PUMP Token Unlock Schedule: Key Dates, Vesting Periods, and Price Impact

Pump.fun Token Unlock events have become a recurring point of attention for traders, analysts, and long-term observers of the Solana meme economy. As one of the most active meme token creation platforms, Pump.fun does not just shape meme narratives—it also introduces structured token supply dynamics that directly influence market behavior, liquidity, and sentiment around its native token, $PUMP.

Unlike short-lived meme coins with chaotic supply releases, Pump.fun follows a predefined token unlock and vesting schedule extending several years into the future. Events such as the ~$18M token unlock on January 14 are closely watched, not because they guarantee selling pressure, but because they signal new supply entering circulation under transparent rules.

In this article, we will break down the Pump.fun Token Unlock Schedule, explain how vesting works, analyze key dates, and explore how unlock events can affect price behavior—helping you interpret supply changes more intelligently.

Key Takeaways

- Pump.fun Token Unlock follows a transparent schedule through 2029, managing a fixed 1 trillion $PUMP supply instead of chaotic meme emissions.

- $PUMP unlocks don’t equal sell-offs: with 58.04% unlocked and 41.96% still locked, price impact depends on volume and sentiment.

- Key dates drive volatility, as events like the $18M unlock (Jan 14, 2025) shape trader behavior more than daily emissions.

What You Need to Know About the Pump.fun Token Unlock?

At its core, a token unlock refers to the release of previously locked tokens into circulation according to a predefined schedule. These tokens are typically allocated to specific groups—such as team members, early investors, or ecosystem funds—and are restricted from trading until certain time-based conditions are met.

For Pump.fun, token unlocks play a crucial role in balancing platform growth, incentive alignment, and market stability. Rather than releasing all tokens upfront, the project opted for a multi-year vesting framework designed to gradually introduce supply while maintaining predictable issuance.

Source: pump.fun

Core facts about Pump.fun’s token structure

- Native token: $PUMP

- Blockchain: Solana (with expansion to Blast)

- Total supply: 1,000,000,000,000 $PUMP (1 trillion)

- Vesting duration: Extends approximately through 2029

- Key insight: Not all token unlocks represent immediate sell pressure

This structure reflects a deliberate design choice. Pump.fun operates in a highly speculative segment of crypto, yet its tokenomics attempt to reduce abrupt supply shocks—an approach more commonly associated with infrastructure projects than meme platforms.

How Do Token Unlocks and Vesting Work in Pump.fun (PUMP)?

Pump.fun’s token unlock mechanism is governed by time-based vesting smart contracts, meaning tokens are released according to fixed calendar schedules rather than discretionary decisions. These contracts are deployed on-chain, allowing anyone to verify upcoming unlock events and track historical releases.

The vesting system primarily applies to the following groups:

- Team allocation: Tokens reserved for builders and core contributors

- Existing investors: Early backers who supported the project prior to full public circulation

- Community & ecosystem initiatives: Tokens dedicated to growth, incentives, and ecosystem development

Most of these allocations follow a similar pattern: an initial cliff period during which no tokens are released, followed by gradual linear unlocks over multiple years.

When Are the Key Pump.fun Token Unlock Dates?

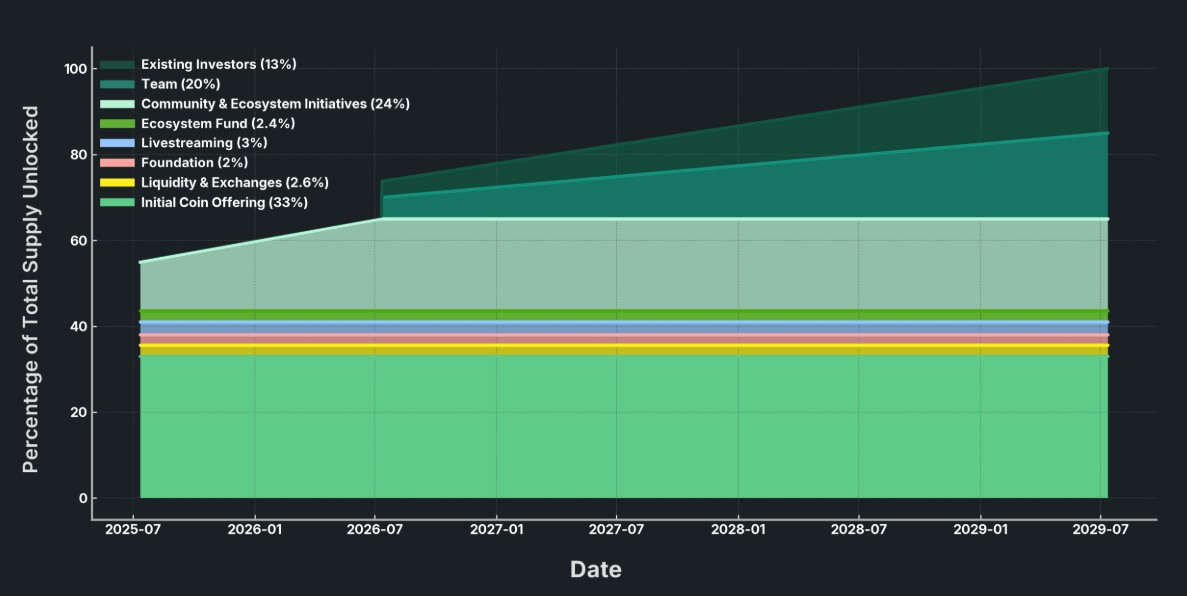

Pump.fun’s token unlock schedule is structured around a multi-year vesting framework running from the Token Generation Event (TGE) through July 2029. Instead of releasing supply abruptly, $PUMP follows a segmented allocation-based model, where each category unlocks at different speeds depending on its role in the ecosystem.

