How to Apply for the Bitget Wallet Card: Step-by-Step Guide for New Users

How to Apply for the Bitget Wallet Card is a key question for users who want to spend crypto in real life and need clear guidance on the application process, eligibility requirements, supported regions, and approval flow. The Bitget Wallet Card is available across Asia, China, Europe (EEA), and LATAM, with different card issuers and verification rules depending on where you apply.

In this article, we’ll explain how to apply for the Bitget Wallet Card step by step, starting directly inside the Bitget Wallet app. You’ll learn how regional eligibility is determined, which card types are available in different markets, and what verification is required for approval.

What Is the Bitget Wallet Card?

The Bitget Wallet Card allows users to use their crypto assets for everyday payments without manually converting funds in advance. By linking directly to Bitget Wallet, the card performs real-time crypto-to-fiat conversion during each transaction, enabling seamless payments at millions of Visa and Mastercard merchants globally.

- A crypto payment card directly linked to Bitget Wallet

- Automatically converts crypto to fiat at the point of sale

- Accepted by Visa and Mastercard merchants worldwide

How is the Bitget Wallet Card different from traditional bank cards?

Traditional bank cards spend fiat held by financial institutions, while the Bitget Wallet Card is funded by crypto assets stored in your Bitget Wallet. Users retain non-custodial control over their funds, and spending occurs through automatic conversion at checkout. Instead of charging fixed annual fees, the Bitget Wallet Card uses a 0-fee allowance structure, offering fee rebates within defined limits to reduce everyday spending costs.

- Crypto-backed spending instead of a bank balance

- Non-custodial wallet funding

- No annual fee with a 0-fee allowance model

Who Can Apply for the Bitget Wallet Card?

Before starting the Bitget Wallet Card application, users should understand that eligibility is not universal. While the basic requirements are consistent, approval logic and supported features vary by region and issuer.

What are the eligibility requirements for applying?

To apply for the Bitget Wallet Card, users must meet the minimum age requirement and successfully complete identity verification inside Bitget Wallet. This verification confirms personal identity and ensures regulatory compliance. Depending on the user’s region, the application is reviewed by different issuing partners—DCS for Asia, Fiat24 for Mainland China, and Immersve for Europe and LATAM—each with slightly different approval and compliance standards.

- Must be 18 years old or above

- Completed identity verification via Bitget Wallet

- Eligibility handled by regional issuers (DCS, Fiat24, Immersve)

Which countries and regions support Bitget Wallet Card applications?

The Bitget Wallet Card is available in selected countries and regions, depending on local regulations and card issuer coverage. Eligibility is checked in real time to ensure users see only options that apply to their location.

| Asia | Supported Asian markets through the DCS-issued card |

| Mainland China: | Virtual card supported via Fiat24 |

| Europe (EEA) & LATAM | Immersve-issued card |

Before applying, always review your in-app eligibility status, as supported regions may change without notice.

The Bitget Wallet Card supported countries list is determined dynamically within the Bitget Wallet app. Users should rely on the in-app eligibility display rather than external lists, as availability depends on regulatory requirements and issuer coverage. Bitget Wallet does not recommend applying from unsupported regions, as applications outside eligible areas may be declined during verification.

Read more:

What to Do If My Crypto Card Application Gets Declined?

What Do You Need Before Applying for the Bitget Wallet Card?

Before you apply for the Bitget Wallet Card, it’s important to prepare the required documents and complete account verification in advance. Having everything ready helps reduce review time and improves the success rate of your Bitget Wallet Card application.

