What is Nado: A Deep Look at Ink Network’s Central Limit Order Book DEX Design

What Is Nado? Nado goes beyond being a conventional decentralized exchange—it represents a push to bring professional, order-book–based trading infrastructure into decentralized finance while preserving on-chain transparency and self-custody. By combining the cultural expectation of centralized-exchange–level performance with decentralized settlement, Nado reflects the core principles of modern DeFi: user control, capital efficiency, and open access.

Built on the Ink Network, Nado is not merely an experimental trading interface within the blockchain ecosystem. It introduces a central-limit order book (CLOB) model, unified margin concepts, and high-performance execution—features traditionally reserved for centralized platforms. Traders can access Nado seamlessly via Bitget Wallet, benefiting from secure stablecoin storage, hot memecoin trading, and a seamless cross-chain experience while retaining full self-custody. This article explores what Nado is, how it works, and why it matters—helping traders and analysts assess its role in the evolving decentralized trading landscape and its potential as next-generation DeFi infrastructure.

Key Takeaways

- Nado is an order-book–based decentralized exchange built on the Ink Network, designed to bring centralized-exchange–style execution speed and pricing precision into DeFi without sacrificing self-custody.

- There is currently no official Nado native token; the platform focuses on trading infrastructure, with user activity rewarded via points that are expected to convert into $INK, the Ink Network’s ecosystem token.

- Nado’s hybrid design (off-chain matching + on-chain settlement) enables higher capital efficiency and a more professional trading experience, positioning it as emerging infrastructure for next-generation decentralized markets.

What Is Nado and Why It Matters?

Nado is a next-generation decentralized exchange (DEX) built on the Ink Network, designed to deliver a central-limit order book (CLOB) trading experience within decentralized finance. Unlike AMM-based DEXs that rely on liquidity pools and pricing curves, Nado adopts an order-book model similar to centralized exchanges—enabling precise limit orders, deeper market visibility, and more controlled execution.

At its core, Nado combines off-chain high-speed order matching with on-chain settlement, allowing traders to benefit from fast execution while maintaining transparency and self-custody. Importantly, Nado does not currently have an official native token; instead, its early incentive structure centers around platform usage and points, with potential future rewards linked to the Ink ecosystem rather than a standalone Nado token.

Why It Matters

Nado matters because it addresses one of DeFi’s longest-standing trade-offs: speed and precision vs. decentralization. By introducing an order-book DEX architecture, Nado enables:

- Professional-grade trading mechanics (limit orders, real order depth, tighter spreads) that appeal to active and advanced traders.

- Improved capital efficiency through unified margin concepts, reducing idle collateral compared to fragmented AMM positions.

- A bridge between CeFi expectations and DeFi principles, lowering the barrier for centralized-exchange users to transition into self-custodial trading environments.

In short, Nado represents a meaningful step toward institutional-style trading infrastructure in DeFi, focusing on execution quality and market structure rather than token hype—making it relevant for traders, analysts, and builders watching the evolution of decentralized markets.

Source: X

Nado Listing: Key Details and Trading Schedule

1. Key Listing Information

As of now, Nado has not announced an official native token nor a confirmed exchange listing.

- Exchange: To be announced

- Trading Pair: To be announced

- Deposit Available: To be announced

- Trading Start: To be announced

- Withdrawal Available: To be announced

At this stage, Nado’s focus is on building and testing its order-book DEX infrastructure on the Ink Network, rather than promoting a token launch or exchange listing. Users can currently participate through platform usage and incentive programs, which may later relate to Ink Network ($INK) rewards rather than a standalone Nado token.

- Please refer to official Nado or Ink Network announcements for the most accurate and up-to-date information.

Nado Price Prediction and Outlook 2026

The value of Nado in 2026 is not expressed through a standalone token price, but through its adoption as decentralized trading infrastructure within the Ink Network ecosystem. As of now, Nado has not launched an official native token, and therefore no direct price prediction exists for Nado itself.

Instead, Nado’s 2026 outlook should be evaluated through platform usage growth, order-book liquidity depth, and trader activity, alongside the evolution of incentive mechanisms tied to Ink Network ($INK) rather than a separate Nado token.

Key Factors Impacting Nado’s 2026 Outlook

Several structural factors will shape Nado’s trajectory in 2026:

-

Market Conditions:

As market volatility and derivatives activity increase in mature crypto cycles, demand for order-book–based DEXs typically rises—benefiting platforms that offer precise execution over AMM slippage.

-

Adoption & Utility:

Nado’s relevance depends on active traders and sustained volume, not speculative token flows. Growth in daily trades, open interest, and recurring users signals strengthening network effects.

-

Project Expansion:

Continued rollout of advanced trading features, broader market coverage, and deeper integration with the Ink Network will be critical to long-term traction.