As of the latest vesting snapshot:

- 58.04% of total supply is already unlocked, equivalent to 580.41 billion $PUMP

- 41.96% remains locked, or 419.59 billion $PUMP

- The remaining vesting period spans roughly 1,289 days, reinforcing a long-tail supply release rather than short-term dilution

This design shifts market attention away from day-to-day emissions and toward specific milestone dates where unlocked value becomes meaningful relative to liquidity and trading volume.

Understanding the Unlock Timeline Structure

Pump.fun’s unlocks are not uniform. They fall into three distinct phases:

- Immediate unlocks at TGE

- Ongoing linear vesting (monthly emissions)

- Delayed cliff-based vesting for insiders

At TGE, several allocations were fully unlocked immediately, meaning their supply impact has already been absorbed by the market:

- Initial Coin Offering (ICO): 330B $PUMP (100%)

- Foundation: 20B $PUMP (100%)

- Ecosystem Fund: 24B $PUMP (100%)

- Liquidity & Exchanges: 26B $PUMP (100%)

- Livestreaming incentives: 30B $PUMP (100%)

Because these categories were unlocked from day one, they do not represent future supply risk and should be treated as part of the baseline circulating supply.

Key Unlock Highlights Traders Monitor

While unlocks occur continuously, market participants tend to focus on economically relevant checkpoints rather than every vesting tick.

Source: pump.fun

1. January 14, 2025 — ~$18M Estimated Unlock

- Represents a scheduled vesting tranche, primarily tied to non-ICO allocations

- The ~$18M figure reflects market-value at the time, not guaranteed sell volume

- Historically viewed as a medium-impact unlock, large enough to influence short-term sentiment but not structurally destabilizing

This date gained attention because the unlocked value was large relative to average daily volume, making it visible on crypto calendars and analytics platforms.

2. Community & Ecosystem Vesting (2025–2029)

The Community & Ecosystem allocation (240B $PUMP) follows a 48-month linear vesting schedule:

- ~58.33% already unlocked (~150.41B $PUMP)

- Remaining tokens release gradually through mid-to-late 2029

- Monthly emissions are relatively smooth, reducing abrupt supply shocks

This category contributes to ongoing, predictable inflation, rather than event-driven volatility.

3. Mid-2026 — High-Attention Phase (Team & Investors)

The most closely watched future period begins in mid-2026, when two major allocations enter active vesting after their cliff periods:

- Team allocation: 200B $PUMP

- Existing investors: 130B $PUMP

Key characteristics:

- 0% unlocked at TGE

- Subject to a cliff, followed by 36-month linear vesting

- Marks the first time insider-held supply begins entering circulation

Because these allocations are associated with insiders, this phase typically attracts heightened market scrutiny, even though the unlocks remain gradual rather than lump-sum.

Why Is the $18M Pump.fun Token Unlock Important?

The frequently cited $18 million unlock does not represent a fixed dollar amount being sold on the market. Instead, it reflects the estimated market value of tokens scheduled to unlock at prevailing prices around that date.

Several key points are often misunderstood:

- An unlock increases circulating supply, not guaranteed sell volume

- Token holders may choose to hold, stake, or deploy tokens rather than sell

- Market behavior often reacts before unlocks through positioning and hedging

In practice, traders tend to monitor volume trends, funding rates, and liquidity depth both before and after unlock events. The unlock itself acts more as a sentiment catalyst than a mechanical price trigger.

How the Pump.fun Token Unlock Affects Price & Market Behavior

Token unlocks impact price through market behavior, not supply alone. For Pump.fun (PUMP), unlocks are part of a transparent, long-term vesting schedule, allowing traders to anticipate events well in advance.

When tokens unlock, circulating supply increases, but price reaction depends on three key factors:

- Unlock size vs. daily trading volume

- Who receives the tokens (team, investors, ecosystem)

- Overall Pump.fun activity and meme momentum

Smaller, recurring unlocks are often absorbed by market liquidity with limited impact. Larger team or investor unlocks attract attention mainly because traders price in potential selling risk, not because selling is guaranteed.

Markets typically react through:

- Pre-unlock positioning

- Short-term volatility around the event

- Post-unlock stabilization if sell pressure is limited

Unlocks act as volatility catalysts, not automatic bearish triggers.

Does Pump.fun Have Any Mechanism to Reduce Sell Pressure?

Pump.fun does not use artificial price-support mechanisms:

- No buyback-and-burn programs

- No yield or reward emissions

- No hidden supply sinks

Instead, $PUMP’s price is driven by meme activity, user engagement, and Solana ecosystem sentiment, making unlock impact highly context-dependent rather than mechanical.

How Pump.fun’s Token Unlock Compares With Other Meme Platforms

Compared to typical meme tokens, Pump.fun adopts a structurally different approach to token unlocks. Instead of releasing most supply at launch, Pump.fun implements a multi-year vesting schedule through ~2029, which reshapes how markets perceive supply risk.

Key differences at a glance:

| Aspect | Pump.fun (PUMP) | Typical Meme Token |

| Vesting duration | Multi-year | Minimal or none |

| Unlock predictability | High | Low |

| Insider concentration | Gradual | Front-loaded |

| Supply shocks | Reduced | Common |

This structure helps reduce sudden post-launch collapses that frequently affect meme tokens with near-total early unlocks.

