What Is U.S. Oil Reserve (USOR): An Oil-Narrative Meme Token and High-Risk On-Chain Asset

What is U.S. Oil Reserve (USOR)? Rooted in commodity-themed meme culture and political-economic symbolism, U.S. Oil Reserve (USOR) bridges traditional oil reserve narratives and on-chain digital assets within the crypto meme and speculative token sector. It leverages blockchain technology to translate a familiar real-world concept into the digital economy, aiming to keep the oil-reserve narrative relevant in a modern, tokenized financial landscape.

Thanks to the support of its community and early speculative participants, U.S. Oil Reserve (USOR) is redefining how narrative-driven digital assets are created and traded, allowing users to participate in its on-chain ecosystem through decentralized markets. It functions primarily as a tradable meme-style token, rather than a regulated commodity-backed asset, and serves as a foundation for narrative-based speculation and community engagement within the crypto market.

Through this article, we explore U.S. Oil Reserve (USOR), outlining its conceptual vision, key characteristics, and market presence. Whether you’re assessing its on-chain behavior, speculative potential, or broader narrative impact, this guide helps you understand its position within the evolving crypto ecosystem—while highlighting how Bitget Wallet supports secure stablecoin storage, fast memecoin trading, and a seamless cross-chain experience for managing assets like USOR efficiently.

Key Takeaways

- U.S. Oil Reserve (USOR) is a narrative-driven, meme-style token, built around oil-reserve symbolism rather than verified, redeemable, or audited oil backing.

- USOR functions primarily as a tradable on-chain asset, enabling community participation and speculative trading, not as a regulated commodity token or yield-generating protocol.

- Participation carries elevated risk, as the project relies on narrative appeal and market sentiment, with no confirmed institutional support, reserve attestations, or formal governance structure.

What Is U.S. Oil Reserve (USOR): What You Should Know?

U.S. Oil Reserve (USOR) is a meme-style, narrative-driven token based on the Solana blockchain that represents a modern, on-chain reinterpretation of the U.S. oil reserve concept. Rather than functioning as a regulated or commodity-backed instrument, the project uses blockchain as a medium to express and trade an oil-themed economic narrative. The project embodies the following values:

- Narrative symbolism rooted in energy, reserves, and macroeconomic themes

- Decentralized participation through permissionless on-chain trading

- Community-driven speculation shaped by market sentiment rather than formal governance

U.S. Oil Reserve (USOR) does not claim verified oil custody or redemption mechanisms, but instead applies its thematic identity to the crypto meme and speculative trading sector, forming a loosely organized, participation-based community centered on narrative relevance rather than utility guarantees.

