Gumi XRP Purchase Soon 2026: Why Japan’s Corporate Crypto Strategy Is Shifting from Bitcoin to Altcoins

Tokyo-listed Gumi Inc. made waves in the Japanese financial market in 2026 with its announcement to acquire ¥2.5 billion (~$17 million) worth of XRP, marking a significant step in corporate crypto adoption. This move complements Gumi’s existing Bitcoin holdings, which are used both as a long-term store of value and for staking yield. By combining Bitcoin and XRP, Gumi demonstrates a dual-asset treasury strategy: Bitcoin for long-term investment and XRP for cross-border payments, liquidity, and operational utility.

Gumi’s approach reflects a broader trend among Japanese corporations toward utility-focused cryptocurrency adoption. With a longstanding partnership with SBI Holdings and access to the Ripple ecosystem, Gumi is positioned among the first companies in Japan to leverage blockchain assets not just for investment, but also for practical business functions. For individuals and organizations seeking secure management of Bitcoin and XRP, Bitget Wallet provides a robust solution, offering cross-chain support, safe custody, staking opportunities, and multi-chain asset management.

Key Takeaways

- The Gumi XRP purchase 2025 is ¥2.5 billion, likely one of the bigger corporate XRP purchases ever seen in Japan.

- By having a dual-asset crypto strategy, Gumi has a position in Bitcoin (store of value, staking yield) and XRP (cross-border liquidity, settlement utility).

- Gumi's access to Ripple's ecosystem, via a strong relationship with SBI Holdings in Japan, further supports their corporate XRP strategy.

Who Is Gumi and What Is Its Crypto Strategy for the XRP Purchase?

The Gumi XRP purchase 2025 represents a calculated move by Tokyo-listed Gumi Inc. (Ticker: 3903, TSE Prime) to diversify its digital asset portfolio. By acquiring roughly ¥2.5 billion (US$17 million) in XRP, Gumi is prioritizing utility-focused crypto, leveraging XRP’s liquidity for real-world use within its Web3 and blockchain initiatives.

Source: AMBC

What Is Gumi’s Background as a Company?

Gumi Inc. is a Tokyo-listed mobile gaming and blockchain company (Ticker: 3903, TSE Prime), known for hit games like Brave Frontier and for pushing immersive technology innovations. Over time, Gumi has become a bridge between entertainment and emerging tech, establishing itself as one of Japan’s first major game developers to embrace blockchain.

- Known for mobile gaming and blockchain innovation, particularly Brave Frontier.

- Since 2018, Gumi has expanded into blockchain ventures, including node operations, Web3 gaming, XR technologies, and decentralized content via gumi Cryptos Capital, which invests in early-stage crypto startups.

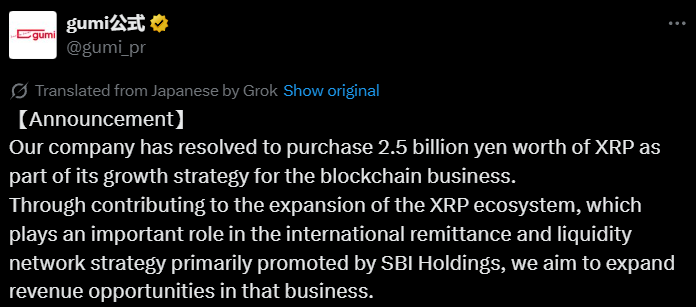

What Did Gumi Announce in August 2026?

In August 2026, Gumi’s board approved an allocation of USD 17 million for the XRP Purchase 2026. This strategic move aims to strengthen Gumi’s role in payment infrastructure, manage liquidity, and leverage Japan’s growing cross-border crypto ecosystem.

- The XRP Purchase of USD 17 million was executed in August 2026.

- Additional purchases are scheduled from September 2026 through February 2026, following a phased acquisition plan.

- Gumi continues to expand its presence in payments and liquidity infrastructure, with further crypto integrations planned within its ecosystem.

- Following the announcement, Gumi’s stock rose approximately 7% in post-trading hours, reflecting positive market sentiment.

Source: X

How Does Gumi’s Dual-Asset Strategy Work with Bitcoin and XRP?

Gumi balances long‑term value stability and operational utility by leveraging the strengths of both Bitcoin and XRP. In early 2026, the company invested 1 billion yen (≈ $6.7 million) in Bitcoin, viewing it as a stable store of value that can also generate yields via staking protocols such as Babylon. This position anchors Gumi’s digital asset treasury with an asset often compared to a digital reserve or treasury bond in traditional financ

Later in August 2026, Gumi’s board approved the strategic acquisition of 2.5 billion yen (≈ $17 million) worth of XRP. Rather than a one‑off buy, this acquisition is phased over five months, with purchases planned from September 2026 through February 2026. This structured approach demonstrates a deliberate effort to integrate XRP into Gumi’s financial ecosystem — particularly for remittances, liquidity management, and participation in blockchain‑based payment infrastructure rather than mere price speculation

Why did Gumi previously buy Bitcoin in February 2026?

