$USOR Listing Launch Date: What Is U.S. Oil Reserve Token on Solana DEX Trading?

U.S. Oil Reserve (USOR) listing is generating excitement in the crypto market, sparking speculation about its potential to be the next fast-moving Solana narrative trade. Not long ago, the PEPE cycle showed how early participation can translate into outsized returns—fueling the “catch it early” mindset that often drives meme and narrative tokens. Now, another potential game-changer is drawing attention: U.S. Oil Reserve (USOR).

Set to hit a widely discussed Feb 1, 2026 milestone via an “announcement” teaser (often framed as “oil tokenization technology” going live), USOR is creating buzz among traders—but it is important to note that this date is presented publicly as an announcement/event, not an exchange-confirmed CEX listing. In practice, USOR is already tradable on Solana decentralized exchanges, with liquidity and volume most commonly tracked on venues like Meteora and Orca (and related routing). Will this be another success story in the making?

In this article, we explore what makes USOR stand out, how to trade it efficiently, and why the Feb 1 announcement remains a key focal point—especially when paired with tools like Bitget Wallet, which enables secure stablecoin storage, hot memecoin trading, and a seamless cross-chain experience for active Web3 participants.

U.S. Oil Reserve (USOR) Listing Details and Launch Date

1. Key Listing Information

Here are the important details about the U.S. Oil Reserve (USOR) launch and listing status:

- Exchange: To be announced

- Trading Pair: USOR/USDT

- Deposit Available: February 1, 2026

- Trading Start: February 1, 2026

- Withdrawal Available: February 2, 2026

Don’t miss your chance to monitor or trade U.S. Oil Reserve (USOR) via supported Solana DEX routes and stay alert for any official centralized exchange announcements.

- Please refer to official project channels and verified exchange announcements for the most accurate and up-to-date schedule.

U.S. Oil Reserve (USOR) Price Prediction: Market Maker Impact

The trading activity around U.S. Oil Reserve (USOR) is not a conventional centralized-exchange listing with disclosed institutional market makers. Instead, USOR behaves similarly to Solana narrative / meme-style tokens, where price discovery is driven by on-chain liquidity providers, aggregators, and speculative rotation, rather than by firms such as Wintermute or GSR.

To estimate a realistic price range, the analysis below references historical USOR price behavior and comparable Solana narrative tokens with similar liquidity profiles and hype-driven cycles.

Key Market Maker Indicators

-

Market Maker Roster & Strategy

There are no publicly confirmed institutional market makers for USOR. Liquidity is supplied permissionlessly on Solana DEXs. This structure typically results in high short-term volatility, rapid price expansions during hype events, and sharp pullbacks once momentum fades.

-

Liquidity Pool Size at Launch / Current State

USOR’s liquidity is moderate to thin compared with established Solana assets. This implies:

- Higher sensitivity to large trades

- Faster upside during narrative surges

- Increased downside risk during sentiment reversals

-

Market Maker Contract Expiry & Options Open Interest

USOR has no listed derivatives or options markets (e.g., Deribit). As a result, volatility is not driven by contract expiries, but rather by:

- Spot-market demand

- Narrative catalysts (e.g., Feb 1 announcement expectations)

- Liquidity rotation across Solana tokens

Price Projection Based on Market Maker Activity Activity

| Time Frame | Predicted Price Range | Market Maker / Liquidity Influence |

| Short-term (1–3 months) | $0.03 – $0.08 | High volatility expected due to thin liquidity and event-driven speculation |

| Medium-term (3–6 months) | $0.02 – $0.05 | Potential consolidation as speculative flows normalize |

| Long-term (1 year or more) | $0.01 – $0.04 | Narrative strength and sustained attention become the dominant drivers |

Fear & Greed Narrative

🚨 USOR does not have institutional market-making contracts or derivatives support. Traders should expect sharp price swings around narrative milestones, as liquidity shifts rapidly in and out of the token.

Source: On-chain Solana DEX liquidity behavior and comparable narrative token cycles

Note: This price prediction is based on historical price data and comparable token behavior observed at the time of writing. It does not represent the official stance of U.S. Oil Reserve, Bitget Wallet, or any exchange. Crypto assets are highly volatile. Please conduct your own research and rely on verified on-chain data before making any investment decisions.