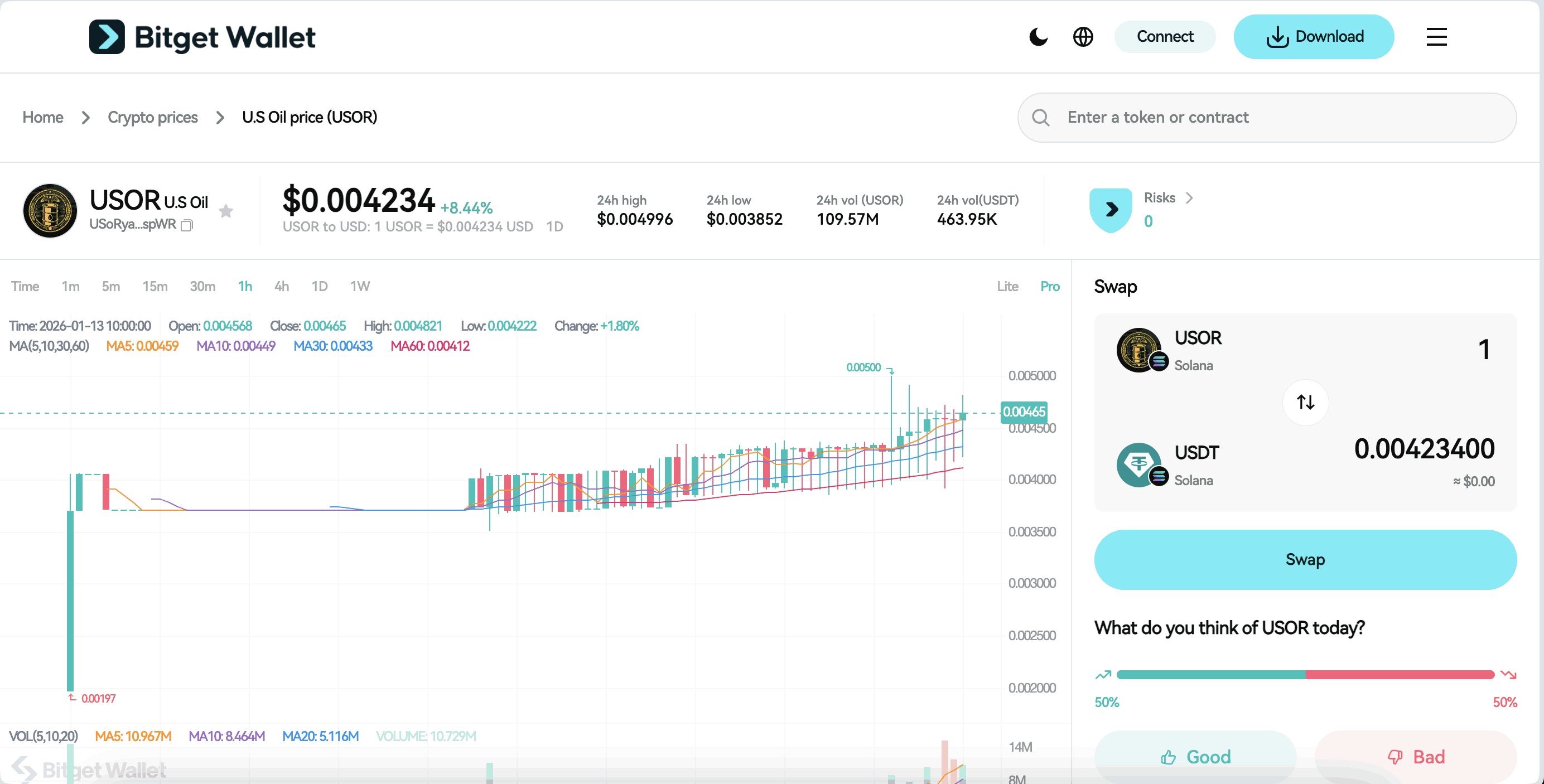

Source: Bitget Wallet

U.S. Oil Reserve (USOR) has recently attracted attention as a Solana-based narrative token, with activity driven largely by community interest and short-term market momentum rather than confirmed utility developments. As with many meme-style assets, visibility has increased through wallet integrations and decentralized trading venues, while the project continues to evolve primarily through narrative adoption rather than formal product milestones.

U.S. Oil Reserve (USOR) Listing: Key Details and Trading Schedule

1. Key Listing Information

Here are the important details about the U.S. Oil Reserve (USOR) listing:

- Exchange: To be announced

- Trading Pair: USOR/USDT

- Deposit Available: To be announced

- Trading Start: To be announced

- Withdrawal Available: To be announced

Don’t miss your chance to start trading U.S. Oil Reserve (USOR) on exchanges once an official listing is announced and be part of this emerging on-chain narrative.

- Please refer to the official project or exchange announcement for the most accurate schedule.

U.S. Oil Reserve (USOR) Market Trends & Price Predictions 2026

U.S. Oil Reserve (USOR)’s price is primarily determined by market sentiment, narrative strength, liquidity depth, and short-term adoption among speculative traders. As a narrative-driven, meme-style token rather than a utility or yield asset, USOR’s valuation is closely tied to attention cycles rather than fundamentals. Under neutral market conditions, USOR could trade within a highly volatile range, with prices fluctuating roughly between $0.00001 – $0.0001, depending on liquidity and trading activity. If narrative traction strengthens or meme momentum returns, speculative upside could temporarily push valuations toward $0.0002 – $0.0003, though sustainability remains uncertain.

Factors Influencing the Price of U.S. Oil Reserve (USOR)

Several crucial aspects contribute to the growth potential and volatility of U.S. Oil Reserve (USOR):

-

Market Trends:

USOR is highly sensitive to broader meme-coin cycles, macroeconomic narratives, and social-media-driven momentum. Periods of increased interest in energy, geopolitics, or commodity themes can temporarily amplify trading activity.

-

Adoption & Real-World Utility:

USOR currently lacks verified real-world utility or commodity-backed mechanisms. Adoption is driven mainly by speculative interest rather than functional use cases, limiting long-term price stability.

-

Project Advancements:

Without a published roadmap, audited reserves, or protocol upgrades, price movements are largely reactive. Any future announcements related to transparency, liquidity management, or ecosystem integrations could influence short-term valuation.

