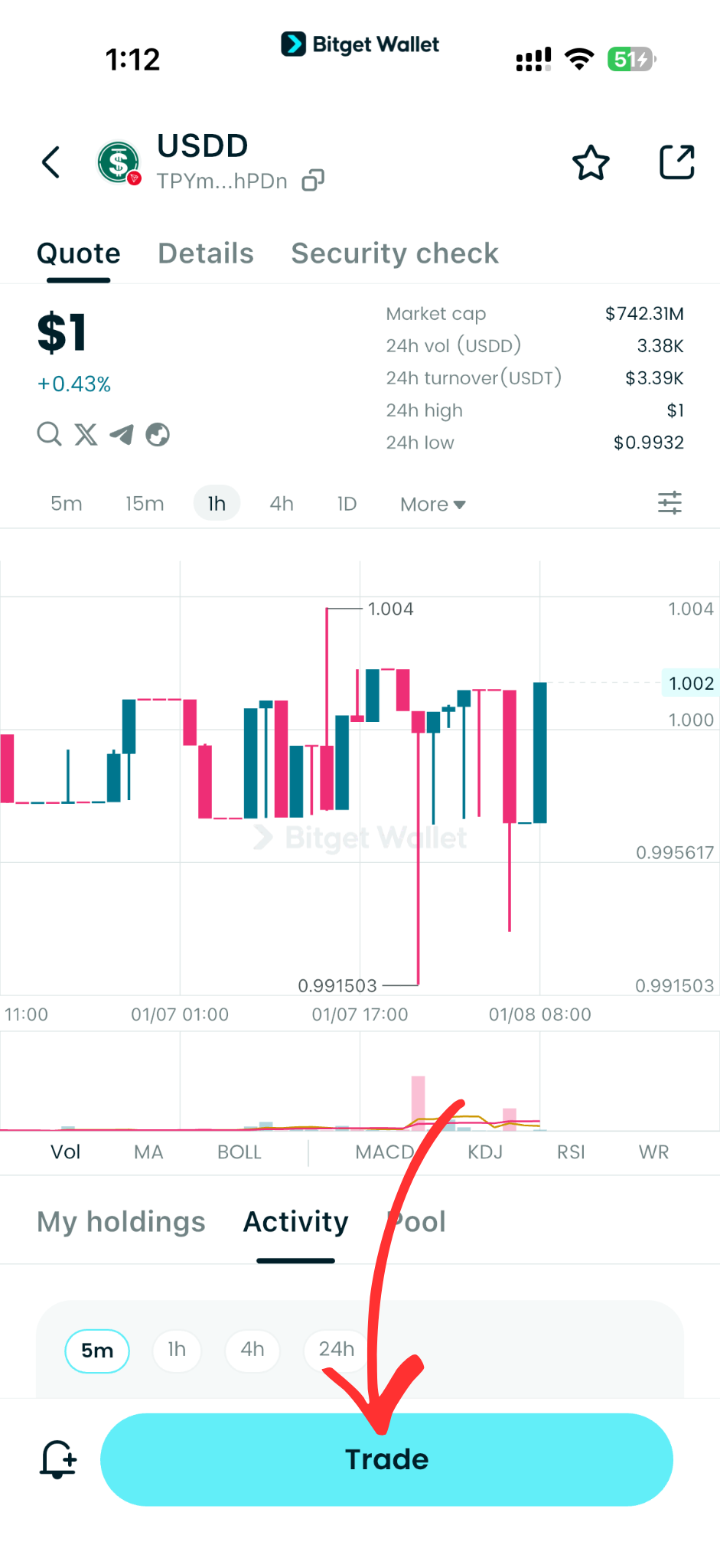

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, USDD/USDT.

By doing this, you will be able to exchange USDD (USDD) for USDT or any other cryptocurrency.

