SUI Token Unlock Schedule: Key Dates, Vesting Periods, and Price Impact

SUI token unlocks are closely watched by traders because they introduce new supply into circulation on a predefined schedule, often acting as short-term volatility triggers even when overall market conditions appear stable. These events are widely anticipated—yet market reactions still vary based on liquidity and positioning.

What sets SUI apart is its multi-bucket supply structure, spanning reserves, community funds, stake subsidies, and investor allocations, all governed by a long-term vesting framework extending toward 2030. With a 44.25M SUI unlock (~$63.7M) approaching, the key question isn’t whether tokens unlock—but how the market responds.

This article breaks down the SUI Token Unlock Schedule, explains vesting mechanics, highlights key dates, and shows how to assess price impact by looking beyond headline numbers to who receives the tokens and how supply meets liquidity.

Key Takeaways

- SUI token unlocks follow a multi-year path (May 2023–~2030), using cliffs plus linear and nonlinear vesting to release supply gradually.

- Around 35% of SUI is already unlocked, with 3.74B in circulation and a 44.25M Sui unlock (~$63.7M) coming next.

- SUI token unlocks don’t equal selling—price impact depends on unlock size vs volume and whether tokens go to community or investors.

What You Need to Know About the Sui (SUI) Token Unlock

A SUI unlock moves tokens from “locked” to “circulating” according to a preset schedule. The real edge is knowing which allocation bucket unlocks and whether it follows a cliff, linear vesting, or nonlinear vesting, because that changes how markets interpret sell risk and liquidity impact.

A token unlock is the release of previously locked tokens into circulation on a defined timeline—often tied to team, investors, ecosystem funds, and incentive programs. For SUI, the unlock design plays a balancing act: the network needs tokens to support growth and security, but it also needs to avoid sudden, chaotic supply shocks that undermine confidence.

In practice, SUI unlocks help support:

- Ecosystem growth via reserve/community reserves allocations

- Network security through stake subsidies and staking-related incentives

- Time-distributed issuance, which reduces “one-day dump” risk compared with heavily front-loaded releases

What are Core facts of SUI Token Unlock?

SUI token unlocks are anchored around a clearly defined supply framework, giving traders enough visibility to anticipate potential market reactions.

- Token: SUI

- Total/Max supply: 10.00B SUI

- Circulating: 3.74B SUI (37.37%)

- Market cap: $5.38B

- FDV: $14.42B

- 24h volume: $286.25M

- Price: $1.44

- 24h low/high: $1.42 / $1.45

A transparent unlock schedule lets markets price events in early, so unlock dates are often volatility catalysts, not automatic “price drop triggers.” The same unlock can produce very different outcomes depending on whether recipients sell, stake, or hold.

How Do Token Unlocks and Vesting Work in Sui (SUI)?

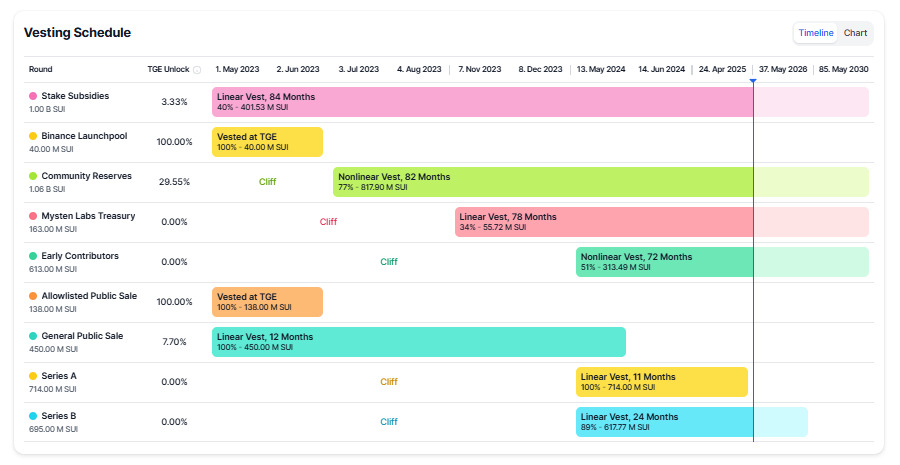

SUI vesting is multi-bucket: some allocations unlock immediately at TGE, others unlock after a cliff, and many follow linear/nonlinear vesting over years. Understanding these mechanics tells you whether supply enters the market smoothly—or arrives in attention-grabbing tranches.

How Do SUI Vesting Mechanics Work?

From your vesting timeline, SUI uses three main structures:

-

Cliff periods

A “cliff” means no unlocks for a period, followed by releases later. This matters because cliff endings often become high-attention windows (traders front-run them, hedgers price them in, and volatility can pick up).

-

Linear vesting

Linear vesting releases tokens steadily over time (e.g., monthly). This tends to feel “more predictable” and can be absorbed more easily—especially when daily liquidity is strong.

-

Nonlinear vesting

Nonlinear vesting releases at a variable cadence, which can create periods where unlock pressure feels heavier even if the total schedule is long.

SUI also includes a major bucket for stake subsidies, which supports network security and incentives over time (and is one reason SUI unlocks are not purely “insider supply”—there’s a meaningful incentives/security component in the schedule).

Who Receives Unlocked SUI Tokens?

SUI unlocks and vesting spread across these major buckets:

- Reserve / Community Reserves (ecosystem funds)

- Stake Subsidies (staking incentives / network security)

- Early Contributors

- Mysten Labs Treasury

- Series A / Series B investors

- Public Sale (General + Allowlisted)

- Binance Launchpool

This “who receives tokens” layer is crucial: markets often price investor/contributor unlocks differently from ecosystem or subsidy releases—even if the raw token amount is similar.