Long-Term Growth Potential

Should U.S. Oil Reserve (USOR) expand its presence within the crypto meme and narrative-asset sector, demand could increase during favorable market cycles, resulting in temporary valuation spikes. Some market observers speculate that sustained narrative relevance could push prices toward $0.0002 – $0.0003, but this outlook remains high-risk and heavily dependent on sentiment, liquidity conditions, and overall crypto market health. Investors should remain cautious of sharp volatility, limited disclosures, and broader regulatory and market risks.

Source: Bitget Wallet

Why U.S. Oil Reserve (USOR) Stands Out: Essential Features

The standout features of U.S. Oil Reserve (USOR) include:

-

Narrative-Driven Identity

U.S. Oil Reserve (USOR) is built around an oil-reserve and energy-security narrative, using a familiar macroeconomic concept to create thematic relevance in the crypto space. Rather than emphasizing technical innovation, the project relies on symbolism and storytelling to attract attention and trading interest.

-

On-Chain Accessibility and Permissionless Trading

USOR exists as a standard on-chain token, allowing users to acquire, hold, and trade it through decentralized wallets and DEX routing without approval or centralized control. This permissionless design lowers entry barriers but also means there are no built-in protections such as price stabilization mechanisms or redemption guarantees.

-

Community-Led and Speculative Market Dynamics

The token’s activity and visibility are driven primarily by its community and market participants. With no confirmed roadmap, audited reserves, or formal governance structure, USOR’s price action and relevance depend largely on sentiment, social momentum, and broader meme-coin market cycles rather than long-term protocol development.

The U.S. Oil Reserve (USOR) Ecosystem: How It Functions?

U.S. Oil Reserve (USOR) is a decentralized crypto token project designed primarily for on-chain trading and community participation, rather than for complex DeFi automation or protocol-level utilities. Built as a narrative-driven, meme-style asset, USOR empowers users through permissionless transactions and open market access on the blockchain.

By leveraging blockchain technology, USOR enables basic token interactions such as buying, selling, and holding, while relying on market dynamics rather than staking, governance, or yield mechanisms. Below is a step-by-step overview of how the U.S. Oil Reserve (USOR) ecosystem functions in practice:

| Step | Process | Benefit |

| 1. Blockchain Integration | U.S. Oil Reserve (USOR) runs on the Solana blockchain, ensuring fast, low-cost, and decentralized transactions. | Efficient on-chain transfers with minimal fees |

| 2. Token Transactions | Users can buy, sell, and transfer USOR through wallets and decentralized swap routes. | Open, permissionless market access |

| 3. Smart Contracts | Smart contracts manage basic token logic such as supply and transfers, without advanced DeFi automation. | Transparency and immutability of token behavior |

| 4. Governance Participation | USOR does not currently offer on-chain governance or voting mechanisms. | Reduced protocol complexity but limited community control |

| 5. Staking & Yield Farming | There are no native staking or yield farming features associated with USOR at this time. | Avoids lock-up risk, but offers no passive income |

U.S. Oil Reserve (USOR) Team: Leadership and Strategic Vision

Leadership

U.S. Oil Reserve (USOR) does not publicly disclose a formal leadership team, founders, or core developers. The project appears to be community-driven and anonymously launched, which is common among narrative-based and meme-style tokens. As a result, there are no verified executive profiles, advisory boards, or institutional backers associated with the project at this time. Decision-making and direction are largely shaped by market participants and informal community consensus, rather than centralized leadership.

Strategy

The strategic vision of U.S. Oil Reserve (USOR) centers on narrative positioning rather than product development. The project leverages oil-reserve and energy-related symbolism to remain relevant during periods of heightened interest in commodities, geopolitics, or macroeconomic themes. Instead of pursuing complex protocol upgrades, governance systems, or utility expansion, USOR’s strategy relies on visibility, accessibility, and speculative engagement within the broader crypto meme ecosystem. This approach prioritizes adaptability to market sentiment but also limits long-term predictability and structural growth.

U.S. Oil Reserve (USOR): Practical Applications & Use Cases

Why Utility Matters for U.S. Oil Reserve (USOR)?

Utility is a key factor in determining whether a token can sustain relevance beyond short-term market cycles. In the case of U.S. Oil Reserve (USOR), utility is limited and non-functional, as the token is not designed to power a protocol, provide access to services, or enable governance. Instead, its value proposition is rooted in narrative exposure and tradability, making market perception and liquidity far more important than technical use cases. Understanding this distinction helps participants accurately assess risk and expectations.