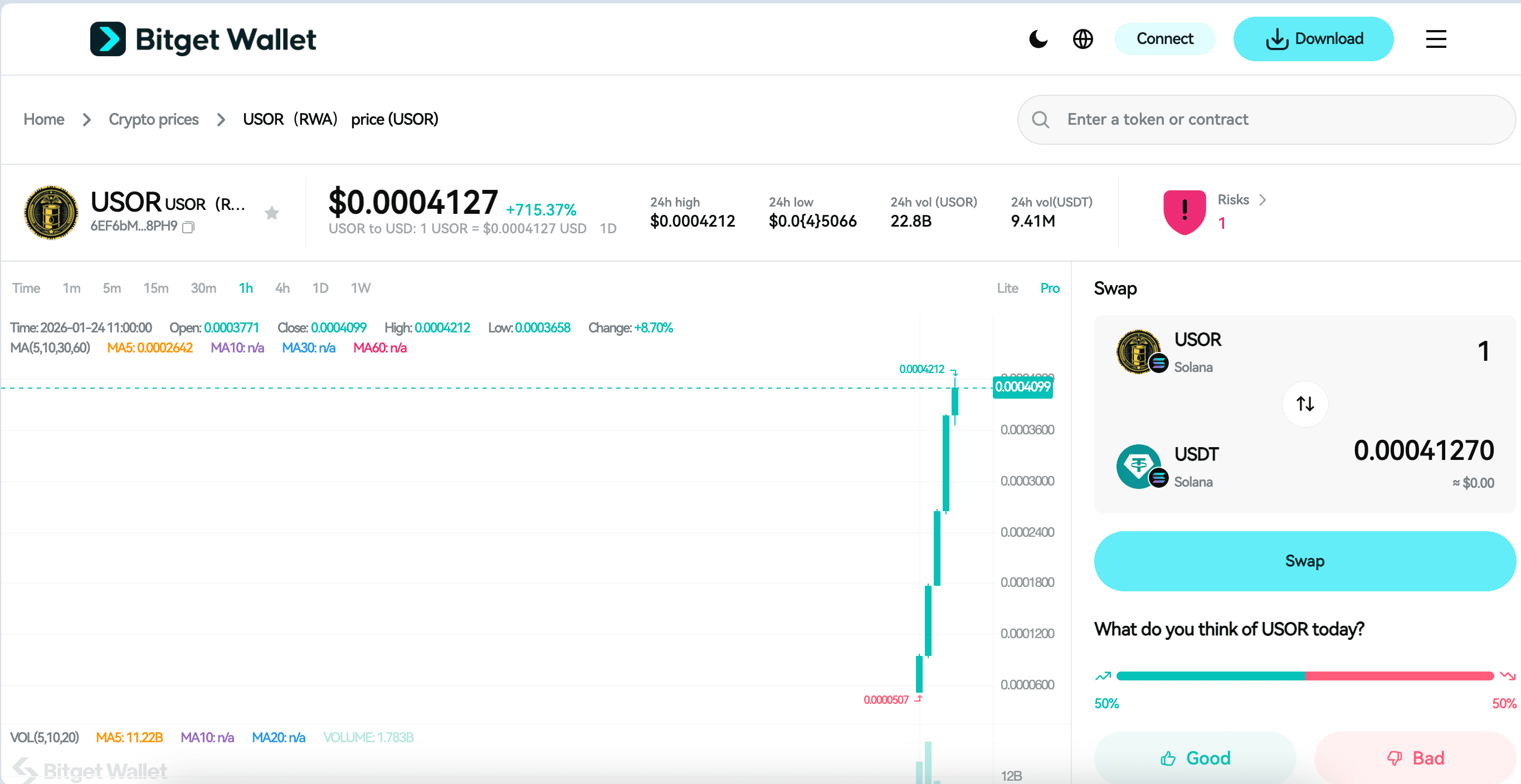

Source: Bitget Wallet

What Is U.S. Oil Reserve (USOR)? $USOR Token Explained

U.S. Oil Reserve (USOR) is a Solana-based narrative crypto token that leverages a real-world macro theme—U.S. oil reserves and energy security—to create a tradeable, on-chain asset. It combines headline-driven storytelling with fast, low-cost Solana liquidity, appealing to traders who rotate into macro and narrative tokens during hype cycles. The project’s goal is to capture market attention around energy and geopolitics through a simple, accessible on-chain token, rather than offering a regulated or commodity-backed product.

Key features

- Macro Narrative Positioning: Built around the widely recognized concept of U.S. oil reserves, giving the token immediate thematic clarity and media relevance.