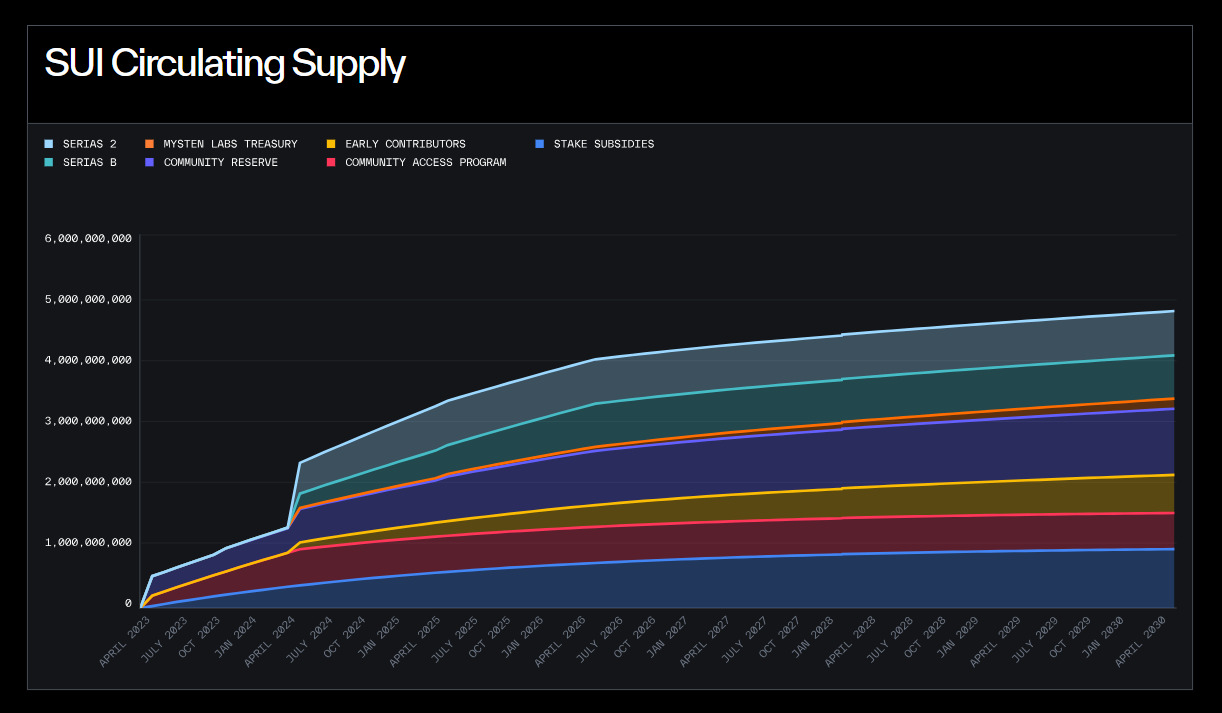

How Is SUI’s Total Token Supply Allocated?

SUI’s supply is split between ecosystem reserves, network incentives, and vested stakeholder allocations, supporting long-term growth with controlled issuance.

- Reserve: 52.20% (5.22B SUI)

- Community Reserves: 10.60%

- Stake Subsidies: 10.00%

- Series A: 7.14%

- Series B: 6.95%

- Early Contributors: 6.13%

- General Public Sale: 4.50%

- Mysten Labs Treasury: 1.63%

- Allowlisted Public Sale: 1.38%

- Binance Launchpool: 0.40%

With Reserve + Community Reserves forming a large share, a big part of the supply narrative becomes “ecosystem runway and incentives,” while investor/contributor buckets (Series A/B, Early Contributors) are the ones traders often watch most closely for potential sell behavior.

When Are the Key SUI Token Unlock Dates?

SUI’s unlock timeline runs from TGE in May 2023 through roughly May 2030. Traders tend to focus less on daily emissions and more on milestone dates—especially the next unlock event and any cliff endings that can change perceived supply risk.

Source: Sui.io

Timeline overview of SUI Token Unlock (TGE → ~2030)

From the vesting timeline shown in your images, SUI’s unlocks follow a long, structured arc:

- Start (TGE): May 2023

- Mid-cycle milestones: 2024–2026 (multiple cliffs ending; vesting ramps visible)

- Long tail: Vesting continues through ~May 2030

This design deliberately spreads supply over many years, reducing the chance that a single date overwhelms market liquidity—while still creating visible checkpoints traders price in.

Typical phases across the timeline:

- Immediate or high unlock at TGE (for some public allocations)

- Ongoing vesting (linear and nonlinear releases)

- Cliff-based vesting for insiders/treasury/investors, which starts later and attracts the most attention

Current Vesting Status of SUI

SUI’s vesting profile shows a balanced transition from early distribution toward long-term issuance.

- 35.04% unlocked: 3.50B SUI

- 13.79% locked: 1.38B SUI

- 51.17% untracked: 5.12B SUI

- Remaining vesting time: ~1,583 days

This confirms two important things:

- A meaningful portion of supply is already circulating, so SUI is past its most fragile early phase.

- A large amount of supply is still scheduled, which keeps unlock events relevant for years—not weeks.

Understanding the SUI Token Unlock Timeline Structure

To make the schedule easier to reason about, SUI’s allocations can be grouped into three unlock archetypes.

1. 100% unlocked at TGE

These buckets were fully released at launch and no longer create future unlock risk:

- Binance Launchpool: 100% unlocked (40.00M SUI)

- Allowlisted Public Sale: 100% unlocked (138.00M SUI)

These allocations are already “old news.” They define baseline circulating supply and don’t create new unlock-driven volatility.