More importantly, Pump.fun functions as meme infrastructure, not just a speculative asset. It enables thousands of meme tokens, scales with platform activity, and monetizes attention rather than hype—making token unlocks part of a broader ecosystem narrative rather than isolated “dump events.”

What Can Traders Learn From Pump.fun (PUMP)’s Tokenomics?

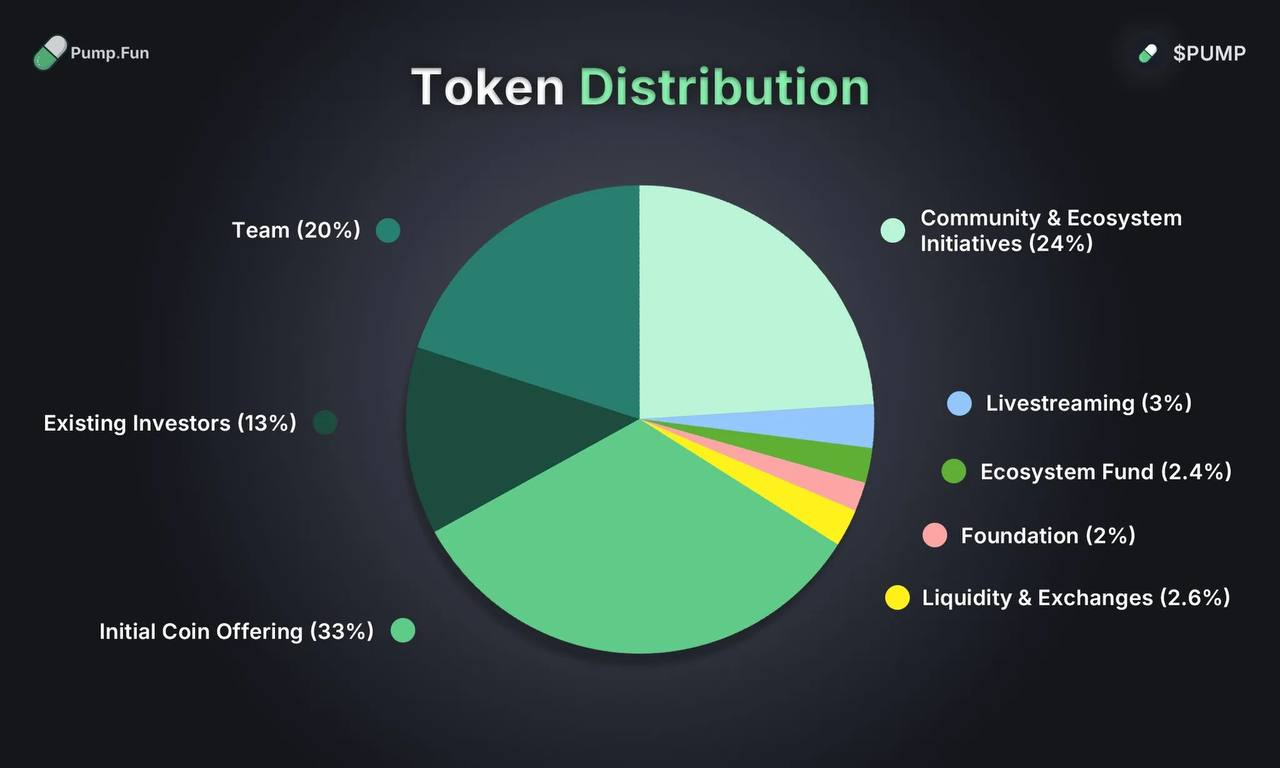

With a fixed total supply of 1 trillion $PUMP, Pump.fun’s tokenomics are designed around clear allocation and long-term visibility rather than short-term hype.

From a tokenomics perspective, $PUMP is allocated as follows:

- 33% Initial Coin Offering (fully unlocked at TGE)

- 24% Community & Ecosystem Incentives (partially vested)

- 20% Team (cliff + linear vesting)

- 13% Existing Investors (cliff + linear vesting)

- Remaining 10.4% split across liquidity, livestreaming, ecosystem fund, and foundation

Source: pump.fun

For traders and analysts, several practical lessons stand out:

- Unlock schedules are fixed, public, and predictable, reducing uncertainty around supply changes

- No single unlock event dominates total supply, as allocations are spread across multiple categories and timelines

- Price behavior is driven more by platform usage and market sentiment than by emissions alone

How to Track Pump.fun Token Unlocks Easily?

As Pump.fun’s token unlock schedule stretches over multiple years, the ability to track unlock events consistently becomes a practical advantage rather than a convenience. Traders who understand when supply enters circulation are better positioned to manage risk, plan entries, and interpret volatility more objectively.

Unlike unpredictable meme token emissions, Pump.fun’s unlocks are fully scheduled and transparent, which makes them ideal for structured tracking using a combination of tools.