- Solana-Native Liquidity: Deployed on Solana, enabling fast settlement, low fees, and seamless swaps via DEX aggregators.

- Pure On-Chain Price Discovery: No confirmed institutional market makers or derivatives—price action is driven by on-chain demand, liquidity depth, and sentiment.

Why U.S. Oil Reserve (USOR) Stands Out?

U.S. Oil Reserve (USOR) stands out due to its clear, real-world narrative built around the globally recognized concept of U.S. oil reserves, giving it stronger thematic clarity than abstract or purely meme-driven tokens. As a Solana-native asset, it benefits from fast, low-cost trading that appeals to active traders rotating capital across trending narratives. At the same time, USOR’s price action is highly attention-driven, often reacting sharply to announcement timelines and speculation, while its pure on-chain price discovery—without confirmed institutional market makers or derivatives support—means valuation is dictated entirely by supply, demand, and sentiment, resulting in elevated volatility.

Source: Bitget Wallet

The U.S. Oil Reserve (USOR) Ecosystem: How It Functions

U.S. Oil Reserve (USOR) is a decentralized, Solana-based crypto project designed primarily for on-chain trading and narrative-driven participation, rather than a full DeFi utility stack. Its ecosystem focuses on permissionless transfers, liquidity-based trading, and speculative participation, enabled by Solana’s high-throughput blockchain infrastructure.

By leveraging Solana, USOR enables seamless on-chain interactions such as wallet-to-wallet transfers, DEX swaps, and liquidity participation. Below is a step-by-step overview of how the USOR ecosystem functions in practice:

| Step | Process | Benefit |

| 1. Blockchain Integration | USOR runs on Solana, ensuring fast, low-cost, and decentralized transactions. | High-speed execution with minimal fees |

| 2. Token Transactions | Users can buy, sell, and transfer $USOR via Solana DEXs and aggregators. | Permissionless trading and self-custody |

| 3. Smart Contracts | Liquidity pools and swap mechanics are handled by Solana-based smart contracts. | Trust-minimized, automated trading |

| 4. Governance Participation | No formal on-chain governance is implemented at this stage. | Simplified structure, reduced complexity |

| 5. Staking & Yield Farming | No native staking or yield programs are currently live. | Lower protocol risk, narrative-focused exposure |

Meet the Team Behind U.S. Oil Reserve (USOR): Leadership and Strategy

Leadership

As of now, U.S. Oil Reserve (USOR) does not have a publicly disclosed core team or doxxed leadership structure. The project appears to follow a community-driven and pseudonymous model, which is common among Solana narrative and meme-style tokens. Development, messaging, and ecosystem coordination are primarily communicated through official social channels rather than through identifiable founders or executives. This structure places greater emphasis on market consensus and community momentum rather than individual leadership credibility.

Strategy

USOR’s strategy centers on narrative positioning and liquidity accessibility rather than long-term protocol development. By anchoring itself to a globally recognizable macro theme—U.S. oil reserves and energy security—the project maximizes attention efficiency, making it easy for traders to understand and speculate on. Operating exclusively on Solana, USOR prioritizes fast execution, low transaction costs, and frictionless participation via DEXs. Instead of pursuing complex DeFi features or formal governance, the strategy focuses on simplicity, visibility, and rapid market reaction, allowing USOR to benefit from hype cycles, news-driven speculation, and capital rotation within the Solana ecosystem.

U.S. Oil Reserve (USOR): Practical Applications & Use Cases

Why Utility Matters for U.S. Oil Reserve (USOR)

For U.S. Oil Reserve (USOR), utility is less about complex DeFi mechanics and more about tradability, accessibility, and narrative efficiency. In narrative-driven markets, a token’s primary “utility” is its ability to capture attention, move liquidity quickly, and remain frictionless to trade. USOR’s Solana-native design supports this by enabling fast, low-cost swaps and self-custodial participation, which are critical for active traders responding to macro news and speculation cycles.

Key Use Cases of U.S. Oil Reserve (USOR)

- Speculative Trading: USOR is actively used for short-term and swing trading on Solana DEXs, where price action is driven by news, sentiment, and liquidity shifts.

- Narrative Exposure: The token provides on-chain exposure to a recognizable macro theme—U.S. oil reserves and energy security—without relying on traditional commodities markets.

- Liquidity Participation: Users can participate in liquidity pools to facilitate trading and potentially earn fees, while accepting higher volatility risk.