2. Partially unlocked at TGE + vesting

These buckets released some supply at launch, then continue vesting over time:

- General Public Sale

- 7.70% at TGE

- Linear vesting (12 months)

- Stake Subsidies

- 3.33% at TGE

- Linear vesting (84 months)

- Community Reserves

- 29.55% at TGE

- Cliff + Nonlinear vesting (82 months)

These unlocks are often viewed as less aggressive sell risk, especially when tied to ecosystem incentives or staking. However, their long duration means they quietly contribute to ongoing supply expansion.

3. Cliff then vest (insiders, treasury, investors)

These are the most closely watched buckets:

- Mysten Labs Treasury

- 0% at TGE

- Cliff + Linear vesting (78 months)

- Early Contributors

- 0% at TGE

- Cliff + Nonlinear vesting (72 months)

- Series A

- 0% at TGE

- Cliff + Linear vesting (11 months)

- Series B

- 0% at TGE

- Cliff + Linear vesting (24 months)

Cliff endings in these categories often become event-driven catalysts. Even when actual sell pressure is limited, expectations alone can move price and funding rates.

Key SUI Token Unlock Highlights Traders Monitor

This is where theory meets trading reality. Instead of memorizing the entire schedule, most traders focus on high-impact moments.

Source: dropstab.com

1. “Next Unlock” — 44.25M SUI (~$63.7M)

The next highlighted unlock event shows:

- 44.25M SUI

- ~0.44% of total supply

- Estimated value: ~$63.7M

- Shown as ~1.18% of market cap

- Aggregated across 5 allocations

Even though 0.44% of total supply sounds small, the USD value relative to daily liquidity is what grabs attention. This unlock is large enough to influence short-term positioning—but not so large that it guarantees disruption.

2. Locked value by major buckets (from the vesting list)

The vesting list in your images also highlights where locked value concentration still sits:

- Stake Subsidies: ~$863.06M locked

- Early Contributors: ~$446.33M

- Community Reserves: ~$368.61M

- Mysten Labs Treasury: ~$158.04M

- Series B: ~$139.24M

Large locked values signal future optionality, not immediate selling. Traders often watch wallet behavior (exchange inflows vs staking/OTC movement) around these buckets rather than reacting blindly to the headline numbers.

3. Why the “$63–64M unlock” matters

The widely referenced $63–64M unlock figure deserves context:

- It’s a market-value estimate, not proof that $63M will be sold.

- Tokens can be:

- staked

- held long-term

- transferred OTC

- released gradually over the unlock window

Typical market reactions include:

- Pre-unlock positioning: traders hedge or reduce exposure ahead of time

- Event-window volatility: wider spreads, sharper wicks

- Post-unlock stabilization: if exchange inflows stay muted

This is why experienced traders treat unlocks as volatility windows, not binary “bull/bear” events.

How the SUI Token Unlock Affects Price & Market Behavior?

Price impact isn’t just about “more supply.” It’s about expectations, holder behavior, and liquidity. The larger an unlock is relative to trading volume, the more likely it is to spark volatility—especially when recipients are investors or insiders.

Markets frequently price unlocks in advance. What actually moves price is whether unlocked tokens hit exchanges in size.

Three drivers of SUI price reaction:

- Unlock size vs 24h trading volume

- ~$63.7M unlock vs $286.25M 24h volume

- This ratio is meaningful—but not extreme—suggesting volatility risk rather than guaranteed breakdown.

- Who receives the tokens

- Investor or contributor unlocks tend to attract more scrutiny than community or subsidy releases.

- Market context

- Broader L1 sentiment

- Exchange liquidity and derivatives positioning

- Ecosystem news and usage growth

Does Sui Have Any Mechanism to Reduce Sell Pressure?

Yes—several structural features help moderate supply shock risk:

- Multi-year vesting (to ~2030) spreads releases across many cycles.

- Cliffs + vesting prevent large insider allocations from hitting the market all at once.

- Staking and subsidies create incentives to hold rather than immediately sell (though behavior can vary by market conditions).

How SUI’s Token Unlock Compares With Other L1 Tokens

Compared with many Layer-1 projects, SUI follows a transparent, multi-bucket vesting framework rather than relying mainly on inflation emissions or opaque insider releases. This makes unlock events easier to anticipate—but still important to manage.

| Aspect | SUI | Many L1 Tokens |

| Vesting duration | Multi-year (to ~2030) | Often shorter or less explicit |

| Unlock structure | Multi-bucket + cliff + linear/nonlinear | Simpler or inflation-heavy |

| Market focus | Event unlocks + recipient buckets | Inflation rate / emissions |

| Supply shock risk | Reduced via long schedules | Higher if front-loaded |

SUI’s design doesn’t eliminate volatility—it reframes it. Instead of sudden surprises, the market reacts around known dates and cliff transitions, rewarding traders who plan ahead.

What Can Traders Learn From SUI’s Tokenomics?

SUI tokenomics emphasize large reserve/community allocations and time-distributed issuance. The edge comes from tracking FDV vs market cap, the unlock calendar, and exchange inflows around events.

Token allocation insights

- Reserve (52.20%) dominates → long ecosystem runway, but unlock cadence matters.

- Stake Subsidies (10%) support network security → releases are structural, not speculative.

- Series A/B + Early Contributors have cliffs → milestone risk, not daily noise.

Practical lessons for traders

- Don’t fixate on unlock percentages alone.

- Always compare:

- Unlock value vs 24h volume

- Which bucket receives tokens

- On-exchange inflows after unlock

- Treat unlocks as volatility windows, not guaranteed trend reversals.