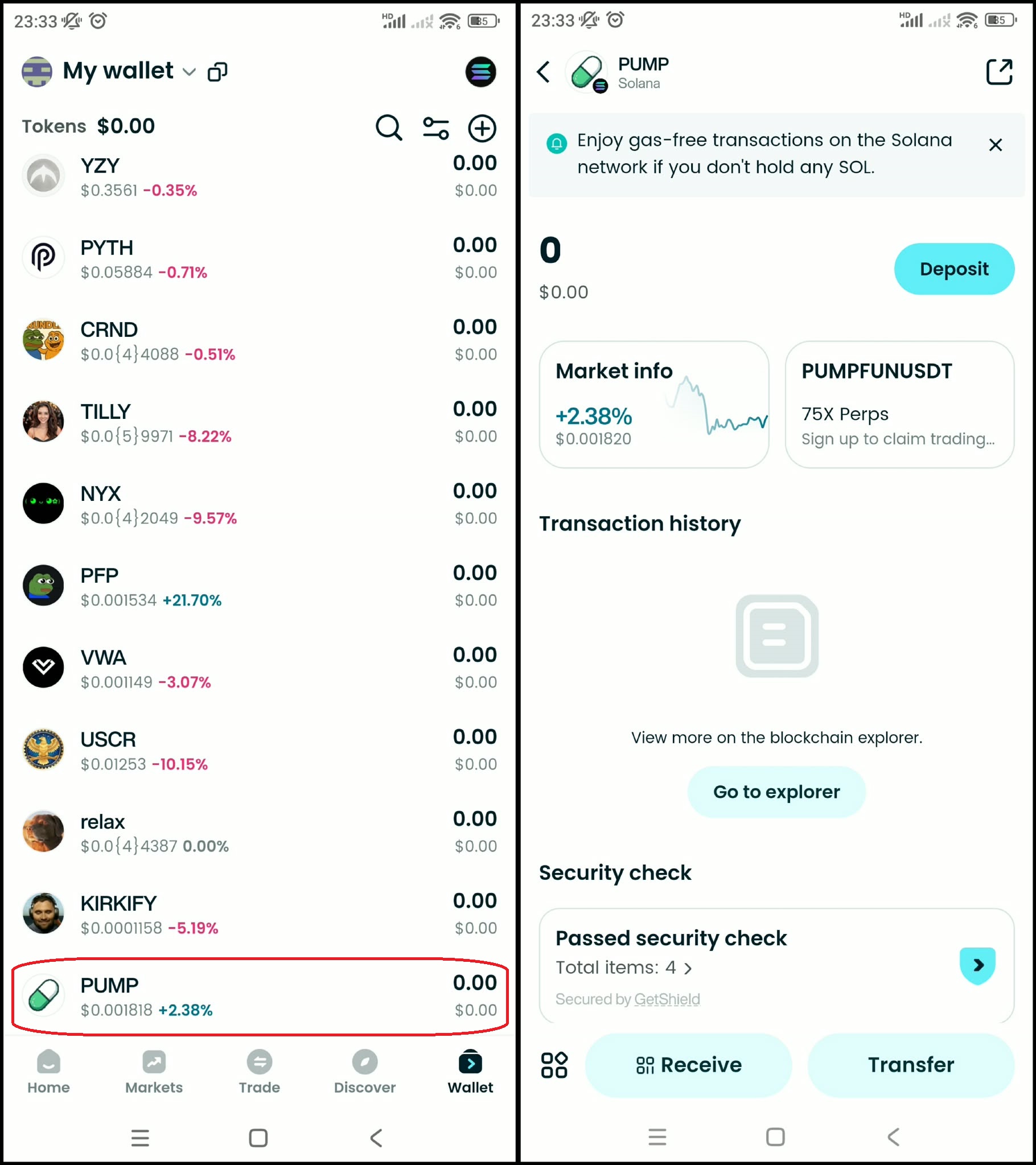

Common tools used to monitor $PUMP unlocks

-

Crypto calendars

Track upcoming unlock dates and estimated unlocked value in USD terms.

-

On-chain explorers

Verify vesting contracts, token movements, and actual unlock transactions on Solana.

-

Wallet-based tracking

Monitor price action, volume shifts, and personal exposure around unlock periods.

Each tool serves a different role. Calendars answer when, explorers confirm what actually moved, and wallets help users act on that information in real time.

Can You Get Unlock Alerts for Pump.fun (PUMP)?

Yes—but not through a single “magic button.” In practice, experienced traders rely on a layered monitoring approach, combining unlock calendars with real-time wallet tracking.

- Bookmarking major Pump.fun token unlock dates well in advance

- Setting price alerts around expected unlock windows

- Monitoring volume, liquidity, and funding behavior before and after unlocks

- Using a wallet interface like Bitget Wallet to continuously track $PUMP balances, price movements, and on-chain exposure

Token unlocks don’t automatically trigger sell-offs—but they change the supply context. A non-custodial wallet such as Bitget Wallet allows users to observe market reactions in real time, manage exposure across Solana assets, and respond calmly rather than reacting emotionally to short-term volatility.

By combining scheduled awareness with live wallet data, traders gain a clearer, more disciplined framework for navigating Pump.fun unlock events.

How to Store and Trade Pump.fun (PUMP) Safely Using Bitget Wallet?