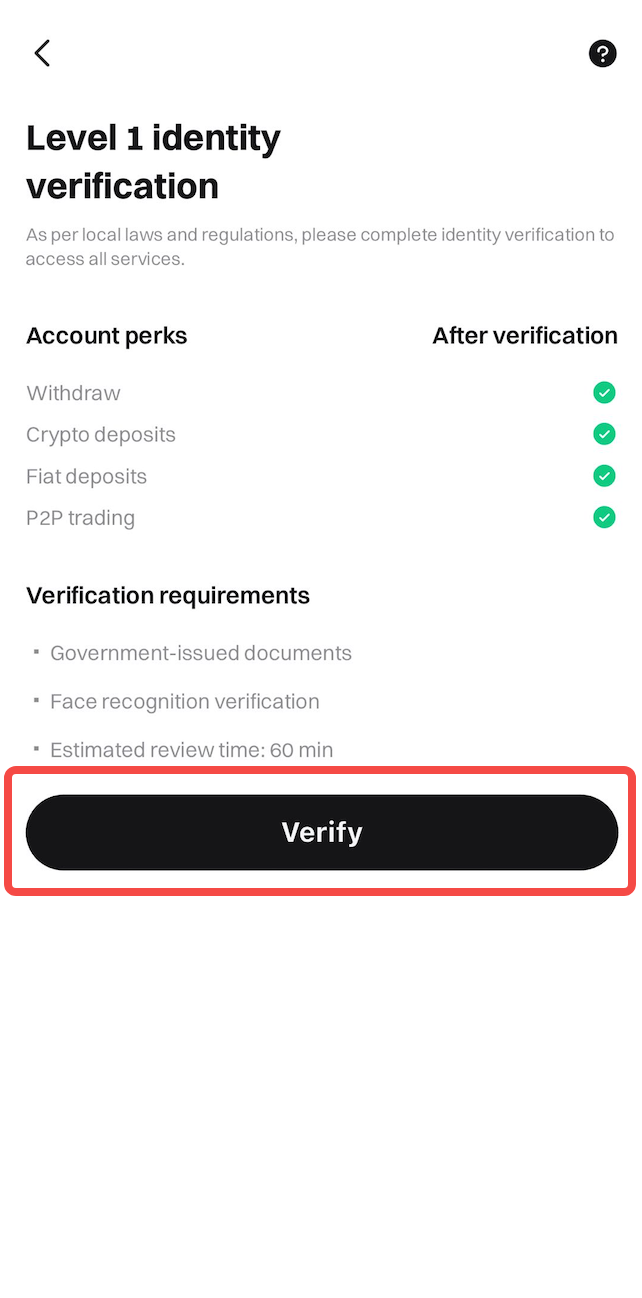

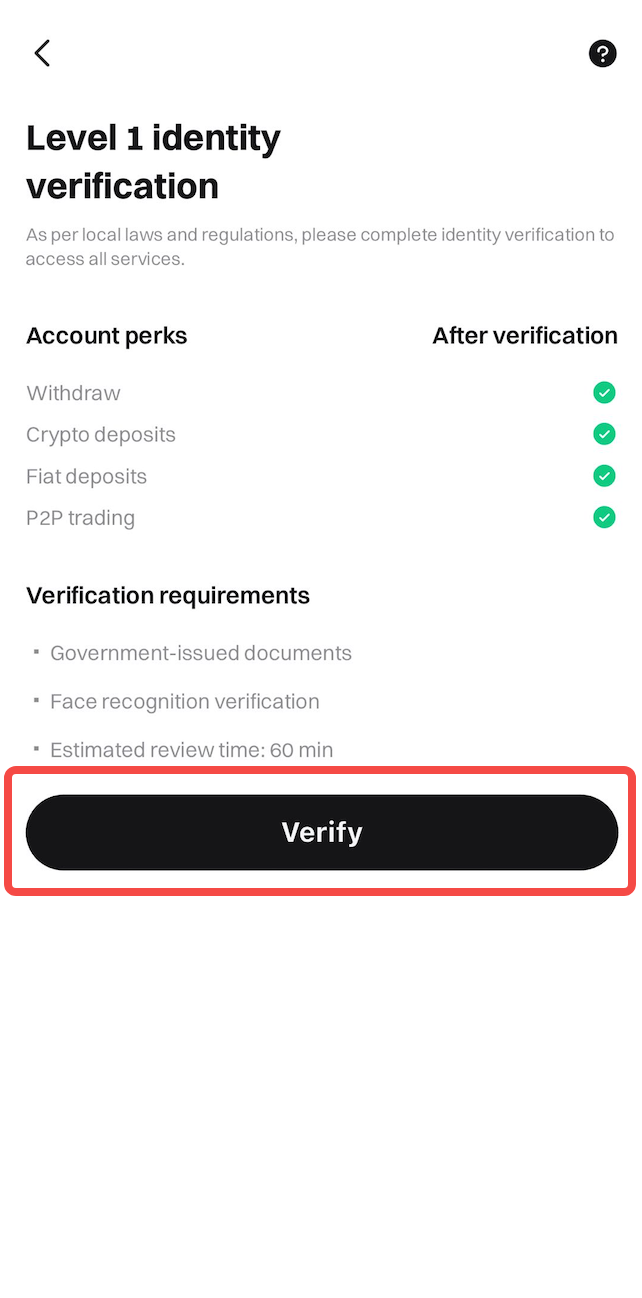

What documents are required for Bitget Wallet Card KYC?

All Bitget Wallet Card applications require identity verification through Bitget Wallet. Users must submit a valid passport or national ID and complete in-app identity checks. Depending on the region and issuing partner, address verification may also be required. Applications submitted without completed wallet verification or with mismatched information may be delayed or rejected.

- Valid government-issued ID or passport

- Address information (required in some regions)

- Verified Bitget Wallet account status

Which cryptocurrencies can be used to top up the Bitget Wallet Card?

The Bitget Wallet Card is designed to use stablecoins for everyday spending to reduce price volatility. Most users will top up their card using USDT or USDC, but supported assets and networks differ depending on the card type and region. Users should always follow the in-app instructions shown during the Bitget Wallet Card application and top-up process to ensure compatibility.

- USDT

- USDC

- Supported networks vary by region and card issuer

How to Apply for the Bitget Wallet Card?

How to apply for the Bitget Wallet Card is not a one-size-fits-all process. Bitget Wallet supports multiple card issuers, and each issuer follows its own compliance rules, verification steps, and card issuance logic. As a result, users must choose the correct Bitget Wallet Card based on their region to ensure a smooth application and approval experience.

How do you apply for the Bitget Wallet Card inside Bitget Wallet?