How to Track SUI Token Unlocks Easily?

For active traders, SUI token unlocks aren’t just data points—they’re time-based market events. The real advantage comes from how smoothly you can move between information, positioning, and execution when volatility starts to build.

That’s why tracking unlocks effectively isn’t only about knowing the date—it’s about having a setup that lets you interact with the right tools instantly, without friction.

What Tools Can You Use to Monitor SUI Token Unlocks?

A practical unlock-tracking workflow usually combines:

- Token unlock calendars and dashboards to identify upcoming SUI unlocks, their USD value, and affected allocation buckets

- Vesting views to understand how much supply is unlocked, locked, or still scheduled

- Circulating supply metrics to evaluate unlock impact relative to FDV vs market cap

- Portfolio and alert tools to manage exposure during fast-moving windows

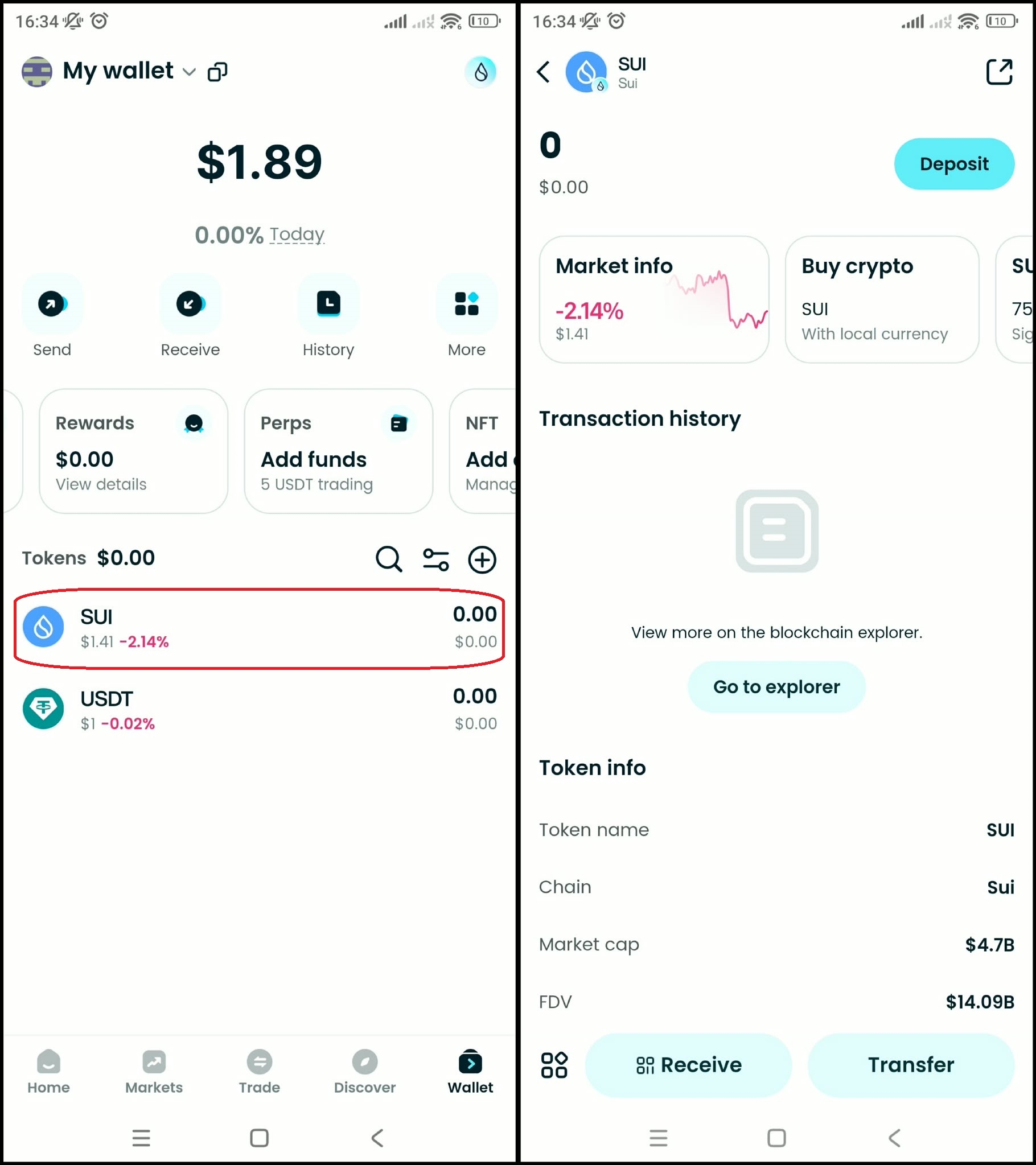

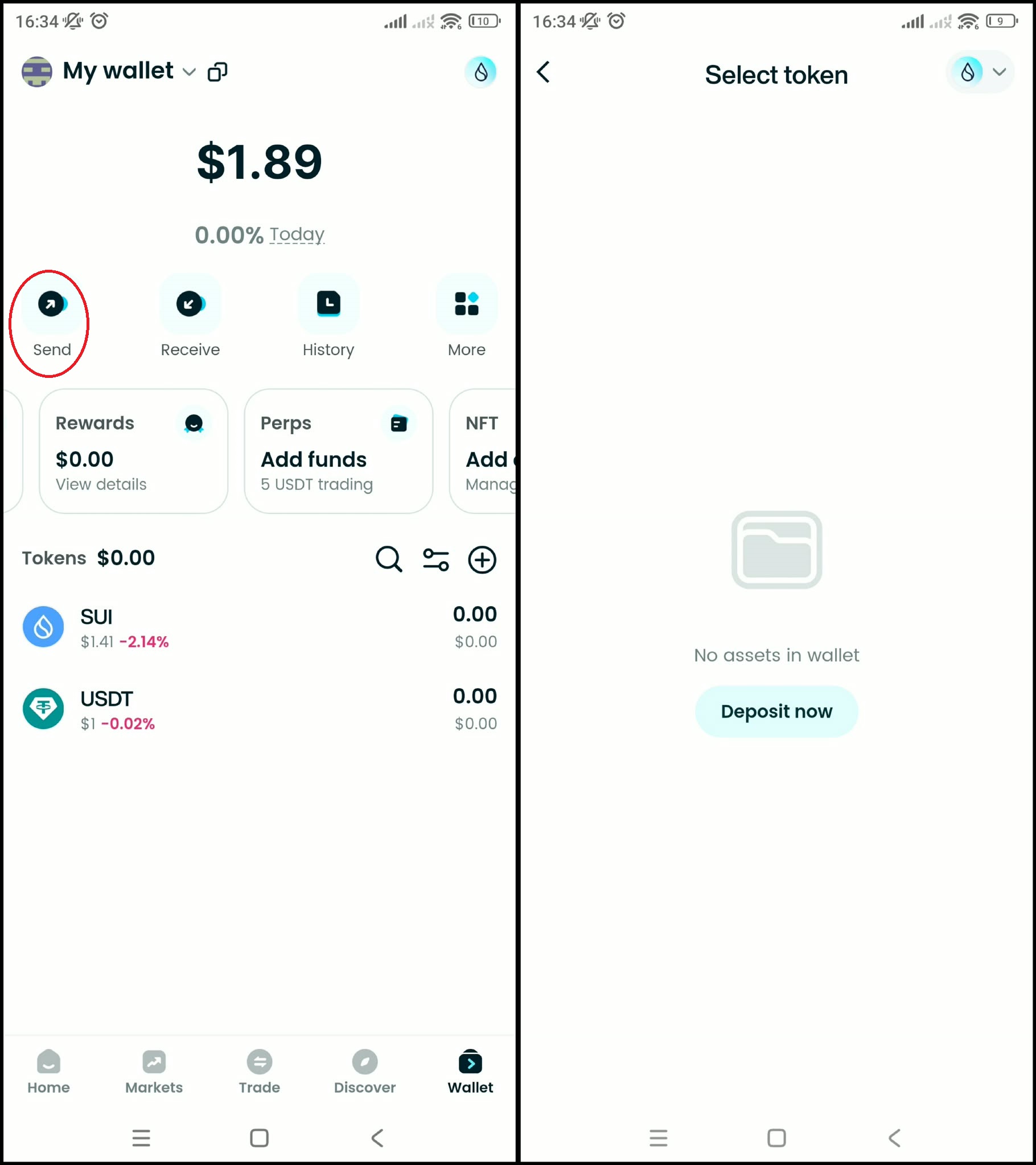

In this workflow, Bitget Wallet plays an important supporting role. Through its built-in Discover browser, traders can seamlessly access token unlock trackers, vesting dashboards, and on-chain analytics dApps, then move straight from analysis to action—without switching platforms or leaving self-custody.

This integrated flow becomes especially valuable during unlock periods, when speed and context matter more than isolated data.

How to Buy Sui (SUI) on Bitget Wallet?