- Portfolio Rotation Asset: USOR is commonly used as a rotation target when capital flows into trending Solana narratives during hype-driven market phases.

What’s Next for U.S. Oil Reserve (USOR)?

Looking ahead, USOR’s trajectory will largely depend on continued narrative relevance, liquidity depth, and market attention rather than protocol upgrades. Potential next steps include increased visibility through announcements, broader DEX integrations, or future centralized exchange listings if traction persists. Ultimately, USOR’s sustainability will hinge on its ability to remain culturally and narratively relevant within the Solana ecosystem while maintaining sufficient liquidity to support active trading.

U.S. Oil Reserve (USOR) Roadmap: What to Expect in 2026 and Beyond?

The roadmap for U.S. Oil Reserve (USOR) reflects its positioning as a narrative-driven, Solana-native token, with progress focused on visibility, liquidity, and market participation rather than complex protocol development.

| Quarter | Roadmap |

| Q3 2025 | Initial Solana deployment, DEX liquidity pool creation, and early community growth driven by narrative positioning around U.S. energy themes |

| Q4 2025 | Increased social exposure, trader onboarding, and liquidity expansion across Solana DEX routes and aggregators |

| Q1 2026 | Announcement-driven momentum cycle, renewed market attention, and potential exploration of broader exchange visibility |

| Q2 2026 | Liquidity stabilization phase, sustained trading activity, and assessment of long-term narrative relevance within the Solana ecosystem |

These developments highlight the practical value of $USOR in the crypto trading and narrative-speculation segment, where accessibility, liquidity depth, and attention cycles play a central role in shaping adoption and price dynamics.

How to Buy U.S. Oil Reserve (USOR) on Bitget Wallet?

Trading U.S. Oil Reserve (USOR) is easy on Bitget Wallet. Follow these simple steps to get started:

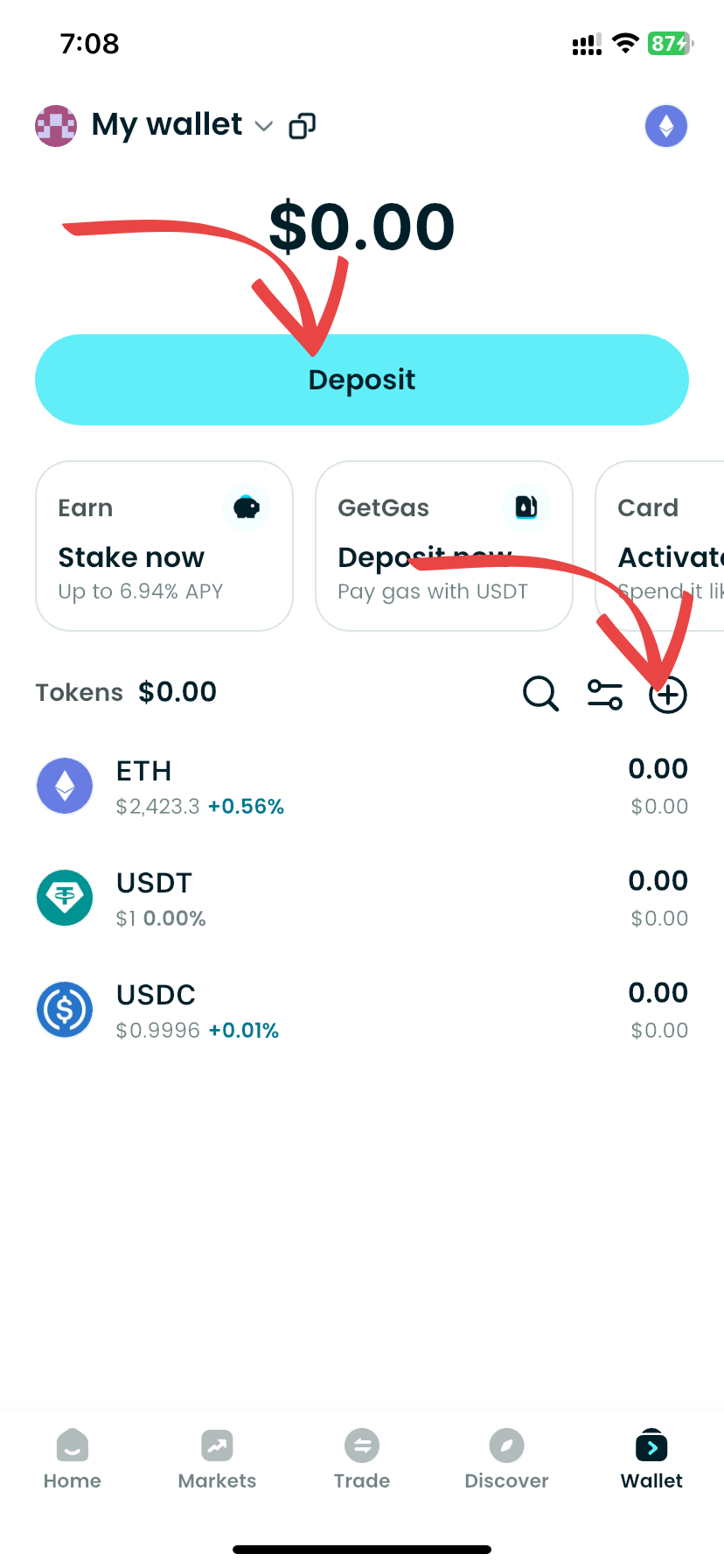

Step 1: Create an Account

If you don't currently have an account, install the Bitget Wallet app. Register by inputting the required details and confirming your identity.

Step 2: Deposit Funds

After setting up an account, you must deposit money. You can do this by:

- Transferring Cryptocurrency: Transfer crypto from a different wallet.

- Purchasing Crypto: Utilize a credit or debit card to buy crypto directly from Bitget Wallet, making sure you have sufficient capital for trading U.S. Oil Reserve (USOR).