Future Outlook

If decentralized finance continues shifting toward CeFi-grade execution with DeFi self-custody, Nado may become a key infrastructure layer rather than a hype-driven token project. While future incentive programs or token-related mechanisms remain possible, no official token launch or price targets have been announced as of now.

Users should rely solely on official Nado and Ink Network communications, carefully assess market risks, and avoid unverified price predictions or unofficial listings.

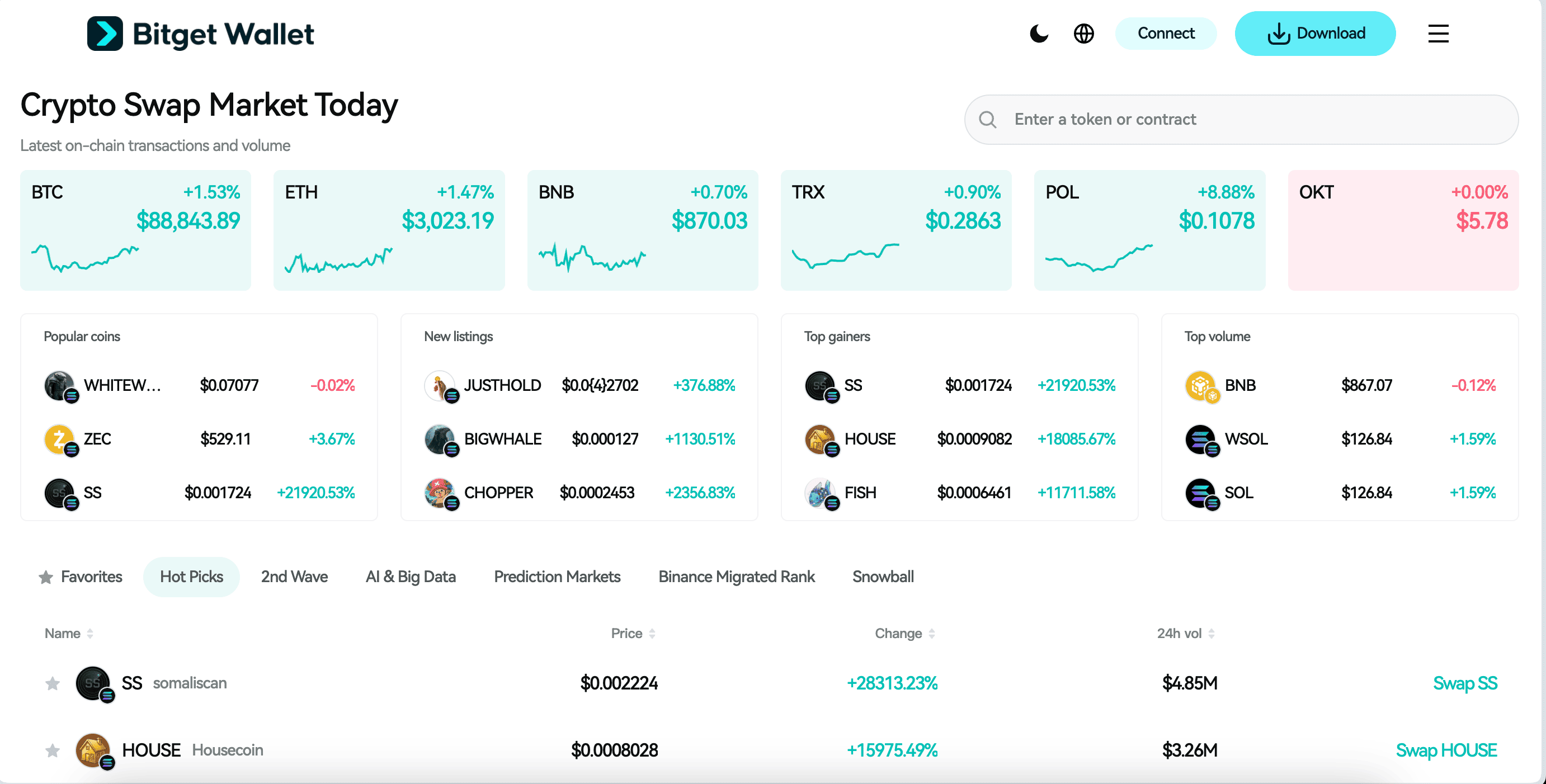

Source: Bitget Wallet

Nado Features: What Sets It Apart?

The standout features of Nado include:

-

Central-Limit Order Book (CLOB) Trading

Nado uses a true order-book model instead of AMM liquidity pools. This allows traders to place limit orders, see real market depth, and achieve more precise pricing—delivering a trading experience closer to centralized exchanges while keeping on-chain settlement.