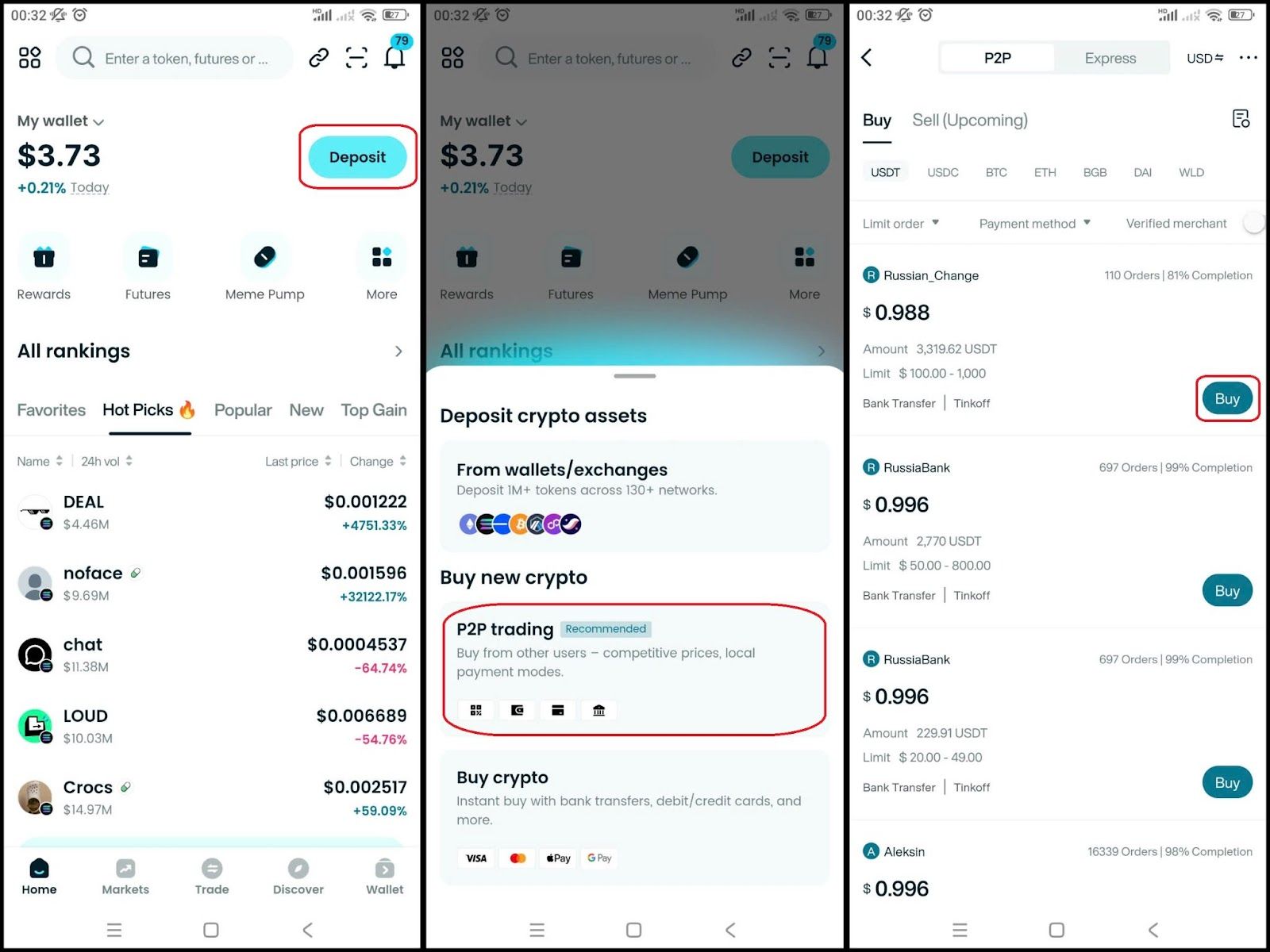

Buying Sui (SUI) on Bitget Wallet is easy! Just follow these simple steps:

Step 1: Create a wallet

- If you don't have a wallet, download Bitget Wallet app now.

- Register with your phone number or email, verify quickly and you can use it right away.

Step 2: Deposit money into your wallet

Once you have finished your wallet, you just need to deposit money into it. You can:

- Transfer coins from other wallets: Send BTC, ETH or any coin you have from an external wallet.

- Buy directly with a card: Use a bank card or credit card to buy USDT or ETH right in the app and then exchange it for USDC.

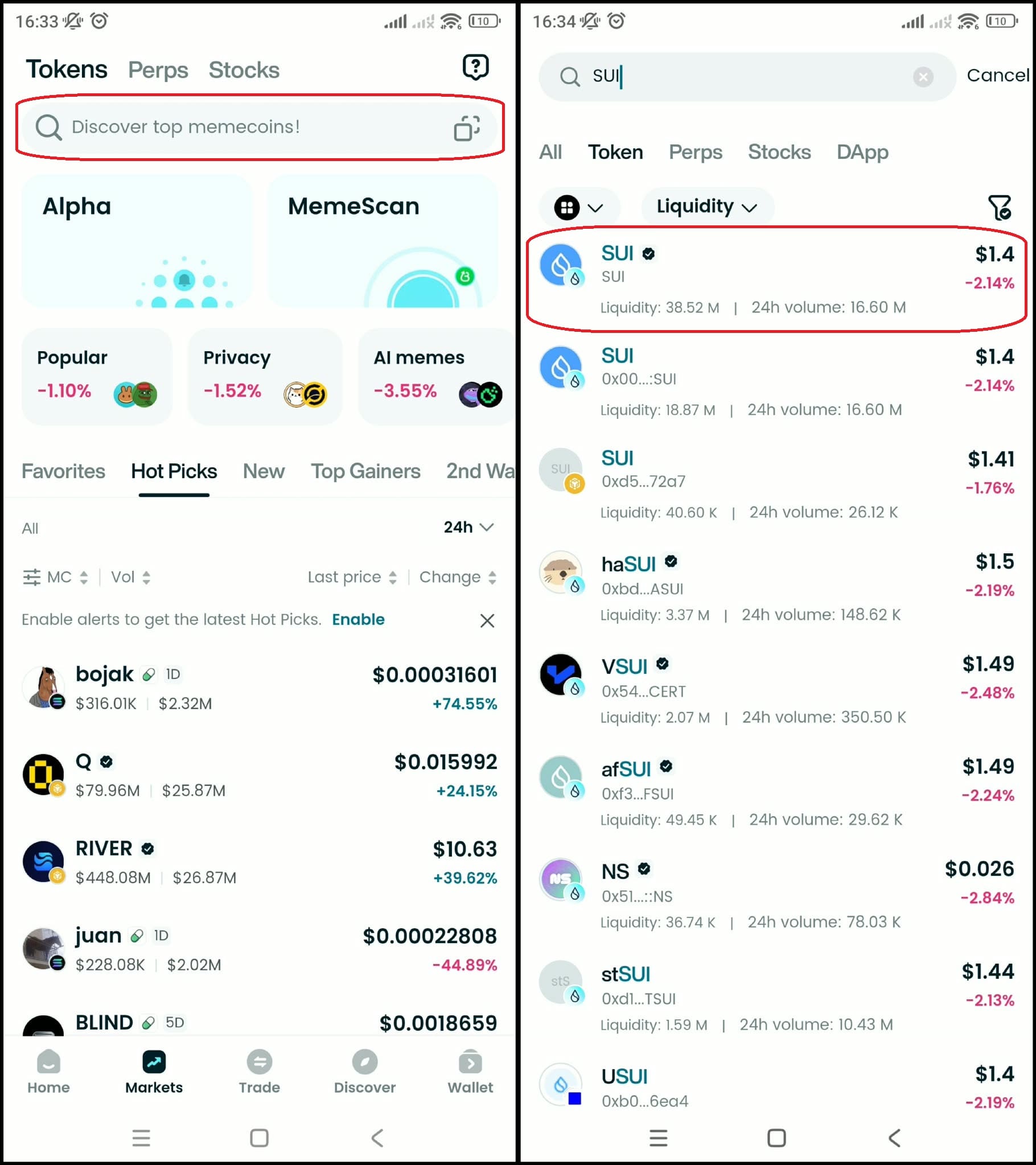

Step 3: Find Sui (SUI)

- In the main interface of the wallet, go to Market, type "SUI" in the search bar.