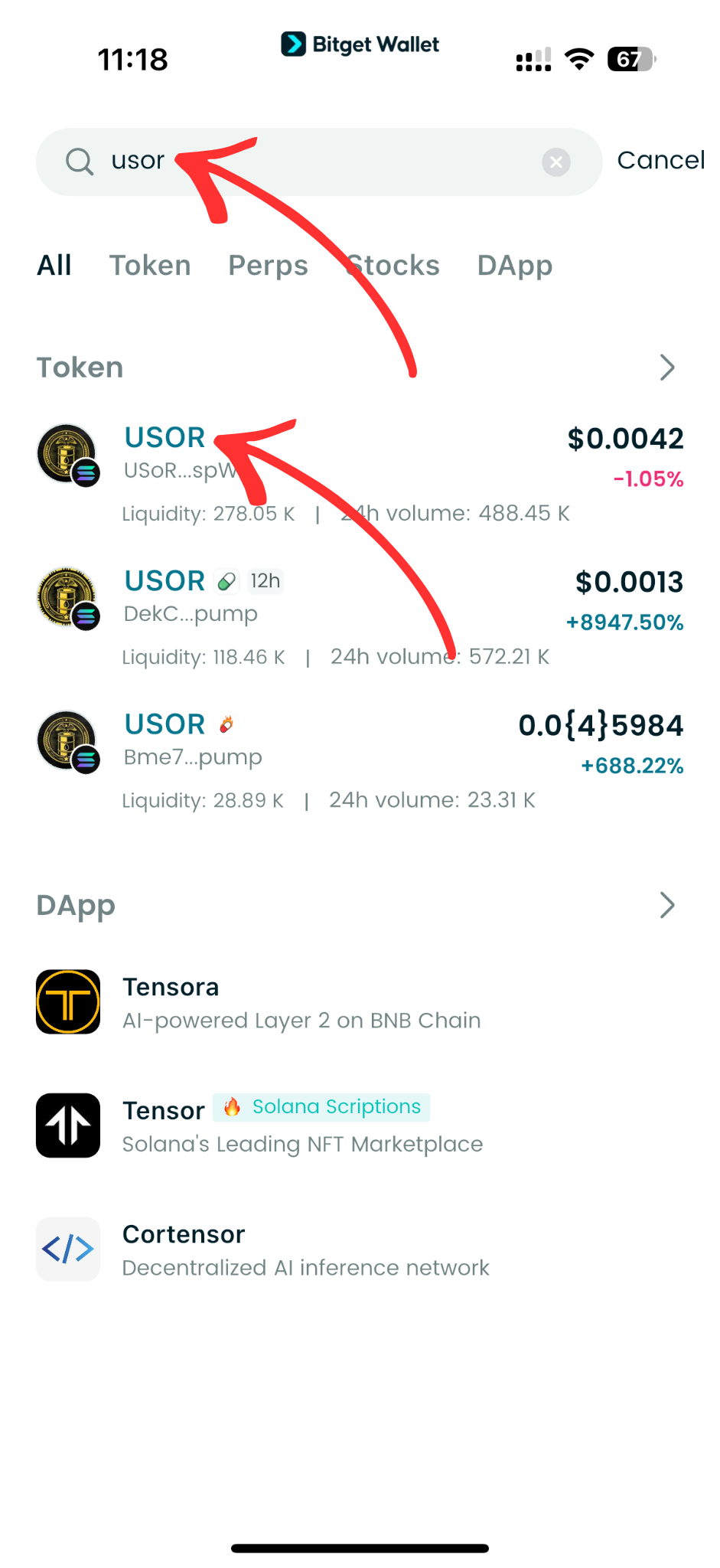

Step 3: Find U.S. Oil Reserve (USOR)

On the Bitget Wallet platform, go to the market area. Search for U.S. Oil Reserve (USOR) using the search function. Click on the token to access its trading page.

As this token has not been listed yet, please look at the last contract address sent by the project team upon listing of the token.