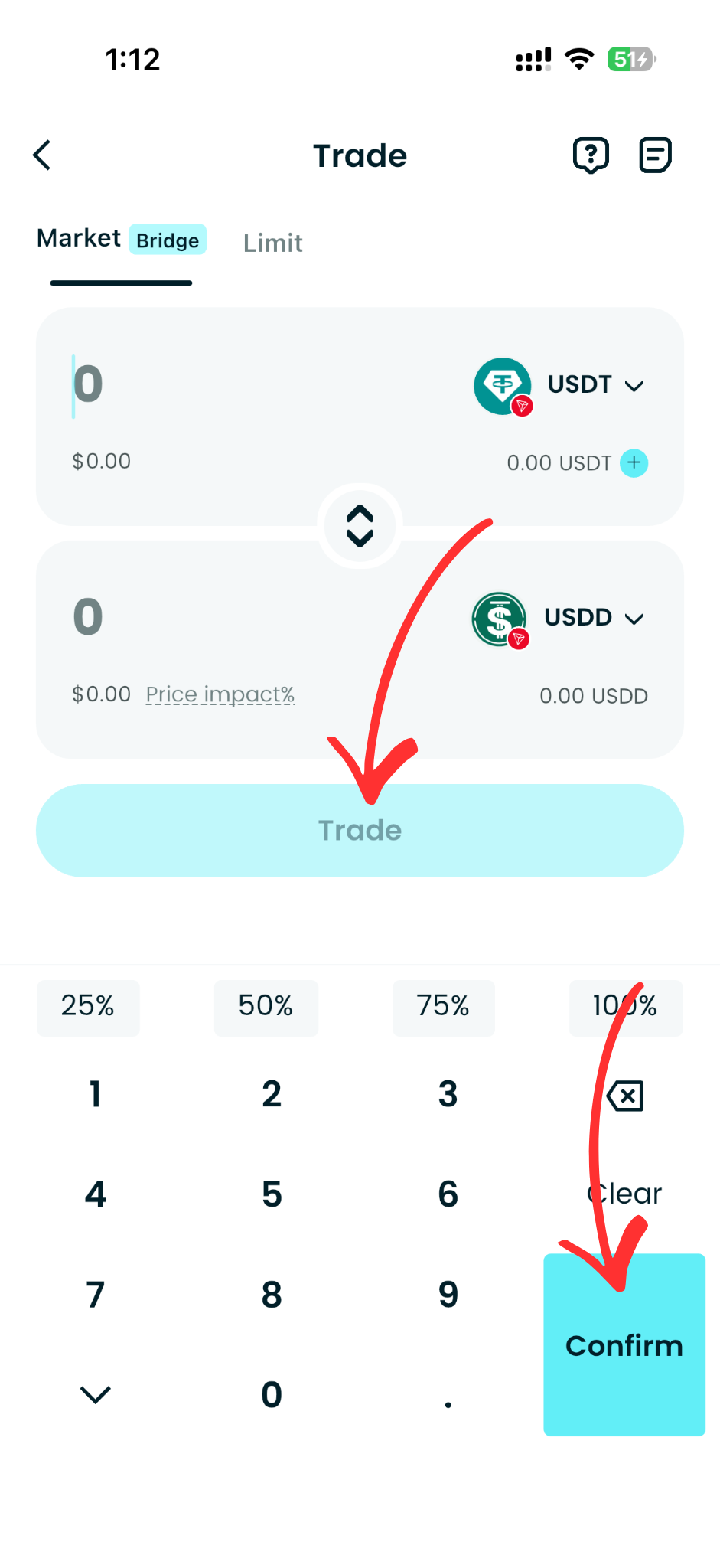

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of USDD (USDD) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased USDD (USDD).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your USDD (USDD) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

USDD (USDD) serves as a practical USD-pegged stablecoin built for on-chain stability, liquidity, and everyday DeFi usage, rather than speculative price appreciation. Supported by a reserve-backed model and embedded within the TRON ecosystem, USDD functions as a reliable settlement and liquidity asset for trading, payments, and capital management, helping users stay active on-chain without taking on unnecessary volatility.

Using USDD through Bitget Wallet further improves that experience by combining self-custody, efficient swaps, and DeFi access in a single interface. Bitget Wallet enables users to manage USDD securely, put idle stablecoins to work with Stablecoin Earn Plus offering up to 10% APY, and benefit from zero-fee trading on memecoins and RWA U.S. stock tokens—making it a more capital-efficient and flexible way to buy, hold, and use USDD in real on-chain scenarios.

Manage all your tokens in one beginner-friendly app – download Bitget Wallet today.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is USDD?

USDD is a USD-pegged stablecoin designed to maintain a value close to $1.00, primarily used for on-chain trading, payments, and DeFi activities within the TRON ecosystem. It is intended to provide price stability rather than investment returns.

2. Is USDD an algorithmic stablecoin?

USDD was originally launched with algorithmic elements, but it is no longer purely algorithmic. Today, USDD is supported by an overcollateralized, reserve-backed model managed by the TRON DAO Reserve, which helps support its USD peg during market fluctuations.

3. What blockchain is USDD on?

USDD is primarily issued on the TRON blockchain, where it is widely used across DeFi protocols, trading pairs, and payment applications. It can also be bridged to other networks for broader on-chain use.

4. What is USDD used for?

USDD is used for stable trading pairs, DeFi liquidity provision, lending and borrowing, and on-chain payments. Its main purpose is to allow users to move and deploy capital on-chain without exposure to high price volatility.

5. Can USDD go above or below $1?

In normal conditions, USDD trades close to $1.00, but short-term deviations (such as $0.99–$1.01) can occur due to liquidity and market demand. The reserve-backed mechanism is designed to help restore the peg over time.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.