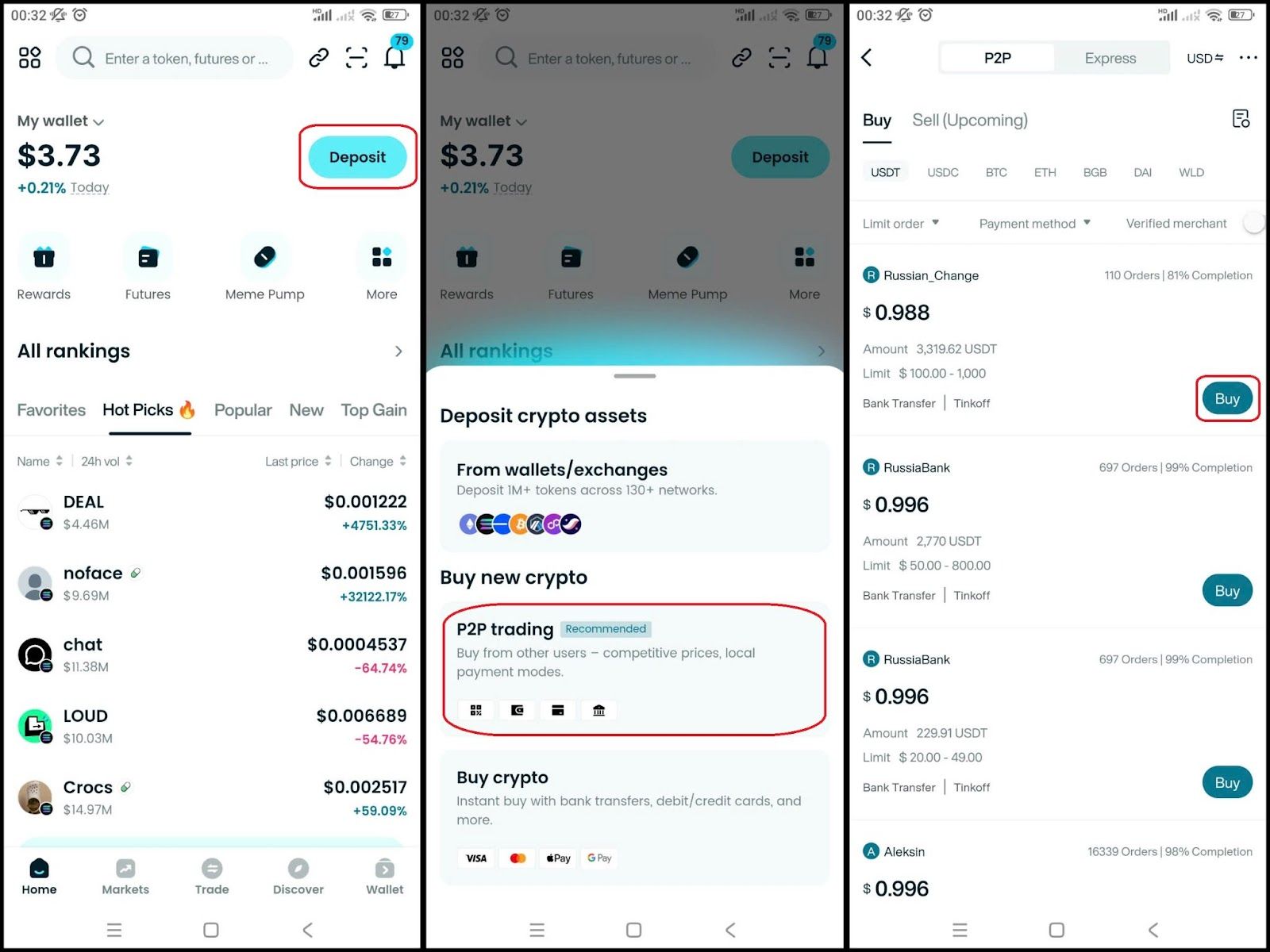

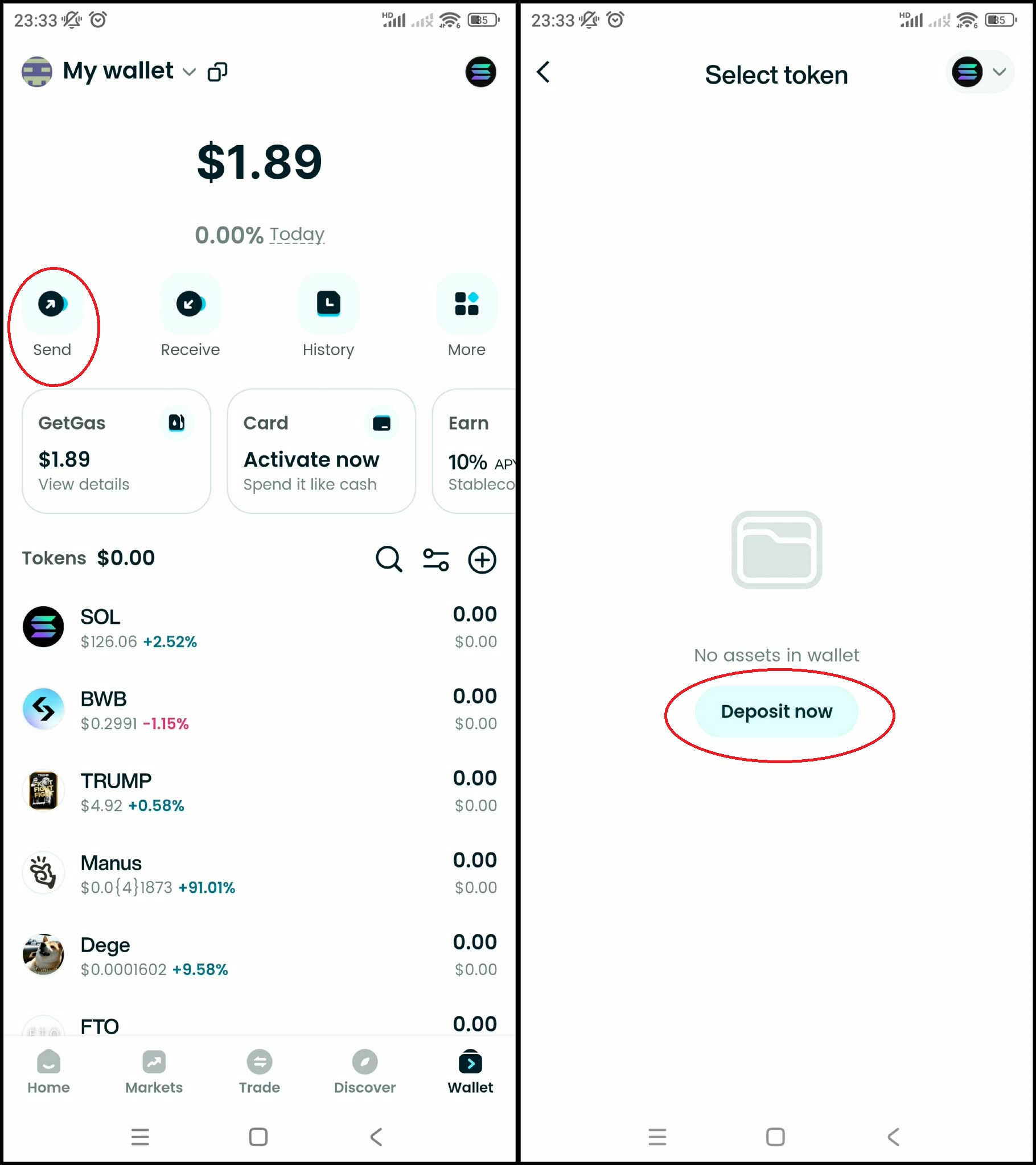

Buying Pump.fun (PUMP) on Bitget Wallet is easy! Just follow these simple steps:

Step 1: Create a wallet

- If you don't have a wallet, download Bitget Wallet app now.

- Register with your phone number or email, verify quickly and you can use it right away.

Step 2: Deposit money into your wallet

Once you have finished your wallet, you just need to deposit money into it. You can:

- Transfer coins from other wallets: Send BTC, ETH or any coin you have from an external wallet.

- Buy directly with a card: Use a bank card or credit card to buy USDT or ETH right in the app and then exchange it for USDC.

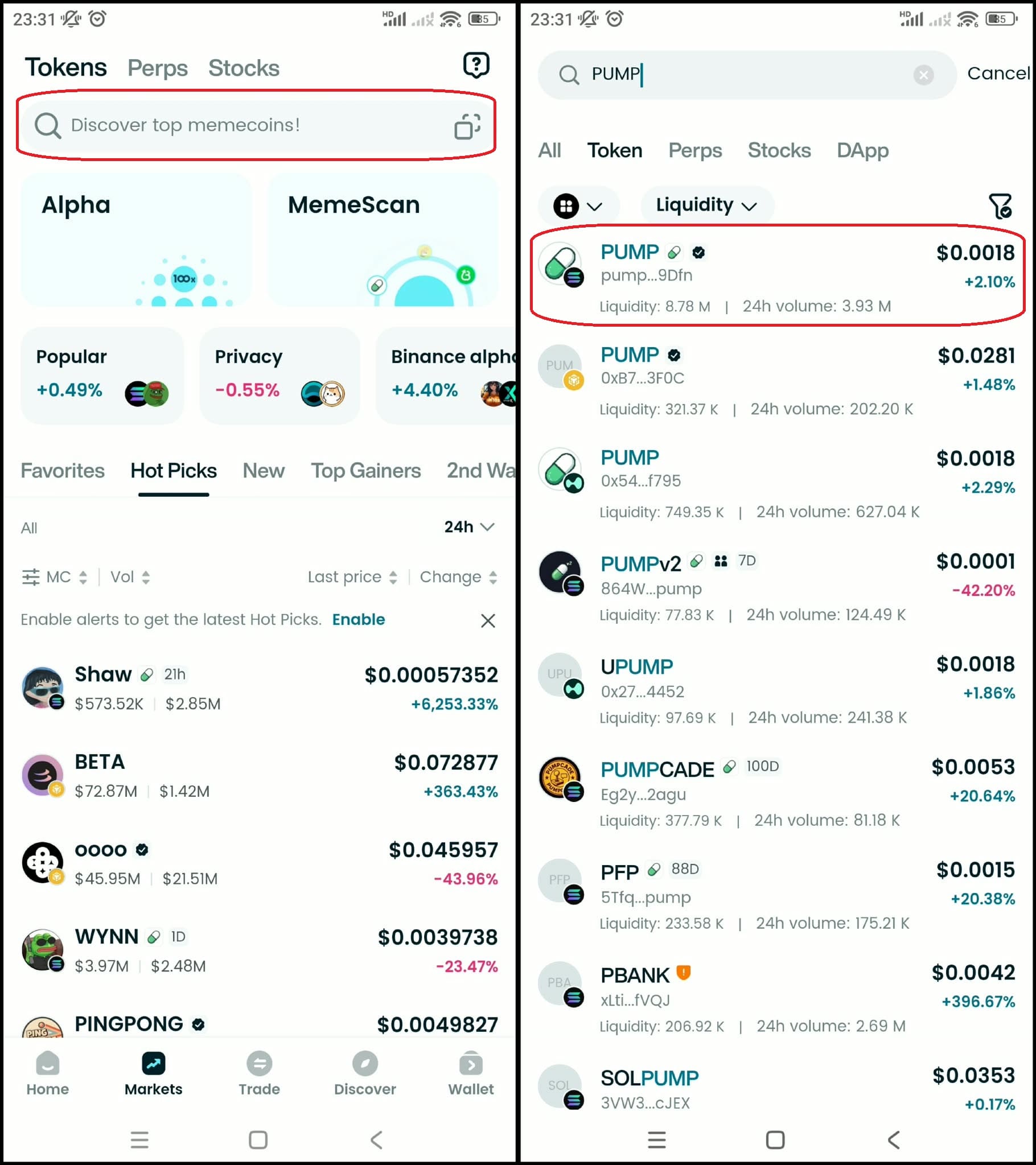

Step 3: Find Pump.fun (PUMP)

- In the main interface of the wallet, go to Market, type "PUMP" in the search bar.

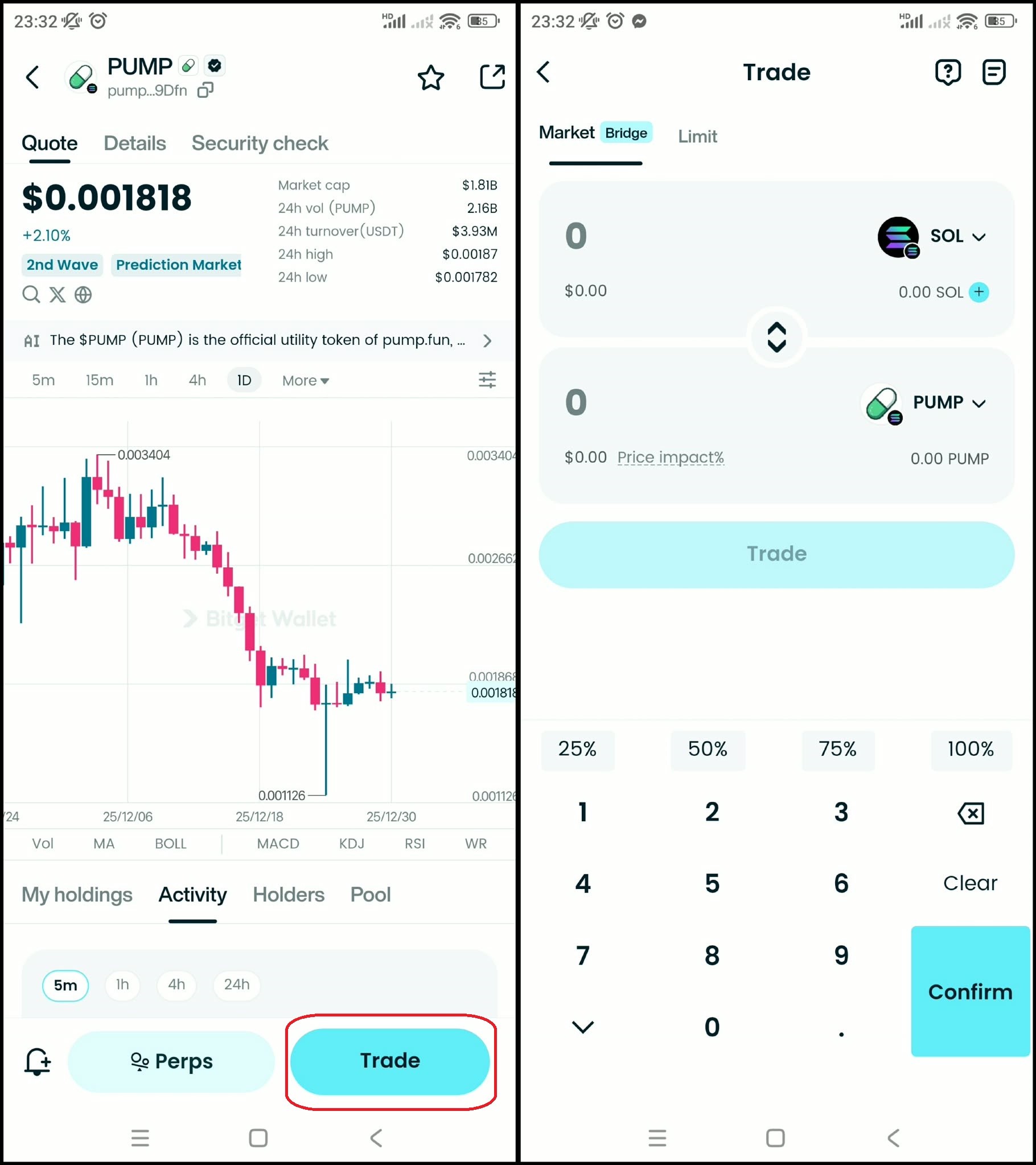

- Select Pump.fun (PUMP) to see the trading page.