Key Use Cases of U.S. Oil Reserve (USOR)

At present, USOR’s use cases are narrow and market-driven, rather than application-driven:

-

Speculative Trading:

USOR is primarily used for buying and selling on-chain through decentralized swap routes, with price action driven by sentiment and narrative momentum.

-

Narrative Exposure:

The token allows participants to gain exposure to an oil- and energy-themed macro narrative within the crypto market, similar to other commodity-inspired meme assets.

-

Community Participation:

Holding USOR enables informal participation in a loosely organized community centered around shared narrative interest, rather than structured governance or protocol contribution.

USOR does not currently support payments, staking, yield farming, governance voting, or real-world commodity redemption.

What’s Next for U.S. Oil Reserve (USOR)?

The future of U.S. Oil Reserve (USOR) largely depends on market conditions and narrative relevance, rather than on a published development roadmap. Potential developments, if pursued, could include improved transparency, clearer communication around token mechanics, or broader wallet and DEX integrations. However, without confirmed plans for utility expansion or protocol development, USOR is expected to remain a high-risk, narrative-driven asset, with performance closely tied to sentiment shifts and overall crypto market cycles.

U.S. Oil Reserve (USOR) Roadmap: What to Expect in 2026 and Beyond?

The roadmap for U.S. Oil Reserve (USOR) does not currently include an official, published development plan. As a narrative-driven, meme-style token, USOR’s progression is shaped primarily by community activity, market sentiment, and liquidity conditions, rather than scheduled protocol milestones. The table below reflects observed or potential focus areas, not confirmed commitments.

| Quarter | Roadmap |

| Q3 2025 | Initial on-chain activity and community formation; trading primarily via decentralized wallets and swap routes |

| Q4 2025 | Increased visibility through narrative traction and social discussion; no confirmed utility or protocol upgrades |

| Q1 2026 | Continued speculative trading tied to macro and energy-related narratives; monitoring of liquidity and holder distribution |

| Q2 2026 | Possible community-led initiatives or visibility improvements, subject entirely to market interest and sentiment |

These developments reflect market-driven participation rather than functional applications, highlighting that USOR’s role remains within the crypto meme and narrative-asset space, not as an operational token in a specific industry with measurable utility.

How to Buy U.S. Oil Reserve (USOR) on Bitget Wallet?

Trading U.S. Oil Reserve (USOR) is easy on Bitget Wallet. Follow these simple steps to get started:

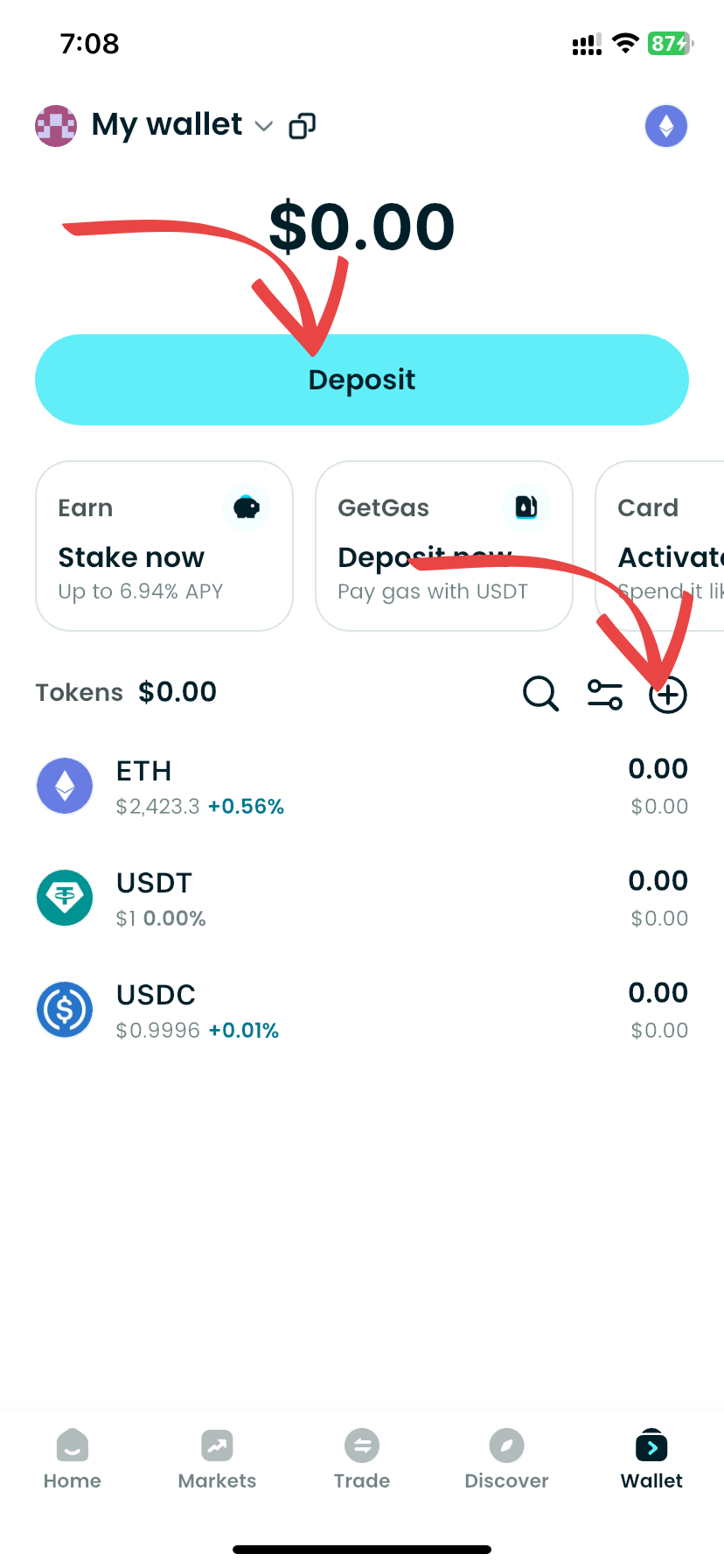

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading U.S. Oil Reserve (USOR).