-

Hybrid Architecture (Off-Chain Matching + On-Chain Settlement)

To balance speed and decentralization, Nado matches orders off-chain for low latency, then settles trades on-chain via the Ink Network. This design provides fast execution, transparent settlement, and full self-custody.

-

Capital-Efficient Trading Design

Nado is built with capital efficiency in mind, reducing fragmented liquidity and idle collateral. By optimizing how margin and liquidity are used, it enables traders to deploy funds more effectively across active positions.

How Nado Works and Delivers Value

The architecture of Nado is designed with multiple elements that work together to support adoption and deliver long-term value—without relying on a native token.

-

Blockchain Infrastructure

Nado is built on the Ink Network, leveraging a Layer-2–style execution environment to optimize transaction speed and reduce costs. It combines off-chain order matching with on-chain settlement, enabling high-performance trading while maintaining transparency, security, and self-custody. This hybrid design allows Nado to scale efficiently without sacrificing decentralization.

-

Protocol Utility (Non-Token Based)

Instead of a native token, Nado delivers value through trading functionality and infrastructure utility. Users interact with the platform to access order-book trading, capital-efficient execution, and advanced market features. Current incentives are activity- and usage-based (points), with potential future rewards expected to align with the Ink Network ecosystem ($INK) rather than a standalone Nado token. Nado does not currently support DeFi staking, liquidity mining, or NFT purchases via a native token.

Governance & Community Engagement

At this stage, Nado does not operate a token-based governance model. Governance and community engagement are driven through platform participation, feedback, and ecosystem collaboration within the Ink Network. Future governance mechanisms—if introduced—have not been officially announced and should be treated as to be determined (TBA) pending formal disclosures.

The Team Behind Nado: Experts Driving Innovation

The Team, Vision, and Partnerships

The team behind Nado is focused on building professional-grade decentralized trading infrastructure, prioritizing execution quality, reliability, and long-term market structure over short-term token narratives.

-

The Team:

Nado is developed by contributors with backgrounds in centralized exchange infrastructure and high-performance trading systems, bringing experience in order-book design, risk management, and low-latency execution into DeFi.

-

The Vision:

The core vision is to bridge CeFi-level trading performance with DeFi principles, enabling traders to access precise order execution and deep liquidity while retaining self-custody and on-chain settlement.

-

Partnerships:

Nado is closely aligned with the Ink Network ecosystem, leveraging its infrastructure to support scalable, cost-efficient trading. Ecosystem-level collaboration plays a larger role than individual brand partnerships at this stage.

Expert Insights

From an industry perspective, Nado reflects a broader trend toward infrastructure-first DeFi. Rather than launching a toen early, the project emphasizes product maturity, trader adoption, and market mechanics. Experts generally view order-book DEXs like Nado as a critical evolution for decentralized markets—especially as more sophisticated traders seek alternatives to centralized exchanges without sacrificing execution quality.

Key Use Cases of Nado: How It’s Transforming Decentralized Trading

Nado supports several core use cases that focus on improving how decentralized trading is performed rather than introducing a new token economy. Nado enables traders to execute order-book–based spot and derivatives trades, offering precise pricing and deeper liquidity visibility. It also supports self-custodial active trading, allowing users to trade frequently without surrendering asset control to centralized exchanges. In addition, Nado is designed for capital-efficient trading, helping users deploy funds more effectively compared to AMM-based liquidity pool models.

How Nado Is Transforming Decentralized Trading

By introducing a central-limit order book model and combining off-chain execution with on-chain settlement, Nado is transforming decentralized trading into a more professional and scalable market structure. It reduces reliance on simplified swap mechanics and moves DeFi toward exchange-grade execution, making decentralized markets more attractive to experienced traders and institutional-style participants.

Nado Roadmap: Key Milestones and Future Developments

The roadmap for Nado outlines a clear path for product-led growth and infrastructure expansion, rather than token-driven milestones. As Nado does not currently have a native token, the roadmap focuses on platform capabilities, trading features, and ecosystem integration.

| Quarter | Roadmap |

| Q3 2025 | Expansion of core order-book functionality, performance optimizations for matching engine, and onboarding of early active traders |

| Q4 2025 | Introduction of additional trading pairs, improved risk management tools, and deeper integration within the Ink Network ecosystem |

| Q1 2026 | Rollout of advanced trading features (e.g., enhanced margin mechanics, analytics dashboards), UI/UX refinements, and scalability upgrades |

| Q2 2026 | Ecosystem expansion, potential incentive framework enhancements (points-based), and preparation for any future governance or token-related announcements (if applicable) |

These milestones highlight the practical value of Nado as decentralized trading infrastructure, strengthening its role in the DeFi trading and market-structure space rather than positioning it as a token-centric project.