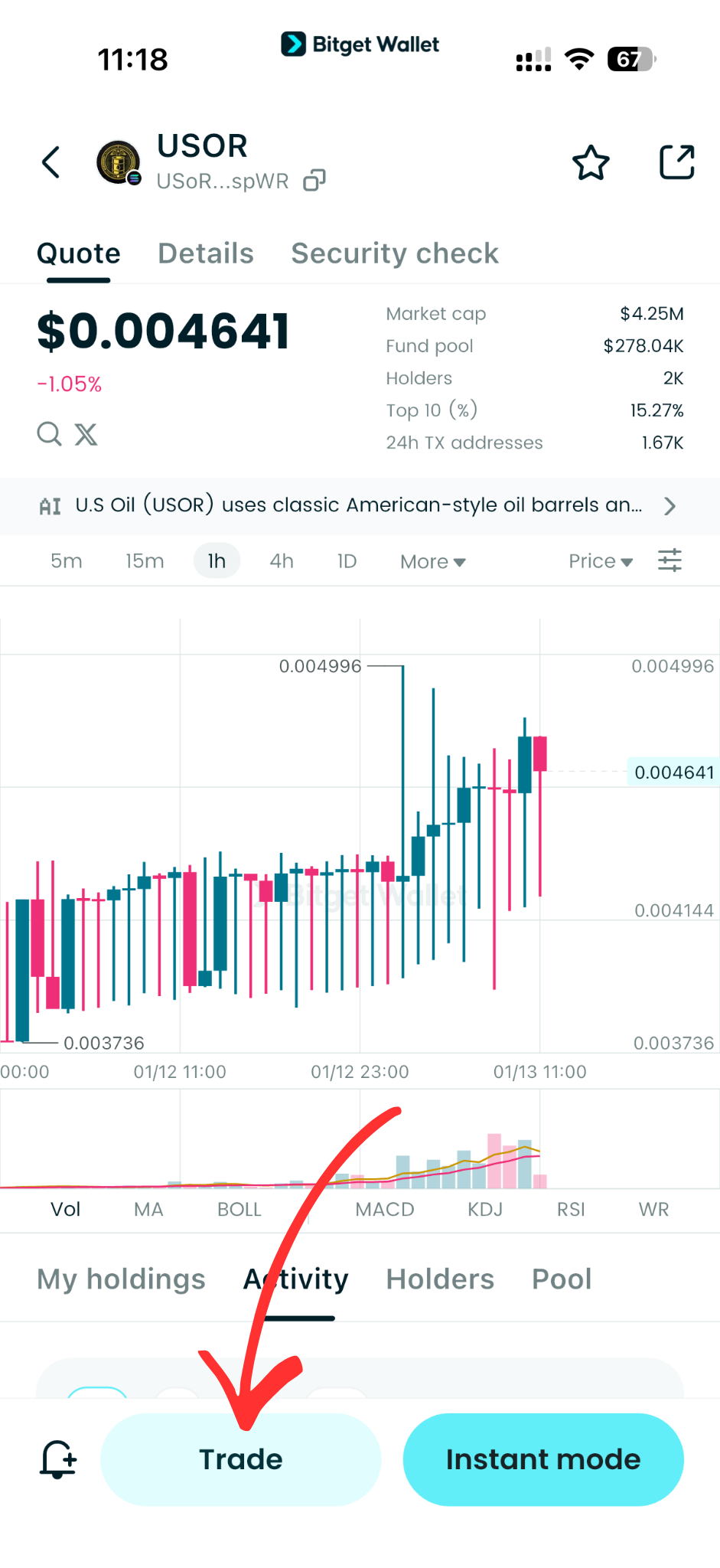

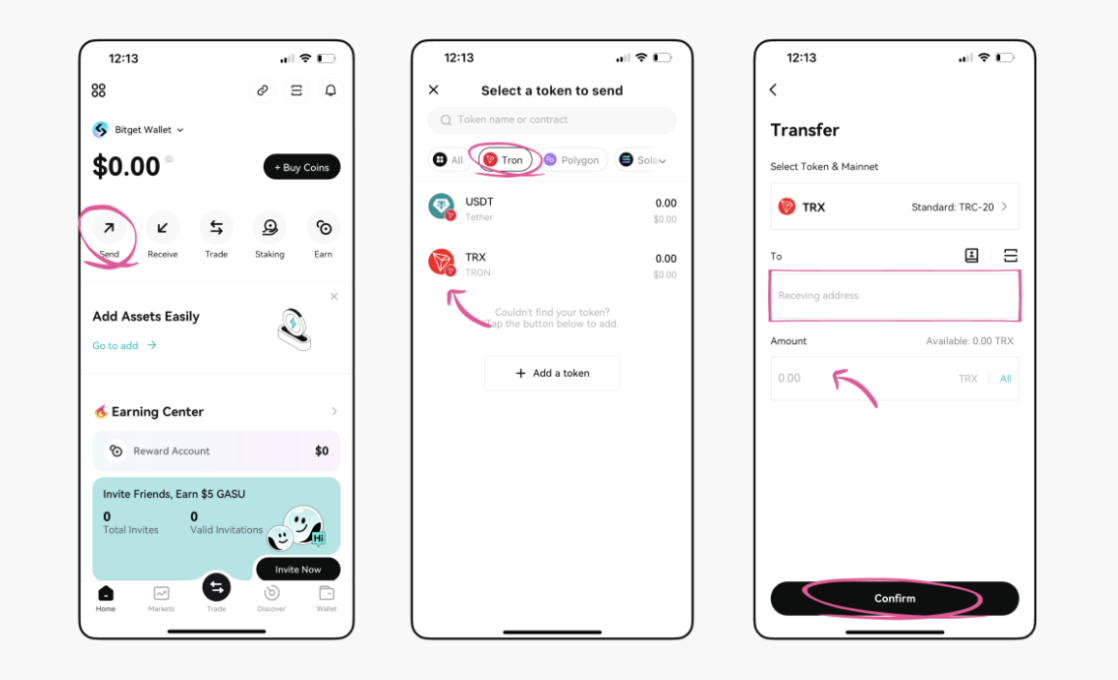

Step 4: Choose Your Trading Pair

Select your trading pair you would like to deal with, for instance, USOR/USDT.

By doing this, you will be able to exchange U.S. Oil Reserve (USOR) for USDT or any other cryptocurrency.