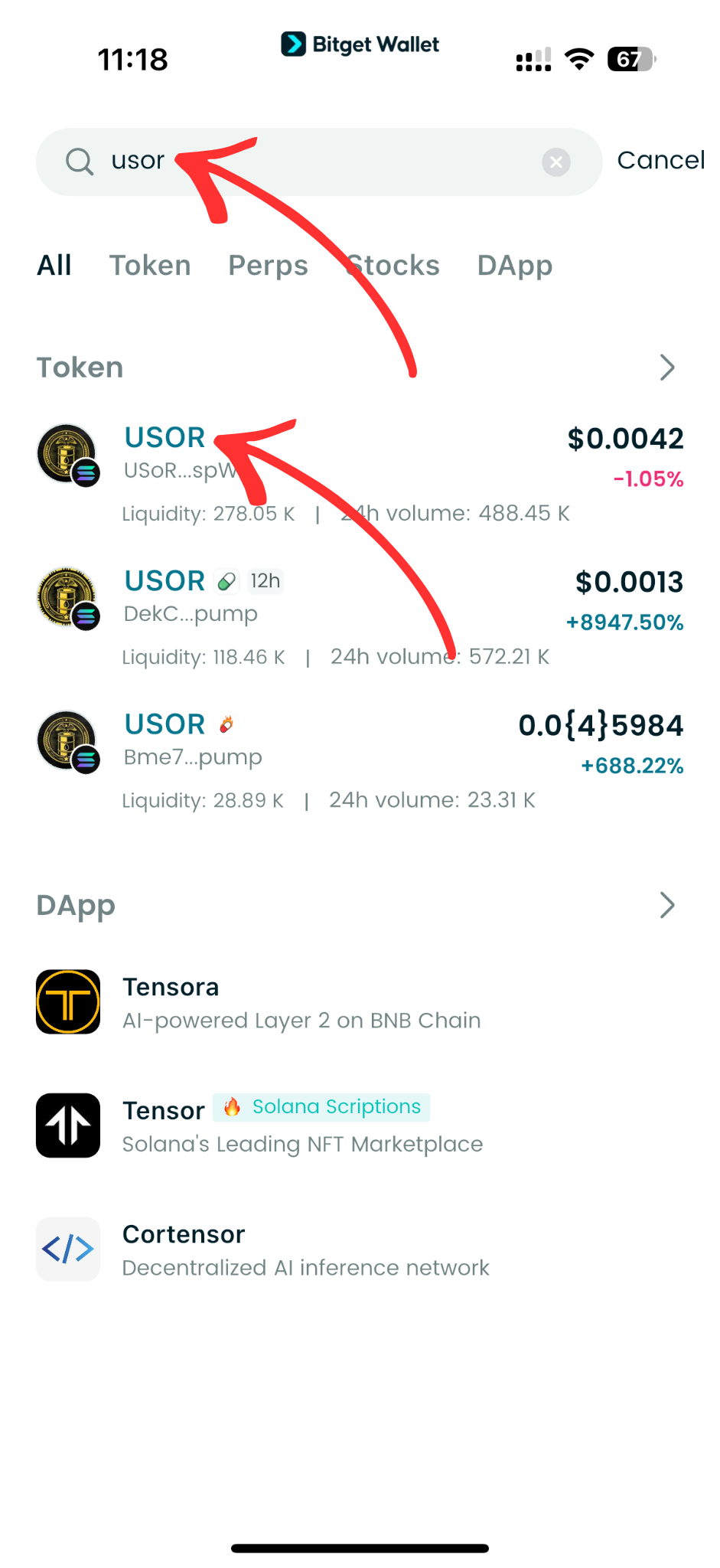

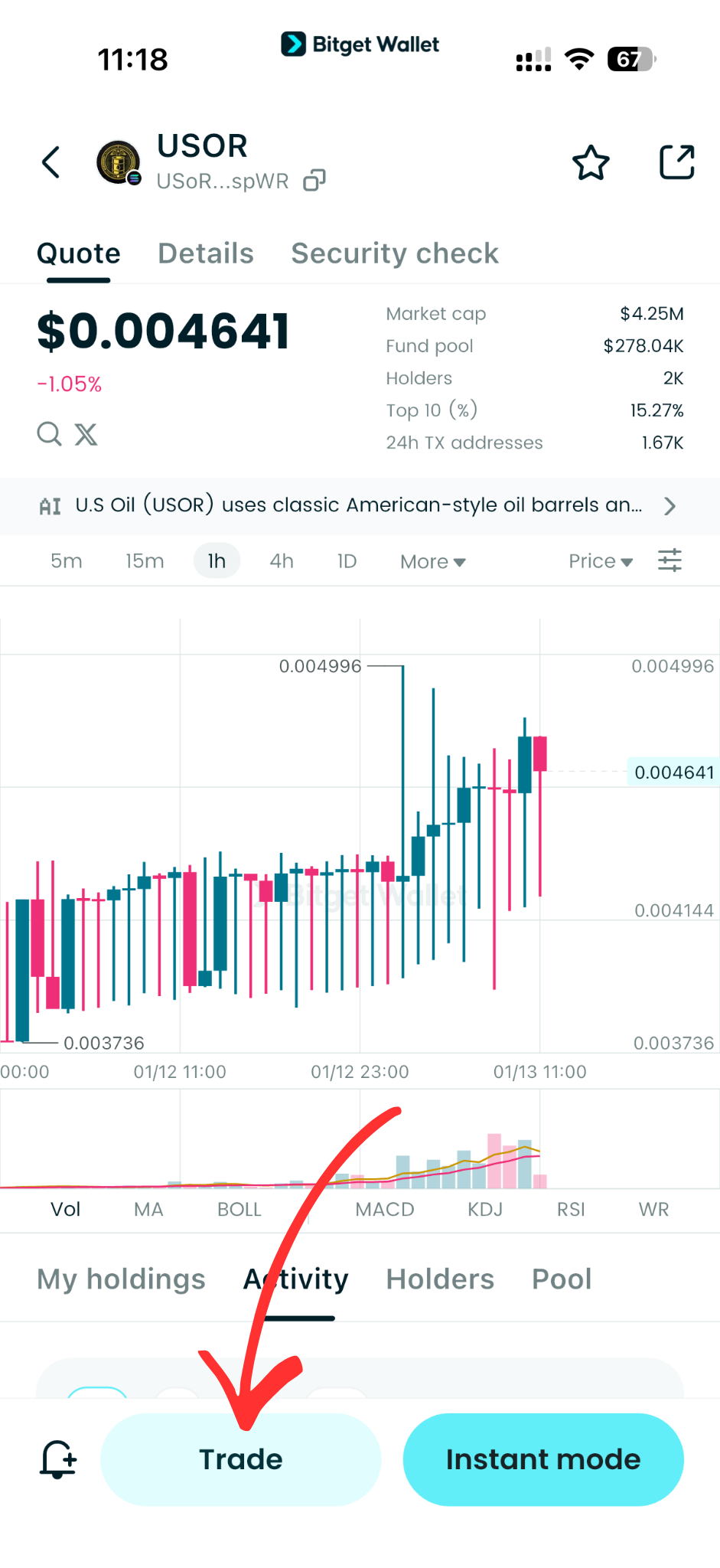

Step 3: Find U.S. Oil Reserve (USOR)