- Select Sui (SUI) to see the trading page.

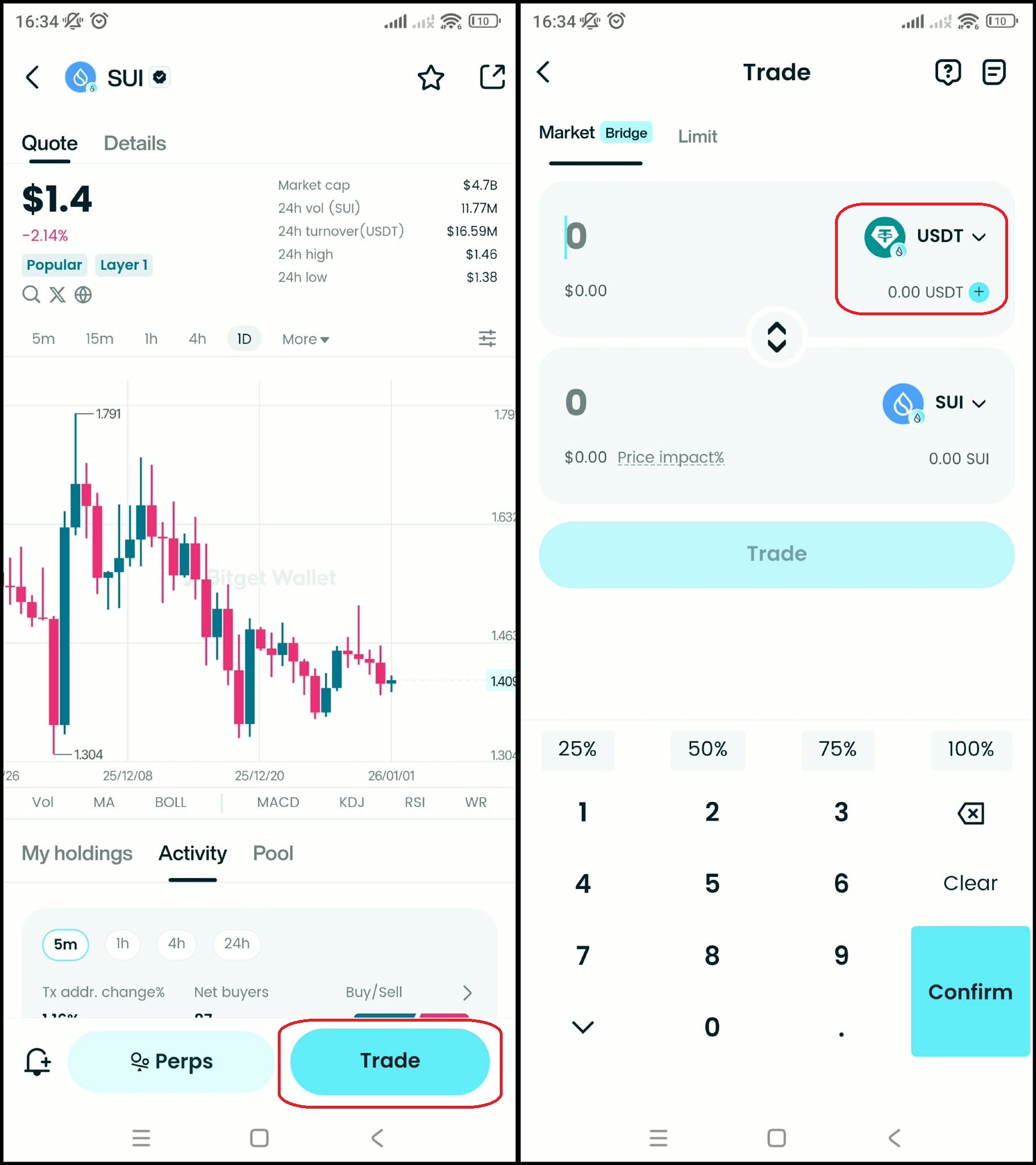

Step 4: Select the trading pair

Select the pair you want to trade, for example SUI/USDT. So you can use USDT to buy Sui (SUI), or vice versa.