Earlier in 2025, Gumi took a calculated step by purchasing ¥1 billion (~US$6.7 million) in Bitcoin, which it then staked via Babylon protocols. This move reflects a desire to leverage BTC as a stable, yield-generating reserve asset—a digital equivalent of a treasury bond. Gumi sees Bitcoin as foundational stability in its evolving crypto portfolio.

Why choose a dual-asset strategy in 2026?

Gumi’s adoption of a dual-asset model reflects thoughtful treasury diversification:

- Balances volatility and utility: Bitcoin provides security; XRP delivers operational capacity.

- Optimizes long-term growth: Stability from BTC and utility-driven performance from XRP.

- Corporate treasury discipline: Spreads risk, supports regulatory compliance, and aligns with financial best practices.

What Is the Strategic Significance of the XRP Purchase?

In August 2026, Gumi Inc., a Tokyo-listed mobile gaming and blockchain firm, announced its strategic decision to acquire ¥2.5 billion (approximately $17 million) worth of XRP between September 2025 and February 2026. This move underscores Gumi's commitment to integrating blockchain technology into its operations and aligns with its broader financial and technological objectives

Source: X

- **XRP offers real financial utility**—fast, low-cost cross-border payments and liquidity access, ideal for expanding Gumi’s blockchain-related services.

- The XRP acquisition complements Gumi’s earlier BTC purchase, crafting a balanced portfolio with both value preservation and utility.

- Long-term vision: Gumi is strengthening its corporate treasury by combining Bitcoin’s universal store-of-value with XRP’s functional strengths in payments and liquidity infrastructure.

What Role Does SBI Holdings Play in the Gumi XRP Purchase 2025?

SBI Holdings is a central strategic partner in the Gumi XRP Purchase 2026, providing both corporate backing and blockchain infrastructure alignment that bolster Gumi’s position in Japan’s fast‑evolving crypto ecosystem. SBI’s involvement extends beyond ownership — it connects Gumi to established payment networks, regulatory know‑how, and industry partnerships that make integrating XRP operationally meaningful.

How are Gumi and SBI connected?

- June 2026 – Multi‑Year Crypto Fund: In mid‑2026, Gumi and SBI launched a multi‑billion‑yen crypto fund with a three‑year horizon, structured to blend DeFi yield generation with capital appreciation. This fund supports initiatives like the Gumi XRP Purchase 2026 by enhancing liquidity and growth capital.

- Expansion of Digital Finance Solutions: Beyond direct asset acquisition, SBI is advancing broader infrastructure efforts, including stablecoin projects like the planned RLUSD launch in Japan by early 2026 in collaboration with Ripple — a move that dovetails with Gumi’s XRP‑focused strategy.

- Institutional XRP Integration: In late 2026, SBI made a significant investment in Evernorth, a U.S. firm building an institutional XRP treasury and financial services platform aimed at Nasdaq listing. SBI’s capital contribution (~$200 M) underscores its commitment to institutionalizing XRP at scale, which Gumi is strategically positioned to benefit from.

Why does SBI favor XRP?

SBI has long partnered with Ripple through SBI Ripple Asia to promote XRP-based remittance systems in Japan. This makes XRP a natural choice for corporate strategies, including the Gumi XRP purchase 2025.

Additionally, SBI plans to introduce the RLUSD stablecoin by 2026, supporting XRP’s ecosystem and enabling Gumi to leverage innovative payment solutions.

- Ongoing Ripple partnership via SBI Ripple Asia promotes XRP for cross-border remittances in Japan.

- XRP is a natural fit for corporate crypto strategies, including the Gumi XRP purchase 2025.

- RLUSD stablecoin plans (2026) complement XRP adoption and enable Gumi to access innovative payment channels.

- Supports integration of XRP into practical financial infrastructure.

How does SBI’s XRP focus influence Gumi’s strategy?

Gumi’s XRP acquisition aligns closely with SBI’s focus on cross-border payments and liquidity networks. Leveraging SBI’s expertise accelerates adoption and strengthens ecosystem synergies for the Gumi XRP purchase 2025.

The collaboration also enhances practical applications of XRP, allowing Gumi to integrate payments and liquidity into its broader corporate operations.

- Strategic alignment with SBI accelerates the adoption of XRP in Gumi’s corporate ecosystem.

- Strengthens ecosystem synergies for payments, liquidity, and treasury management.

- Supports the Gumi XRP purchase 2025 by enhancing XRP’s practical utility in corporate operations.

- Enables faster implementation of XRP-based solutions across Gumi’s blockchain initiatives.

How Does Gumi’s 2025 XRP Purchase Fit into Gumi’s Partnership with SBI Holdings?

The Gumi XRP purchase 2025 reinforces Gumi’s blockchain strategy, complementing its earlier Bitcoin acquisition and joint crypto fund with SBI.

By holding both Bitcoin and XRP, Gumi balances stability with functional utility, optimizing treasury management and payment infrastructure.

SBI’s leadership in XRP adoption and Japan’s clear regulatory framework ensure the Gumi XRP purchase 2025 aligns with compliance standards while supporting strategic growth.

Why Is XRP Strategic for Cross-Border Payments in Japan?

XRP has emerged as a pivotal asset for cross-border payments in Japan, offering distinct advantages over traditional cryptocurrencies like Bitcoin. Its integration into Japan's financial infrastructure is further solidified by regulatory clarity and institutional support, making it a strategic choice for companies like Gumi in their XRP purchase 2025.

Why Is XRP Strategic for Cross-Border Payments in Japan?

XRP’s efficiency and adoption in Japan make it a core asset for corporate cross-border payments. For companies like Gumi, the Gumi XRP purchase 2025 underscores the strategic integration of digital assets into operational and treasury strategies.

How does XRP’s payment utility differ from Bitcoin?

When evaluating cryptocurrencies for corporate payment infrastructure, Bitcoin and XRP serve very different purposes.

- Bitcoin: Primarily a store of value, Bitcoin’s slower transaction speed and higher fees make frequent cross-border payments costly and less practical.

- XRP: Optimized for settlement and remittance, XRP enables near-instant transfers with minimal fees, ideal for real-time corporate payments.

- Strategic Relevance: The Gumi XRP purchase of 2025 leverages XRP’s fast settlement and liquidity features to enhance corporate treasury management, complementing Gumi’s earlier Bitcoin holdings.

How is Japan regulating corporate crypto adoption?

Japanese regulations provide clarity and institutional support, which makes XRP a safe choice for corporate treasury operations like the Gumi XRP purchase 2025.

- Regulatory Clarity: Japan’s Financial Services Agency (FSA) classifies XRP as a “crypto asset,” giving companies legal certainty for treasury and operational use (Bitget).

- Legislative Developments: Amendments to the Financial Instruments and Exchange Act aim to recognize crypto assets as financial products, enhancing protection and market trust (Reuters).

- Institutional Integration: With over 80% of Japanese banks expected to adopt XRP for cross-border payments by 2025, the Gumi XRP purchase in 2025 is aligned with broader corporate adoption trends (AInvest).

What makes XRP attractive to Japanese corporates?

XRP’s practical advantages drive its adoption among corporations, providing Gumi with a functional, high-utility digital asset in the Gumi XRP purchase 2025.

- Cost Efficiency: XRP’s near-zero transaction fees reduce remittance costs by up to 60%, making cross-border operations more efficient (AInvest).

- Speed: XRP enables real-time settlements, boosting liquidity and operational efficiency for Japanese corporates, a key factor in Gumi’s strategic planning.

- Established Infrastructure: With Ripple’s network and SBI Ripple Asia integration, XRP offers reliable payment rails, reinforcing the corporate rationale behind the Gumi XRP purchase 2025.

- Strategic Impact: By leveraging XRP, Gumi strengthens its treasury and payment systems while tapping into Japan’s evolving crypto ecosystem, ensuring the Gumi XRP purchase 2025 delivers both utility and long-term value.

🔵 Be the first to trade trending memecoins – beginner-friendly on Bitget Wallet.

How Will Gumi XRP Purchase 2025 Affect the Corporate Crypto Landscape?

Gumi Inc.’s XRP acquisition, approved by the CEO and valued at ¥2.5 billion (~$17 million), is scheduled to occur in phases from September 2026 through February 2026. This marks one of the first corporate-level purchases of XRP in Japan, signaling a significant step for institutional adoption of digital assets.

The move positions Gumi at the forefront of blockchain and cryptocurrency integration in corporate operations, supporting both operational functions and treasury management. By leveraging XRP’s liquidity and cross-border payment capabilities, Gumi demonstrates how digital assets can play a practical, utility-driven role in corporate finance — beyond speculative holdings.

What does this mean for other Japanese companies?

Gumi's **XRP purchase 2025** sets a precedent for other Japanese corporations considering the integration of digital assets into their financial strategies.

- Standardization of Crypto Treasury Use: Gumi's acquisition of XRP signals a shift towards the normalization of cryptocurrency holdings among Japanese companies.

- Potential Adoption of Dual-Asset Models: Following Gumi's example, other firms may adopt a similar approach, balancing Bitcoin's store-of-value properties with XRP's utility in payments and liquidity.

- Influence of SBI Holdings: As Gumi's largest shareholder, SBI Holdings' long-standing partnership with Ripple and its promotion of XRP for cross-border payments may encourage other companies to align with this strategy.

Could XRP adoption expand beyond Japan?

The Gumi XRP purchase 2025 could catalyze broader adoption of XRP in international markets.

- Global Ripple Network: Ripple's extensive network and partnerships across various countries facilitate the seamless integration of XRP into global payment systems.

- Introduction of RLUSD Stablecoin: The planned launch of the RLUSD stablecoin by SBI Holdings and Ripple could enhance XRP's utility in cross-border transactions, potentially leading to its adoption in other regions.

- Institutional Interest: Gumi's investment may attract attention from other institutional investors worldwide, prompting them to consider XRP as a viable asset for treasury and operational purposes.

How does this compare to global corporate crypto adoption?

Gumi's approach to cryptocurrency adoption offers a distinct model compared to practices in other countries.

- United States: Companies like Tesla and MicroStrategy have predominantly invested in Bitcoin, focusing on its potential as a store of value.

- Japan: Gumi's XRP purchase 2025 illustrates a more diversified strategy, combining Bitcoin's stability with XRP's practical applications in payments and liquidity.

- Global Trends: While Bitcoin remains the dominant cryptocurrency in corporate treasuries, the integration of XRP by companies like Gumi indicates a growing recognition of the utility of alternative digital assets.

Conclusion

The Gumi XRP purchase 2025 reflects Japan’s move toward utility-driven, regulated corporate crypto adoption. By pairing XRP with Bitcoin, Gumi demonstrates a balanced strategy that merges digital asset stability with real-world financial utility. Its partnership with SBI Holdings strengthens XRP integration, aligning with Japan’s supportive regulatory framework. The Gumi XRP purchase 2025 exemplifies a shift where corporations embrace crypto not just as speculation, but as essential financial infrastructure.

For secure and efficient management of digital assets, consider Bitget Wallet. It allows users to store XRP and Bitcoin safely, access cross-chain DeFi, and manage stablecoins—all on one beginner-friendly platform.

Sign up Bitget Wallet now - grab your $2 bonus!

FAQs

Why did Gumi announce an XRP purchase in 2025?

Gumi's decision to invest in XRP is part of a strategic move to enhance its blockchain infrastructure. The company aims to leverage XRP's efficiency in cross-border payments and liquidity management, aligning with its broader financial strategy and partnership with SBI Holdings.

How much XRP is Gumi buying in 2025?

Gumi plans to acquire approximately ¥2.5 billion (about $17 million) worth of XRP between September 2025 and February 2026. This acquisition is part of a dual-asset strategy that includes both Bitcoin and XRP to diversify Gumi's financial portfolio.

What is the difference between Gumi’s Bitcoin and XRP strategies?

Gumi employs a dual-asset strategy:

- Bitcoin: Used as a store of value to preserve capital.

- XRP: Utilized for its utility in cross-border payments and liquidity services, leveraging Ripple's ecosystem.

Why is SBI so important in this XRP purchase?

SBI Holdings, Gumi's largest shareholder, plays a crucial role in this acquisition. SBI has a longstanding partnership with Ripple through SBI Ripple Asia, promoting XRP-based remittance systems across Japan. This alignment ensures that Gumi's investment in XRP benefits from SBI's experience in payments, liquidity, and regulatory compliance.

Is XRP widely used in Japan for cross-border payments?

Yes, XRP is gaining traction in Japan's financial sector. As of 2025, over 80% of Japanese banks are projected to adopt XRP for cross-border payments, reducing transaction costs by 40–60% compared to traditional systems.

What does the Gumi XRP purchase 2025 mean for corporate crypto adoption?

Gumi's investment signifies a shift in Japan's corporate approach to cryptocurrencies. By integrating XRP into its treasury strategy, Gumi sets a precedent for other Japanese companies to consider digital assets not just for speculation but as integral components of their financial operations

Is Bitget Wallet safe for storing XRP?

Yes, Bitget Wallet is a secure option for storing XRP. It offers features like two-factor authentication, strong password protocols, and secure backup options to protect your assets. Additionally, Bitget Wallet provides compatibility with XRP Ledger functionalities, including Trust Lines and decentralized app integrations.

Risk Disclosure

Please be aware that cryptocurrency trading involves high market risk. Bitget Wallet is not responsible for any trading losses incurred. Always perform your own research and trade responsibly.

- Crypto's Halloween Rally: 5 Best Cryptos to Haunt Before Christmas 20262025-10-24 | 5 mins