On the Bitget Wallet platform, go to the market area. Search for U.S. Oil Reserve (USOR) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

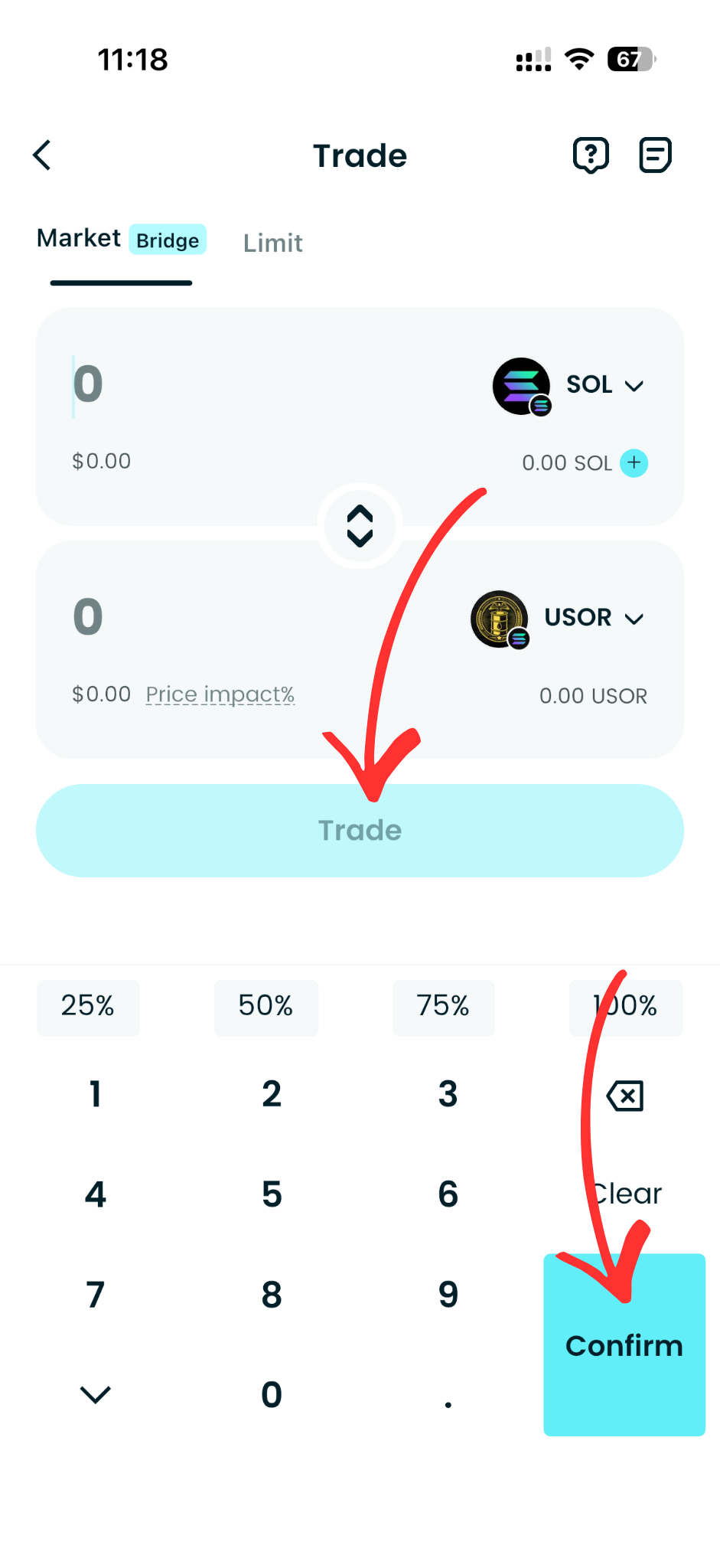

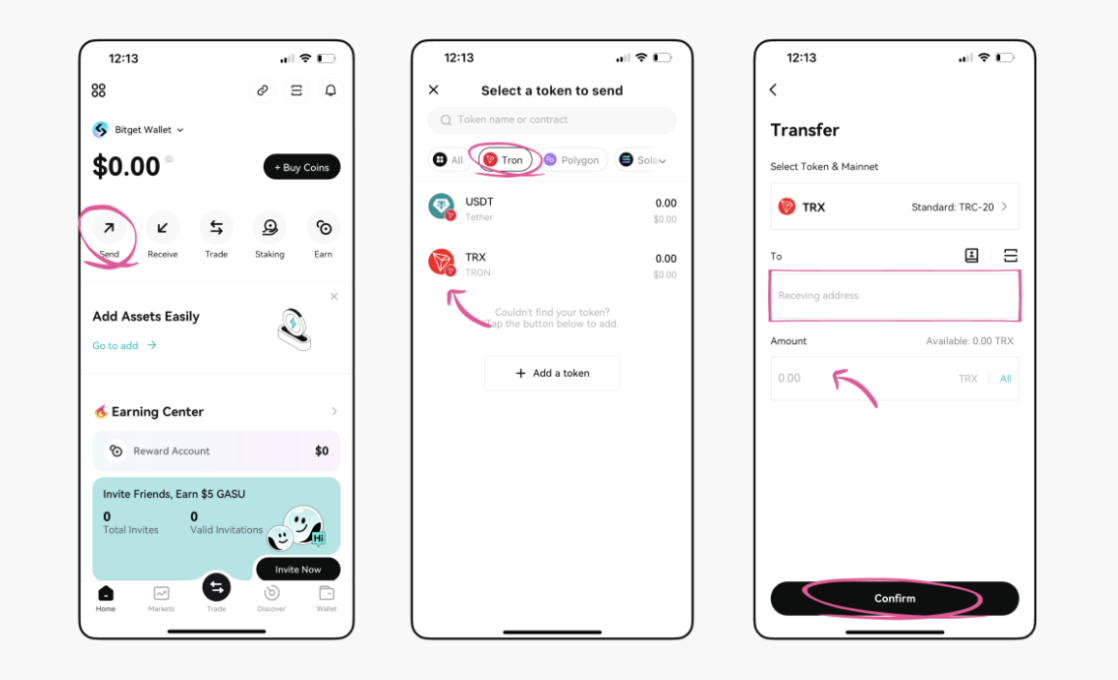

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, USOR/USDT.

By doing this, you will be able to exchange U.S. Oil Reserve (USOR) for USDT or any other cryptocurrency.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of U.S. Oil Reserve (USOR) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased U.S. Oil Reserve (USOR).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your U.S. Oil Reserve (USOR) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

U.S. Oil Reserve (USOR) is a narrative-driven, meme-style token built around oil and macroeconomic symbolism rather than verified commodity backing or protocol-level utility. As discussed throughout this article, its value is largely influenced by market sentiment, liquidity conditions, and community attention, making it a high-risk, speculative asset best suited for users who understand short-term volatility and narrative-based trading.

Using Bitget Wallet to access USOR provides a more efficient and flexible on-chain experience. Bitget Wallet offers optimized swap routing, full self-custody, and additional value through features such as Stablecoin Earn Plus, which allows users to earn up to 10% APY on idle funds, along with zero-fee trading on memecoins and selected RWA U.S. stock tokens. Together, these benefits help users reduce costs, improve capital efficiency, and manage speculative assets like USOR more effectively.