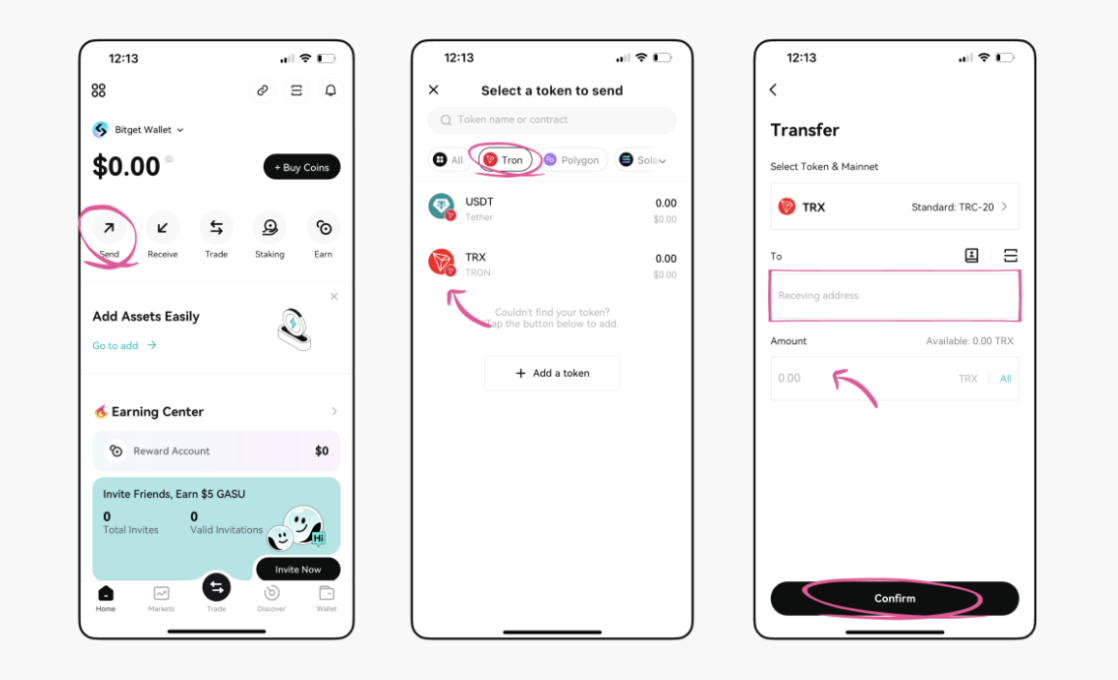

How to Buy Nado on Bitget Wallet?

Trading Nado is easy on Bitget Wallet. Follow these simple steps to get started:

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading Nado.

Step 3: Find Nado

On the Bitget Wallet platform, go to the market area. Search for Nado using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

Step 4: Choose Your Trading Pair

Select the trading pair you want to trade, such as /USDT.

Since Nado does not have a native token yet, you will be trading supported assets on the platform rather than a Nado token. Choose the pair you prefer and start trading using Nado’s order-book interface.

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of Nado you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased Nado.

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your Nado or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

Overall, Nado represents a shift toward professional, execution-focused decentralized trading. By introducing an order-book model, fast matching, and on-chain settlement—without relying on a native token—Nado prioritizes real trading utility over speculation, making it a strong option for users who value precision and self-custody.

Accessing Nado via Bitget Wallet makes the experience even smoother. Bitget Wallet offers a secure, non-custodial way to interact with Nado while helping users optimize their capital through Stablecoin Earn Plus (up to 10% APY) and zero-fee trading on memecoins and RWA U.S. stock tokens, making it a practical choice for active Web3 users.

Unlock cross-chain DeFi and stablecoin savings easily in Bitget Wallet.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is Nado?

Nado is a decentralized exchange built on the Ink Network that uses an order-book (CLOB) model instead of AMMs, allowing traders to place limit orders and trade with greater price precision.

2. Does Nado have a native token?

No. As of now, Nado does not have an official native token or ticker. The platform focuses on trading infrastructure rather than token issuance.

3. Is Nado listed on any centralized exchange (CEX)?

No. There is no confirmed CEX listing for Nado at this time. Users interact with Nado directly as a decentralized trading platform.

4. What makes Nado different from AMM-based DEXs?

Unlike AMM DEXs, Nado uses a central-limit order book, which offers better price discovery, visible liquidity depth, and more controlled execution—features preferred by active traders.

5. How can I use Nado safely?

You can access Nado through a non-custodial wallet like Bitget Wallet, which lets you trade supported assets while maintaining full control of your funds and benefiting from additional wallet features such as stablecoin earning options.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.