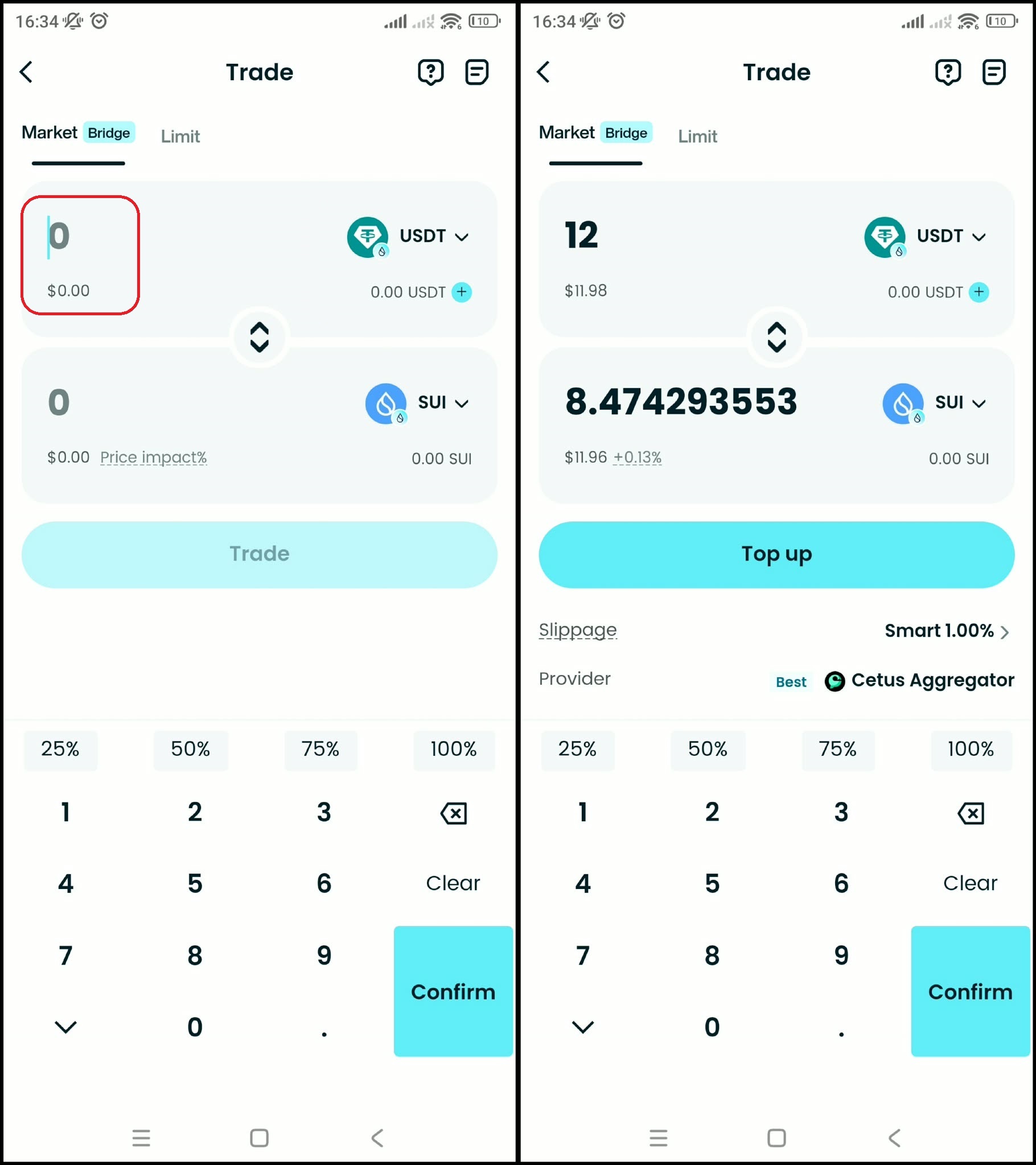

Step 5: Place an order

Enter the amount of Sui (SUI) you want to buy, check carefully and confirm the order.

Step 6: Check the order

After buying, you can check your SUI in the Wallet section.

Step 7: Withdraw (if needed)

Once you have Sui (SUI), if you want to withdraw to another wallet, go to Withdraw, fill in the receiving wallet address, check the blockchain network and the amount carefully, then confirm.

▶Learn more about Sui (SUI):

- What is Sui (SUI)?

- Sui (SUI) Airdrop Guide

- Sui (SUI) Listing Date and How to Buy It

- MetaMask vs Bitget Wallet: Which Is Better in 2025?

- Trust Wallet vs Bitget Wallet: Which One Is Better in 2025?

- Phantom vs Bitget Wallet: Which One Is Better?

Conclusion

SUI Token Unlock Schedule is a core part of Sui’s tokenomics—multi-bucket, cliff-based, and long-term. From the data reviewed, SUI has a 10B max supply, about 3.74B circulating, and ~35.04% already unlocked (3.50B SUI). This places the network beyond its most fragile early phase, while keeping unlock dynamics relevant across multiple years.

Near term, attention centers on the 44.25M SUI (~$63.7M) unlock—a potential volatility catalyst, not a guaranteed sell-off. The edge comes from evaluating unlock size vs liquidity, which buckets receive tokens, and post-unlock flows. To manage this process efficiently, many traders rely on Bitget Wallet as a self-custody hub: its Discover browser enables seamless access to token-unlock dashboards and on-chain analytics dApps, letting users move quickly from research to action without leaving their wallet environment.

👉 Download Bitget Wallet now to track SUI token unlock events, manage assets securely, and stay ready for volatility around key unlock dates.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. When is the next SUI token unlock?

The next SUI token unlock is expected to release 44.25M SUI, worth roughly $63.7M, aggregated across five allocation buckets.

2. How much SUI is unlocked vs locked right now?

Currently, about 35.04% of SUI (3.50B SUI) is unlocked, 13.79% (1.38B SUI) remains locked, while 51.17% is still untracked in the Sui vesting schedule.

3. Does a SUI token unlock always cause a price drop?

No. A SUI token unlock introduces new supply but doesn’t guarantee selling. Price impact depends on liquidity, market conditions, and how SUI holders use unlocked tokens.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- What Is the DeLorean ($DMC) Token: Listing Launch Timeline and Features2025-06-24 | 5 mins

- What is Haedal Protocol (HEADAL): the Future of Liquid Staking on Sui2025-05-02 | 5 mins