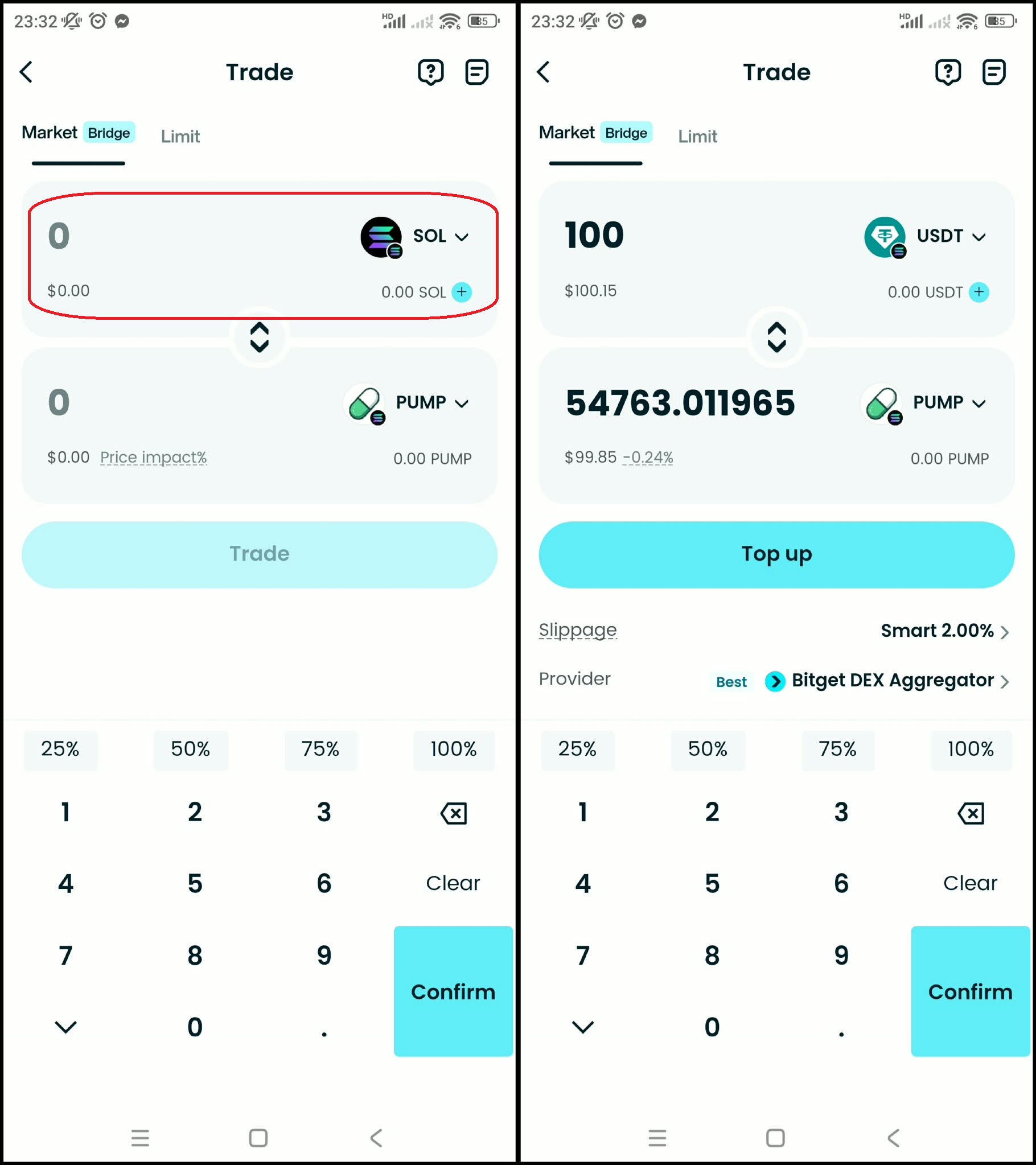

Step 4: Select the trading pair

Select the pair you want to trade, for example PUMP/USDT. So you can use USDT to buy Pump.fun (PUMP), or vice versa.

Step 5: Place an order

Enter the amount of Pump.fun (PUMP) you want to buy, check carefully and confirm the order.

Step 6: Check the order

After buying, you can check your PUMP in the Wallet section.

Step 7: Withdraw (if needed)

Once you have Pump.fun (PUMP), if you want to withdraw to another wallet, go to Withdraw, fill in the receiving wallet address, check the blockchain network and the amount carefully, then confirm.

▶Learn more about Pump.fun (PUMP):

- What is Pump.fun (PUMP)?

- Pump.fun (PUMP) Airdrop Guide

- Pump.fun (PUMP) Listing Date and How to Buy It

- MetaMask vs Bitget Wallet: Which Is Better in 2025?

- Trust Wallet vs Bitget Wallet: Which One Is Better in 2025?

- Phantom vs Bitget Wallet: Which One Is Better?

Conclusion

Pump.fun’s token unlock schedule is not an afterthought—it is a core structural feature of the project’s tokenomics. With unlocks spanning from TGE through approximately 2029, the design emphasizes predictability, transparency, and gradual supply expansion rather than sudden dilution.

By understanding when tokens unlock, which allocations are affected, and how the market typically reacts, traders can reduce uncertainty and avoid emotionally driven decisions. In ecosystems dominated by speculation, structured unlock schedules act as an anchor for rational analysis.

Whether you are actively trading $PUMP or simply monitoring the Solana meme economy, combining unlock awareness with secure wallet management—such as through Bitget Wallet—helps turn token unlocks from a source of fear into a measurable, manageable variable.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. When is the next Pump.fun token unlock?

Pump.fun token unlocks occur on a scheduled basis through 2029. Smaller vesting releases happen regularly, while larger milestones—such as mid-2026 team and investor unlocks—draw the most attention.

2. How much Pump.fun (PUMP) is still locked?

Based on current vesting data, roughly 42% of the total $PUMP supply remains locked, with the remainder already unlocked or gradually vesting over time.

3. Does a token unlock always cause a price drop?

No. Token unlocks increase circulating supply, but price impact depends on demand, market sentiment, and trading activity. Many unlocks pass with minimal long-term effect.

4. Where can I track Pump.fun (PUMP) unlock updates?

You can track updates through crypto calendars, on-chain explorers, and wallet-based tools such as Bitget Wallet that allow real-time monitoring of price and holdings.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.