Trade, store, and explore Web3 seamlessly – beginner-ready with Bitget Wallet.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is U.S. Oil Reserve (USOR)?

U.S. Oil Reserve (USOR) is a narrative-driven, meme-style crypto token that uses oil and energy reserve symbolism as its core theme. It is not a government-issued asset and does not represent verified or redeemable oil reserves.

2. Is U.S. Oil Reserve (USOR) backed by real oil reserves?

No. U.S. Oil Reserve (USOR) is not backed by physical oil, audited reserves, or custodial assets. The “oil reserve” concept is purely narrative-based and should not be interpreted as commodity backing.

3. What blockchain is U.S. Oil Reserve (USOR) built on?

U.S. Oil Reserve (USOR) operates on the Solana blockchain, benefiting from fast transaction speeds and low fees, which makes it suitable for frequent on-chain trading and transfers.

4. Is U.S. Oil Reserve (USOR) a good investment?

U.S. Oil Reserve (USOR) is considered a high-risk, speculative asset. Its price is driven mainly by market sentiment, liquidity, and narrative momentum rather than utility or fundamentals. It may be suitable only for users who understand meme-coin volatility and associated risks.

5. How can I buy and store U.S. Oil Reserve (USOR)?

U.S. Oil Reserve (USOR) can typically be accessed through on-chain wallets and decentralized swap routes, such as those integrated into Bitget Wallet. Using a self-custody wallet allows users to maintain control over their assets while interacting directly with decentralized markets.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.