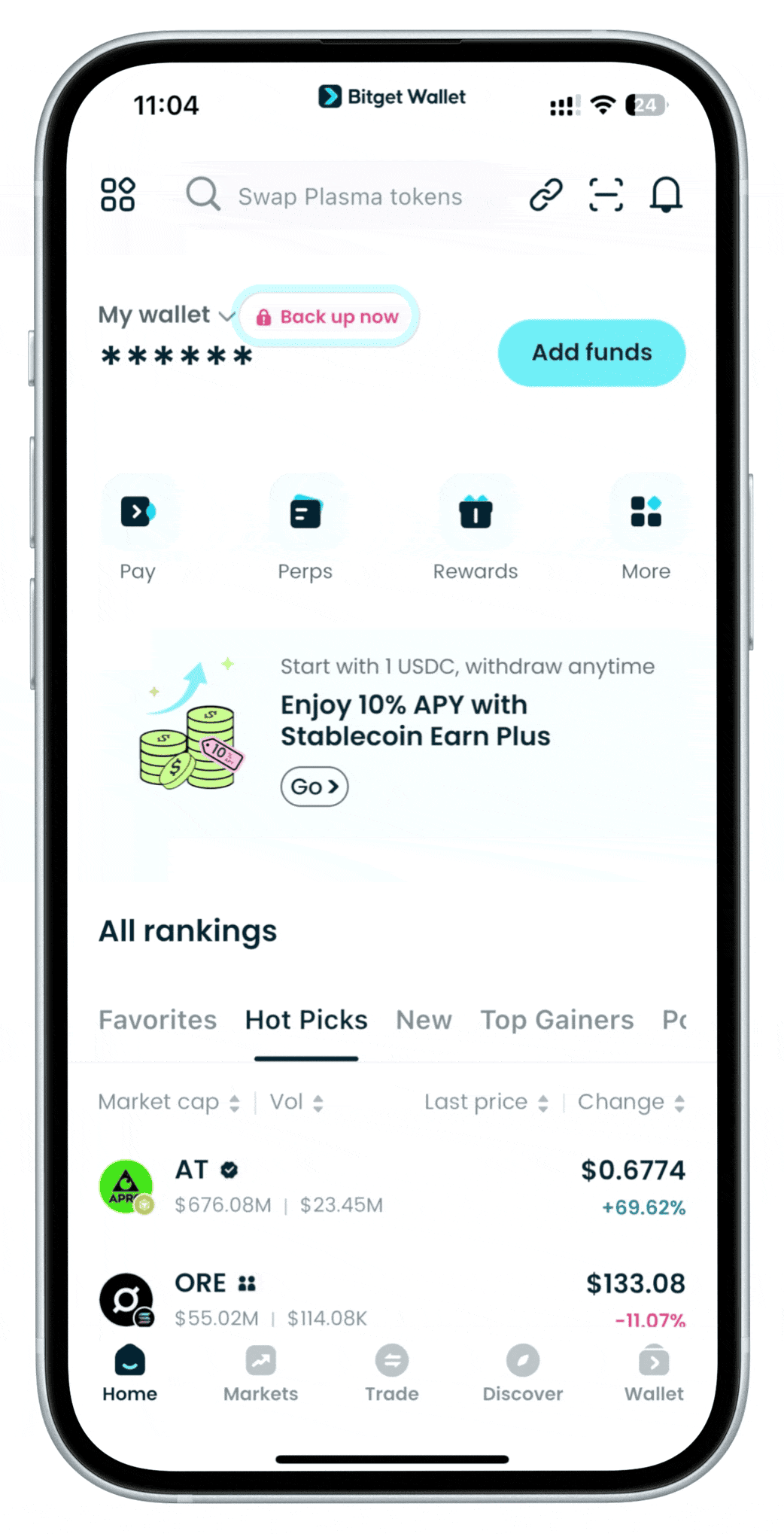

Step 1: Open your Bitget Wallet app and make sure it’s updated to the latest version.

- Step 2: Go to the Wallet tab at the bottom of the screen, then tap Card or Apply Now.

Step 3: The system automatically displays eligible Bitget Wallet Card options based on your region

- Select the appropriate card type (Asia / China / Immersve)

- Submit the application and proceed with identity verification

The Bitget Wallet Card application starts directly inside Bitget Wallet. Instead of following a single universal flow, the app automatically determines which card options you are eligible for based on your location and compliance status. Users then select the appropriate regional card and continue with the verification process specific to that issuer, ensuring regulatory compliance and faster approval.

How does the Bitget Wallet Card (Asia) application process work?

The Bitget Wallet Card (Asia) is designed for users who need higher spending limits and greater flexibility when using crypto for everyday payments. Issued by DCS Card Centre, this card allows eligible users to receive a virtual card immediately after completing Bitget Wallet KYC, enabling instant spending without waiting.

With Visa/Mastercard payment infrastructure, the Asia-issued Bitget Wallet Card supports higher transaction and monthly limits than many other crypto cards. In supported regions, users can also request a physical card, making it suitable for both online and offline payments.

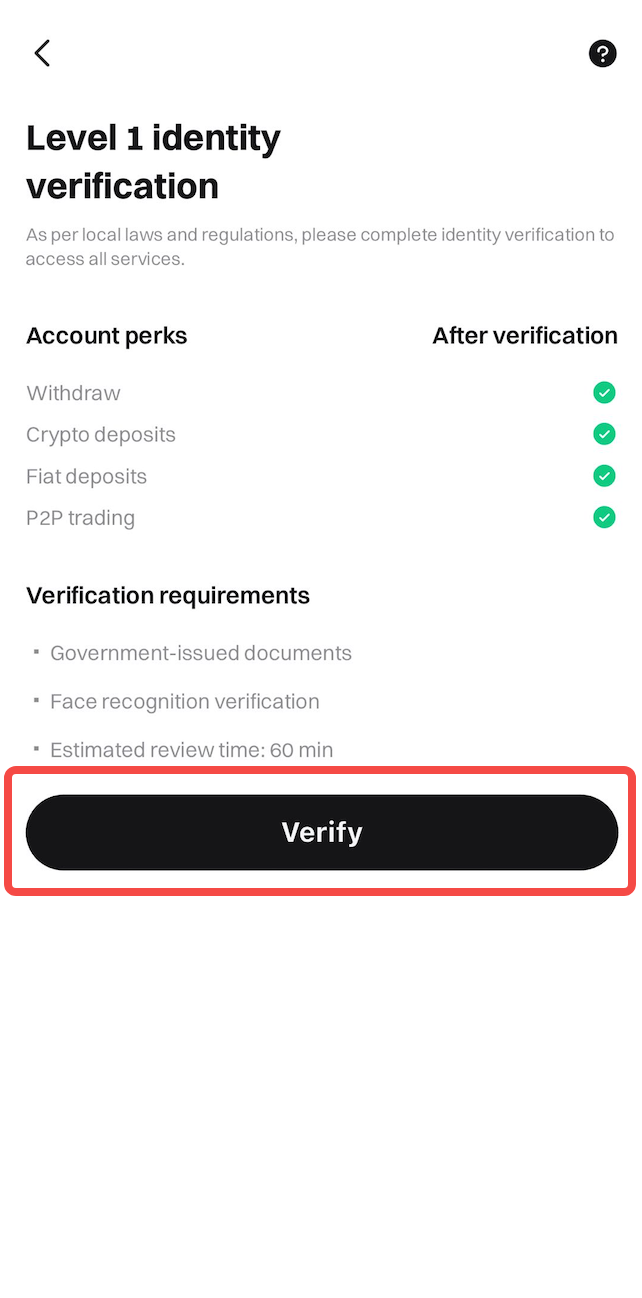

STEP 1: Complete Bitget Wallet KYC

Open the Bitget Wallet app, go to Wallet → Card, and complete identity verification (KYC). Once your KYC is approved, you become eligible to apply for the Bitget Wallet Card (Asia).

STEP 2: Submit the Card Application

In the Card section, select Asia (DCS), provide the required details, and submit your application. Once approved, a virtual Bitget Wallet Card is issued instantly. Where supported, you can later request a physical card through the app.

Read more: What is KYC in Crypto: Full Guide to Compliance, Benefits, and Challenges

How does the Bitget Wallet Card (China) application process work?

The Bitget Wallet Card (China) is powered by Fiat24 and is optimized for digital-first crypto payments. This card is virtual-only, allowing users to start spending immediately after approval without waiting for card delivery.

To activate the card, users top up USDC, which is automatically converted to fiat at the time of payment. This real-time crypto-to-fiat conversion removes the need for manual swaps and simplifies everyday spending.

STEP 1: Apply for the Card & Complete KYC

Open the Bitget Wallet app, navigate to Wallet → Card → Apply, and complete identity verification within the app to apply for the China virtual card.

STEP 2: Top Up with USDC to Activate

After approval, the virtual card appears in your wallet. To activate it for spending, top up USDC. Your USDC balance will be automatically converted to fiat whenever you make a payment.

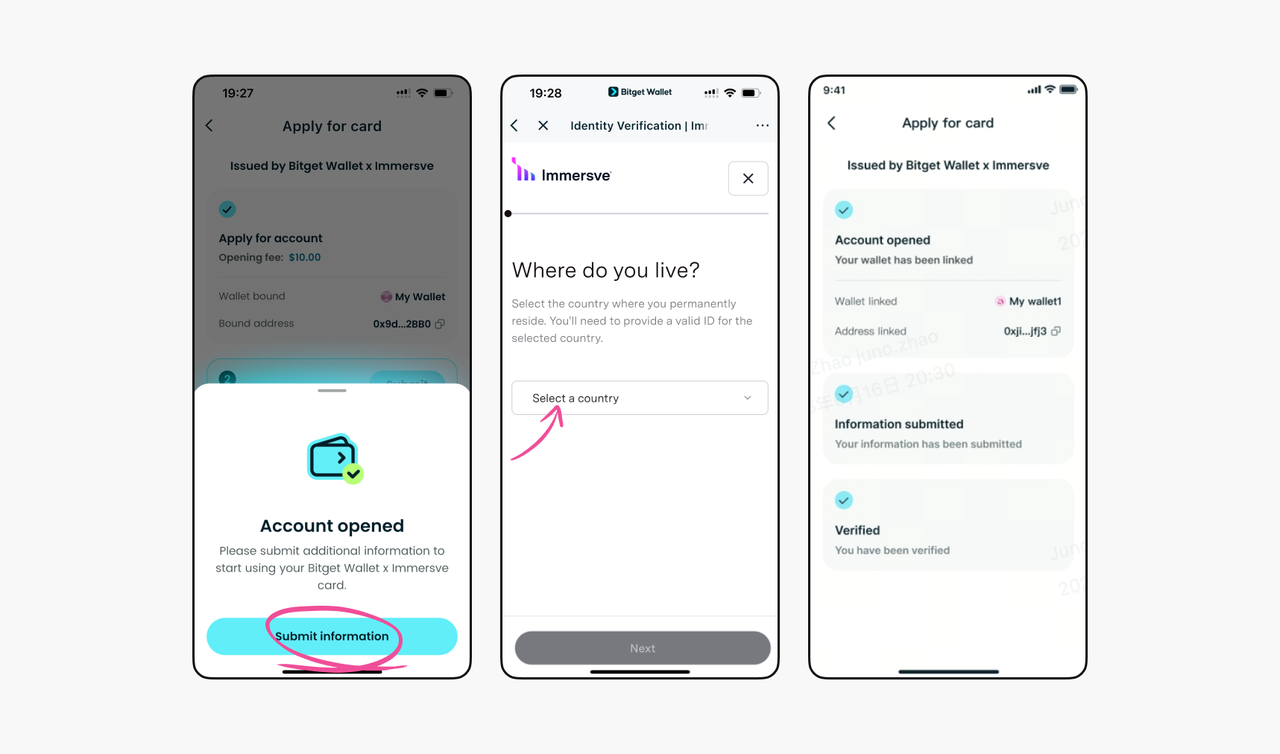

How does the Bitget Wallet Card (Immersve) application process work?

- Card Overview: The Bitget Wallet Card (Immersve) is issued by Immersve for users who mainly spend online or via mobile payments.

- Instant Virtual Card: After approval, users receive a virtual card instantly, perfect for e-commerce, subscriptions, and digital services.

- Key Features: Focuses on fast activation, regulatory compliance, and seamless real-time crypto-to-fiat conversion rather than physical card use.

Rather than focusing on physical card usage, the Immersve card prioritizes fast activation, regulatory compliance, and seamless real-time crypto-to-fiat conversion.

STEP 1: Apply & Verify in Bitget Wallet

Open the Bitget Wallet app and go to Wallet → Card → Apply Now. Select the Immersve card available in your region and complete KYC verification using a valid ID.

STEP 2: Fund with USDC (Base Network)

Once approved, your virtual Immersve card will appear in the app. To activate it, top up USDC on the Base network. This balance enables instant payments with automatic crypto-to-fiat conversion at checkout.

What happens after you submit a Bitget Wallet Card application?

After submitting a Bitget Wallet Card application, the outcome depends on the selected card issuer and region. Asia card users typically receive a virtual card first, with the option to request a physical card later.

China card users gain instant access to a virtual card once approved, while Immersve card users receive a virtual card tailored for mobile and online spending. Approval timelines vary based on KYC completeness, document accuracy, and issuer-specific compliance checks.

STEP 1: Start the application & complete identity verification

Open the Bitget Wallet app and go to Wallet → Card → Apply Now. Choose the Immersve-issued card option available for your region.

You’ll be prompted to enter your personal details and complete KYC (identity verification) by uploading a valid ID (passport, national ID, or driver’s license). Most applications are reviewed and approved quickly once verification is submitted.

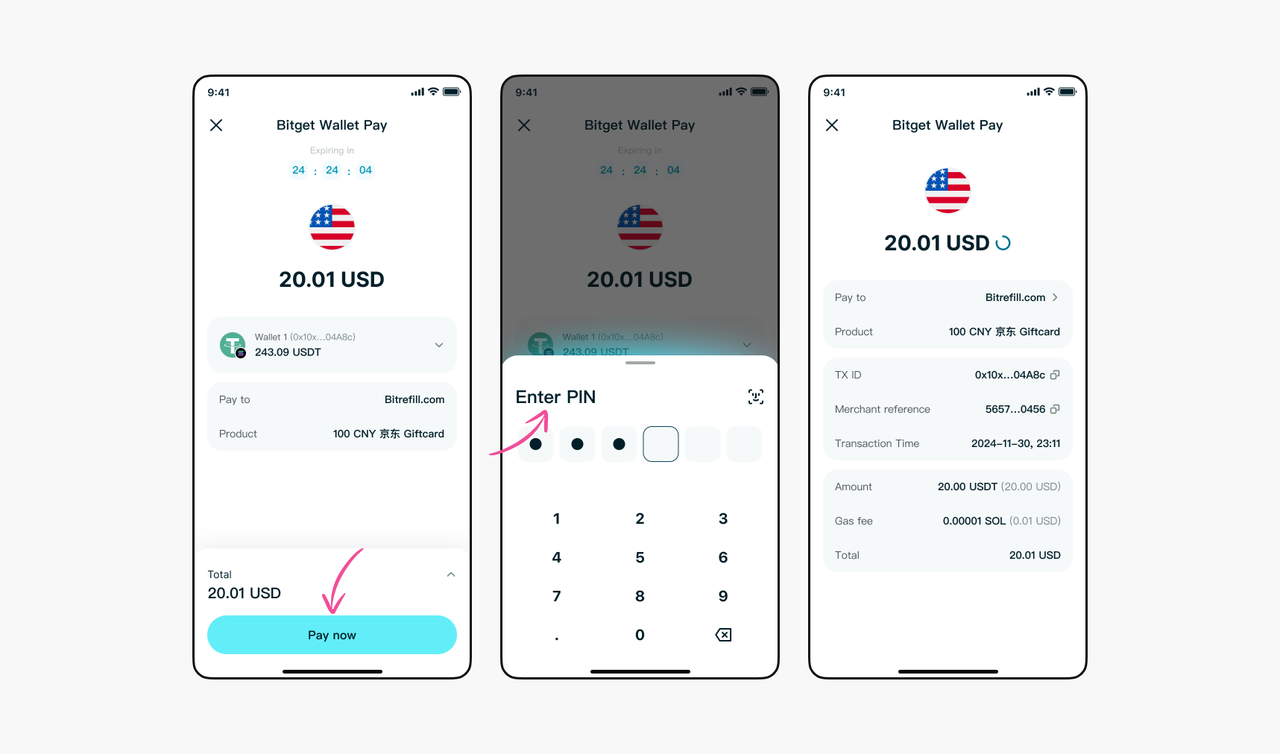

Step 2: Receive and activate the virtual card

After verification is approved, the virtual Bitget Wallet Card will be issued directly inside the app. You’ll see the digital card details immediately in your card dashboard. At this stage, you can view the card number, expiry, and CVV — ready for funding and use.

Step 3: Activate the Card

To activate and use the card for payments, go to Card → Top up and deposit USDC on the Base network into your card balance. Once funded, the card can be used instantly for online and mobile payments wherever Mastercard is accepted — with real-time crypto-to-fiat conversion happening at checkout.

How Long Does Bitget Wallet Card Approval and Delivery Take?

When learning how to apply for the Bitget Wallet Card, one of the most common concerns is approval time.

How long does Bitget Wallet Card approval usually take?

Bitget Wallet Card approval time varies depending on the card type, issuer, and region, but most users receive a virtual card faster than a physical one. In general, applications are reviewed shortly after Bitget Wallet KYC is completed, with timelines influenced by verification accuracy and demand.

- Virtual card approval is typically faster than physical card issuance

- All applications require completed Bitget Wallet KYC

- Approval speed depends on:

- Document accuracy

- Selected region and issuer (DCS, Fiat24, or Immersve)

- Verification volume during peak periods

Virtual card approval timeline

For most users, how to apply for the Bitget Wallet Card focuses on getting a virtual card issued as quickly as possible. Once Bitget Wallet KYC is completed and approved, virtual card issuance may happen within a short review window. This allows users to start using the Bitget Wallet Card immediately inside the app without waiting for physical delivery.

Factors that may delay approval

Even when users follow the correct steps on how to apply for the Bitget Wallet Card, approval may take longer if documents are incomplete, identity details do not match, or additional compliance checks are required. Regional regulations and issuer-specific verification rules can also extend review time, especially during peak application periods.

Does approval time differ by issuer?

Yes. Each issuer—DCS (Asia), Fiat24 (China), and Immersve (EEA & LATAM)—follows its own compliance and verification workflow. As a result, approval timelines are not guaranteed and may vary depending on the issuer, region, and current verification queue.

When will you receive a physical Bitget Wallet Card?

Physical Bitget Wallet Cards are only available in supported regions and for specific card types — primarily for certain Asia-issued cards where the issuer permits physical delivery. Availability depends on local regulations, issuer policy, and whether your region supports physical card issuance.

Some regions or issuers may offer virtual cards only (e.g., China via Fiat24), while others allow users to request a physical card after approval and KYC completion.

- Availability is limited to supported regions and issuer policies

- Applicable mainly to Asia card users with physical card support

- Physical delivery timelines vary widely by location

- Shipping may take up to ~45 business days or more, depending on logistics and couriers

Only certain Bitget Wallet Card types support physical card issuance. After requesting a physical card and having your request approved, delivery times depend on regional courier services and address verification. Users should rely on their virtual card for immediate use while waiting for the physical card to arrive.

What Fees and Limits Should You Know Before Using the Bitget Wallet Card?

Before using the Bitget Wallet Card for daily payments, it’s important to understand how fees, allowances, and spending limits work.

1. Bitget Wallet Card Fees

Bitget Wallet Card fees are designed to be transparent and competitive, with several low-cost or no-cost elements:

- No annual or recurring fees: Many card types don’t charge a yearly maintenance fee.

- Issuance fees: Virtual and first physical card issuance are often free.

- Transaction/Conversion fees: Standard crypto-to-fiat conversion or transaction fees may apply (e.g., ~0.9% on some cards) when spending.

- Foreign exchange fees: Fees may apply when spending in non-base currencies (e.g., ~1–1.7% on some card types).

- ATM withdrawal fees: There may be fees per withdrawal plus percentage charges (varies by issuer and card type).

- Other potential fees: Inactivity fees, replacement card fees, or chargeback investigation fees can apply in certain cases.

Tip: See the exact fee breakdown for your specific card inside the Bitget Wallet app after activation, as fees vary by region and issuer.

Read more: Spend Freely with 0 Fees: Now Live on Bitget Wallet Card

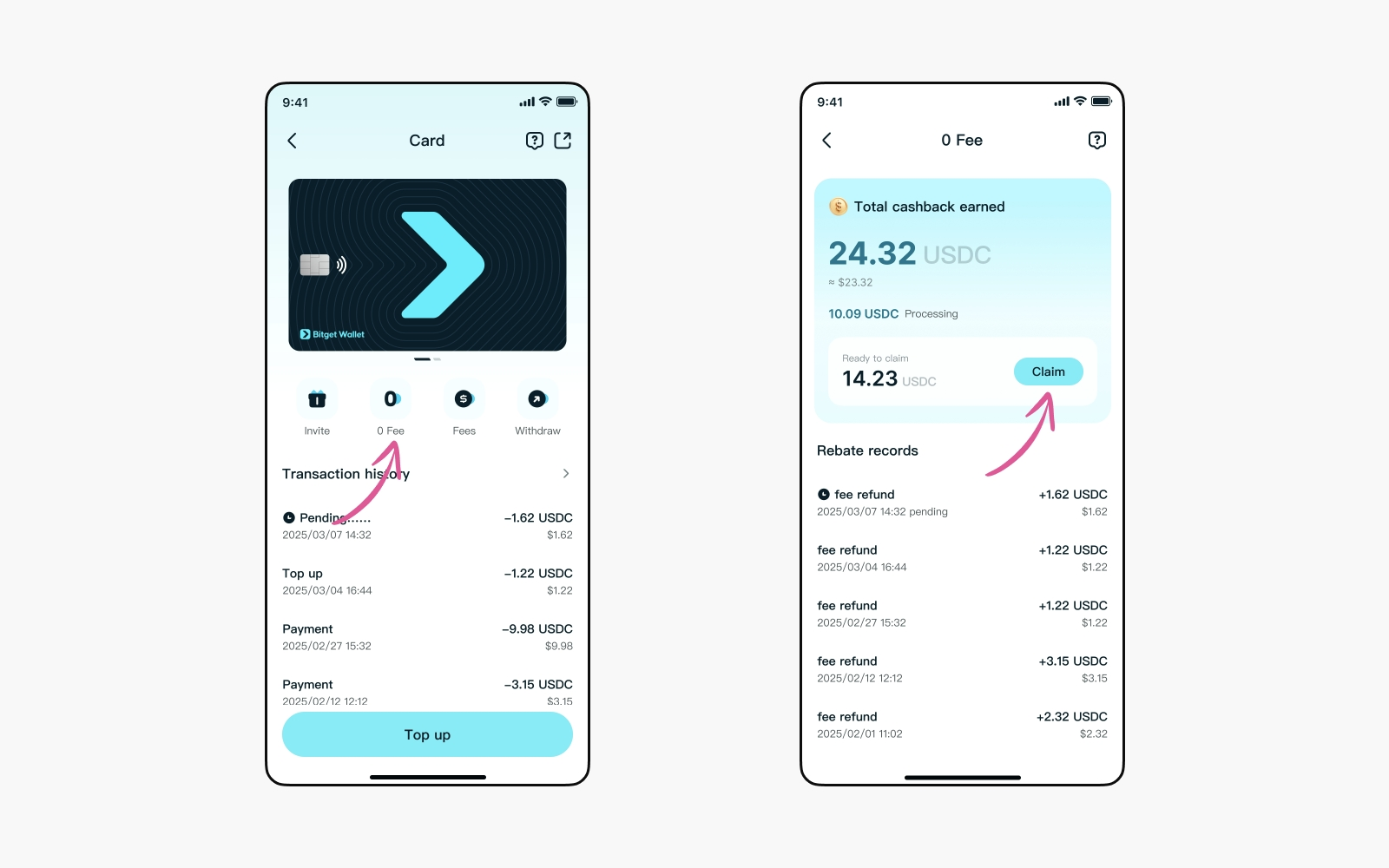

2. Bitget Wallet Card Allowance

Allowances determine what you can do with your card before additional charges or restrictions kick in. These include things like:

- Fee-free spending quotas: Some regions offer a monthly fee-free allowance where FX and conversion fees are refunded up to a set limit.

- Free top-ups: Many card types do not charge top-up fees when you add crypto to your card balance (varies by issuer).

- Real-time conversion: Crypto conversion to fiat typically occurs automatically at the point of sale with transparent exchange rates.

Always check the Fee & Limits section inside Bitget Wallet after card activation for the most accurate details — allowances can vary depending on your card issuer partner

3. Bitget Wallet Card Spending Limits

Spending limits define how much you can transact or withdraw:

- Tiered monthly and per-transaction limits: Some cards use a card level system with higher limits at higher tiers (e.g., up to millions of USD/month for top levels).

- ATM limits: Daily and monthly ATM withdrawal limits apply where supported.

- Regional variations: Limits may differ by market and issuer (e.g., some issuer partners may set their own maximums).

- Per-transaction caps: Certain card levels set limits per transaction that increase with card status or usage history.

You can view your personalized limits directly in the Bitget Wallet app after activation under the Card section.

What Does the 0-Fee Allowance Mean for Bitget Wallet Card Users?

The 0-fee allowance on the Bitget Wallet Card is designed to make everyday crypto-to-fiat spending more affordable and transparent. Within this allowance, eligible card users can enjoy rebates on common costs that typically accompany crypto card transactions — helping stablecoin spending feel closer to using cash or a traditional debit card.

- Includes FX (foreign exchange) fee rebates — foreign exchange costs charged by banks or networks are refunded within the allowance.

- Includes crypto-to-fiat conversion rebates — fees for converting crypto (e.g., USDC/USDT) into fiat at checkout are automatically returned.

- No hidden spreads within the allowance range — settlement rates align closely with real-time FX rates, with no undisclosed markups.

- Fees may apply once allowance thresholds are exceeded — once you go beyond your monthly 0-fee quota, standard issuer fees resume.

What spending and withdrawal limits apply?

Each Bitget Wallet Card has predefined spending and withdrawal limits that help balance everyday usability with compliance and fraud protection. These limits vary by issuer, region, and card level, and users should always check the exact figures shown in their Bitget Wallet app after activation.

- Limits are driven by the card issuer and regional compliance requirements.

- Daily and monthly spending caps help prevent overspending and mitigate risk.

- ATM withdrawal availability and caps depend on local regulations and issuer rules.

- Higher card levels unlock higher transaction and spending thresholds.

What Common Problems Can Occur When Applying for the Bitget Wallet Card?

Applying for the Bitget Wallet Card is generally straightforward, but some users may encounter issues during the application or verification process. Most problems are related to KYC accuracy, regional eligibility, or document quality, and can usually be resolved by reviewing the application details carefully before re-submitting.

Why might a Bitget Wallet Card application be rejected?

A Bitget Wallet Card application may be rejected when verification requirements are not fully met or when the selected card type does not match regional eligibility. Most rejections are related to KYC accuracy, document quality, or issuer-specific compliance rules. Understanding these reasons can help users avoid common mistakes when applying.

- KYC information mismatch: Name, date of birth, or ID details do not match submitted documents

- Unsupported or restricted region

- Incomplete or unclear verification documents

How can users fix verification or application issues?

Users who encounter issues while applying for the Bitget Wallet Card can usually resolve them by reviewing their verification status and following issuer-specific guidance. Most problems are related to document accuracy, regional eligibility, or incomplete verification steps, and can be fixed directly inside the Bitget Wallet app.

- Re-submit verification documents: Upload clear, valid, and unexpired identity documents

- Confirm regional eligibility: Ensure the selected Bitget Wallet Card matches the user’s actual location

- Refer to official Help Center guides: Follow region-specific instructions for Asia, China, or Immersve cards

How Can You Use the Bitget Wallet Card to Spend Crypto Safely in Real Life?

The Bitget Wallet Card is designed as a practical bridge between decentralized assets and everyday payments. By linking directly to Bitget Wallet, users can spend crypto at supported merchants without giving up custody or control. This structure allows users to manage balances actively, convert crypto to fiat only when needed, and maintain a clear view of their spending activity.

How do you fund and manage your Bitget Wallet Card securely?

Funding and managing the Bitget Wallet Card securely starts with maintaining full control over your crypto assets inside Bitget Wallet. By using supported stablecoins and separating spending funds from long-term holdings, users can reduce risk while enjoying flexible, real-life crypto payments.

- Manage USDT and USDC directly inside Bitget Wallet

- Transfer only the amount needed for daily spending

- Keep most assets in the main wallet to avoid overexposure

How can users shop online and offline with the Bitget Wallet Card?

The Bitget Wallet Card allows users to spend crypto seamlessly in both online and offline environments. By supporting major payment networks and mobile wallets, the card makes it easy to use crypto for everyday purchases without manual conversions. Once activated, users can rely on the Bitget Wallet Card for daily spending across multiple payment scenarios.

- Accepted at Visa or Mastercard merchants (depending on card type)

- Supports Apple Pay and Google Pay in eligible regions

- Suitable for everyday payments, including:

- Online shopping

- Subscriptions

- Travel and dining

Why is Bitget Wallet Card suitable for beginners and experienced users?

The Bitget Wallet Card is designed to meet the needs of both new crypto users and experienced Web3 participants. By combining a simple application flow with non-custodial asset control, the card allows users at different skill levels to spend crypto confidently in real life. Whether you are just learning how to use crypto or already managing on-chain assets daily, the Bitget Wallet Card offers a practical and flexible solution.

- Simple, beginner-friendly interface inside Bitget Wallet

- Maintains non-custodial control over crypto assets

- Designed for everyday spending and advanced use cases

Read more

- Spend Freely with 0 Fees: Now Live on Bitget Wallet Card

- All You Need to Know about the Bitget Wallet Card

- How to Use the Bitget Wallet Card for Online Shopping: Spend Crypto Instantly and Earn Rewards

Conclusion

How to Apply for the Bitget Wallet Card is a straightforward process once users understand the application steps, regional card options, and issuer-specific requirements. By choosing the correct Bitget Wallet Card based on location, completing KYC verification, and reviewing fees and limits in advance, users can apply with confidence and avoid common issues.

With transparent fee structures, strong security controls, and non-custodial asset management, the Bitget Wallet Card offers a practical and safe way to turn crypto into everyday payments. To start spending crypto in real life with greater control and flexibility, users are encouraged to use the Bitget Wallet Card directly through Bitget Wallet as their trusted bridge between on-chain assets and daily spending.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

1. How to Apply for the Bitget Wallet Card step by step?

To apply for the Bitget Wallet Card, users need to open Bitget Wallet, go to the Card section, and follow the on-screen instructions. The system will automatically display eligible card options based on the user’s region. After selecting the correct card type (Asia, China, or Immersve), users complete identity verification and submit the application. The exact Bitget Wallet Card application process and approval flow depend on the issuer and region.

2. How long does Bitget Wallet Card approval usually take?

Bitget Wallet Card approval time varies depending on KYC status, document accuracy, and card issuer. In most cases, virtual card approval is completed faster once identity verification is successfully submitted. Delays may occur if documents are unclear, incomplete, or require additional compliance checks. Approval timelines are not guaranteed and may differ between Asia, China, and Immersve card applications.

3. Is the Bitget Wallet Card physical or virtual?

The Bitget Wallet Card can be virtual or physical, depending on the region and card type. Asia card users may be eligible for both virtual and physical cards, while China and Immersve cards are virtual-only. Virtual cards can be used immediately for online payments and mobile wallets, making them suitable for everyday crypto spending through Bitget Wallet.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- How to Apply for a Crypto Mastercard2026-01-05 | 5 mins

- How to Apply for a Crypto Visa Card and Start Spending Crypto Worldwide2026-01-02 | 5 mins

- How to Top Up Your Crypto Debit Card with USDT2025-12-29 | 5mins