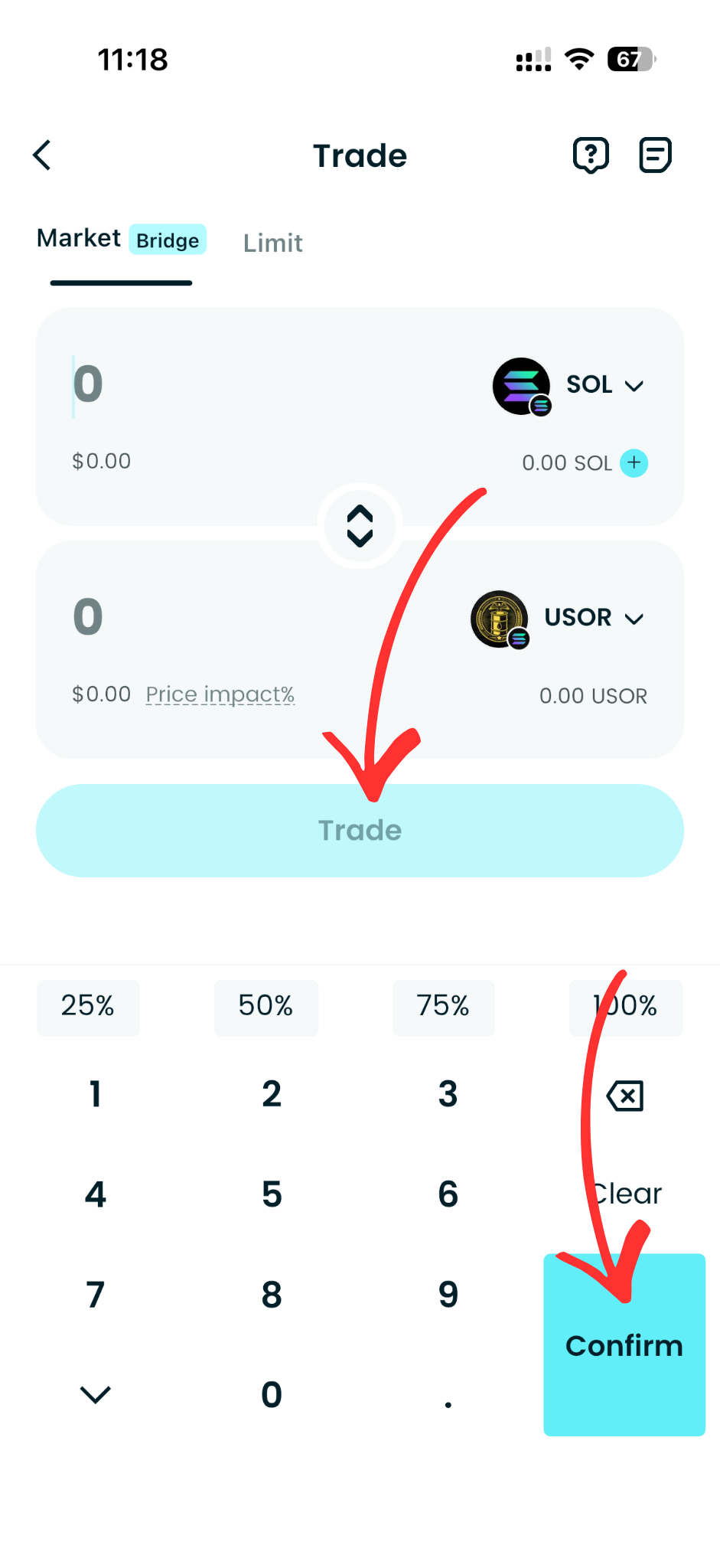

Step 5: Place Your Order

Choose whether to carry out a market order—either buy or sell at the prevailing rate—or place a limit order at your desired price. Fill in the amount of U.S. Oil Reserve (USOR) you want to exchange, then proceed to confirm in order to complete the trade.

Step 6: Monitor Your Trade

Once you have ordered, you can track the status of your order under "Open Orders." Upon completion of the order, you can view your balance to see the newly purchased U.S. Oil Reserve (USOR).

Step 7: Withdraw Your Funds (Optional)

If you want to transfer your U.S. Oil Reserve (USOR) or any other cryptocurrency to another wallet, go to the withdrawal section, provide your wallet address, and confirm the transaction.

Conclusion

The U.S. Oil Reserve (USOR) listing on Solana DEXs isn’t just about short-term price action—it reflects the growing influence of narrative-driven, decentralized markets within the broader crypto ecosystem. With a focus on on-chain accessibility, permissionless trading, and macro-themed speculation, USOR has positioned itself as a token that captures attention during high-momentum market cycles in the Web3 space.

As interest builds around key announcements and liquidity shifts, getting involved early—whether through active trading or participating in on-chain liquidity—can help users stay ahead in a fast-moving, sentiment-driven environment.

For secure and effortless asset management, Bitget Wallet offers a practical solution. With self-custody security, seamless cross-chain support, and a beginner-friendly interface, it enables users to trade and store digital assets with confidence.

Trade, store, and explore Web3 seamlessly – beginner-ready with Bitget Wallet.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. What is the USOR listing?

The USOR listing refers to U.S. Oil Reserve (USOR) becoming available for public trading, currently via Solana decentralized exchanges.

2. Is USOR listed on Bitget?

No. USOR is not officially listed on Bitget or other major centralized exchanges as of now.

3. When is the USOR listing date?

There is no confirmed CEX listing date. A Feb 1 announcement is widely discussed but not exchange-confirmed.

4. Where can I trade USOR?

USOR is traded on Solana DEXs through on-chain liquidity pools.

5. Is USOR backed by real oil reserves?

No. USOR is not backed by physical oil and is a narrative-driven crypto token.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly